In 2025, AI continued to dominate headlines. AI startups didn’t just raise money in 2025 — they pulled in billions at a pace that redefined what a “hot sector” looks like. In January alone, AI companies attracted more than $5.7 billion in funding — roughly 22% of all venture capital for the month. By year’s end, the numbers were staggering.

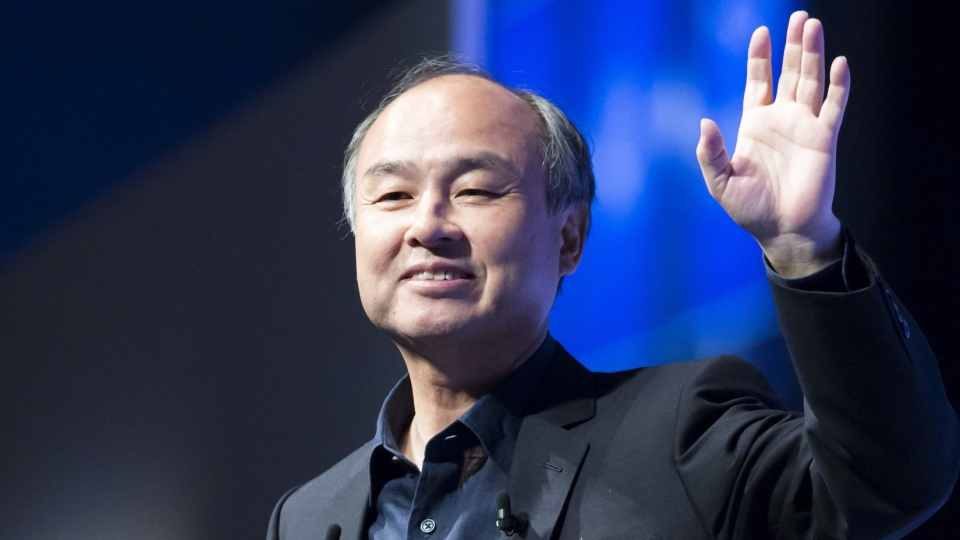

Major investors — from tech giants to family offices — chased everything from generative models to AI-powered biotech, pushing valuations to new highs and driving fierce competition for deal flow. Big names like SoftBank doubled down with multi-billion-dollar bets, while new players like Abu Dhabi’s MGX joined the mix, shaking up the global capital stack.

The Top Investors Fueling Billion-Dollar AI Companies in 2025

This list highlights 50 investors who put real capital behind the hype. It includes venture firms, angels, syndicates, and micro-funds — all ranked by how much they committed to AI startup companies in 2025. Each profile includes estimated funding totals, standout portfolio companies, typical stage focus, location, and a breakdown of what made their strategy stand out this year.

1. SoftBank Group (Tokyo, Japan)

Estimated 2025 AI Investments: $15–25 billion

Key AI Startups Funded: OpenAI (lead investor in proposed $40B round), Skild AI (early-stage AI networking startup)

Stage Focus: Primarily late-stage deals — Series C and beyond, with a heavy emphasis on growth equity and strategic influence

Funding Insight: SoftBank came back swinging in 2025, staking its claim as one of AI’s biggest financial backers. Through a mix of Vision Fund deployments and direct investments, the company moved aggressively — positioning itself to become OpenAI’s largest investor with a potential $15–25 billion commitment, far outpacing its previous high-profile bets. Its strategy? Pour serious money into a small number of companies shaping the future. Backing OpenAI’s infrastructure project “Stargate” was a clear signal: SoftBank isn’t just watching the generative AI boom — it’s trying to shape it. Masayoshi Son’s influence, which had faded in recent years, snapped back into focus with a high-conviction, high-dollar approach targeting market leaders.

2. Thrive Capital (New York, USA)

Estimated 2025 AI Investments: $10 billion

Key AI Startup Funded: Databricks (co-led $10B Series J)

Stage Focus: Mega-late stage growth rounds

Funding Insight: Thrive Capital made one of the boldest AI bets of the year by co-leading Databricks’ $10B Series J — one of the largest private AI rounds ever raised. Known for backing breakout growth-stage winners, Thrive leaned on hard-to-scale infrastructure and enterprise-focused AI. This move reinforced its position as a quiet power player behind AI’s most commercially viable platforms.

3. Andreessen Horowitz (Menlo Park, USA)

Estimated 2025 AI Investments: $10B+ (combined rounds)

Key AI Startups Funded: Databricks, ElevenLabs

Stage Focus: Late-stage and expansion

Funding Insight: a16z maintained its presence across the AI spectrum by co-leading ElevenLabs’ $180M Series C and participating in Databricks’ monster round. The firm’s continued focus on platform plays and infrastructure investments shows it’s betting on core capabilities that underpin enterprise and creative AI alike. With multiple late-stage placements, it kept its reputation as one of Silicon Valley’s most aggressive growth investors.

4. DST Global (Hong Kong)

Estimated 2025 AI Investments: $10B+

Key AI Startup Funded: Databricks

Stage Focus: Late-stage growth

Funding Insight: DST Global stayed true to its large-scale growth thesis by participating in Databricks’ massive raise. Though relatively quiet in public, DST’s allocations speak loudly. Its bet on Databricks aligns with its pattern of targeting dominant infrastructure players that serve as picks-and-shovels in emerging industries.

5. GIC (Singapore)

Estimated 2025 AI Investments: $10B+

Key AI Startup Funded: Databricks

Stage Focus: Growth and strategic partnerships

Funding Insight: Singapore’s GIC joined the high-profile Databricks round, backing the company’s expansion deeper into AI workloads. As a sovereign wealth fund, GIC tends to move only on conviction deals — and its involvement here shows just how far AI has moved into the core of national economic strategies. GIC is also signaling that it’s willing to align capital with global tech platforms powering next-gen data pipelines.

6. Insight Partners (New York, USA)

Estimated 2025 AI Investments: $10B+

Key AI Startup Funded: Databricks

Stage Focus: Late-stage and IPO-track companies

Funding Insight: Insight doubled down on scale by joining Databricks’ historic raise. Known for its operator-first approach and SaaS focus, Insight’s AI investment strategy centers on established teams with strong enterprise traction. Databricks fits that profile — and the firm’s participation suggests it’s looking to back the infrastructure giants most likely to dominate over the next decade.

7. WCM Investment Management (California, USA)

Estimated 2025 AI Investments: $10B+

Key AI Startup Funded: Databricks

Stage Focus: Growth-stage infrastructure plays

Funding Insight: WCM Investment Management joined the Databricks Series J round as part of the institutional wave backing core AI platforms. While not a household VC name, WCM’s involvement added weight to the round’s credibility. It marked a quiet but confident move into AI, aligning their portfolio with the foundational tech layer of modern data systems.

8. Lightspeed Venture Partners (Menlo Park, USA)

Estimated 2025 AI Investments: $3.5 billion

Key AI Startup Funded: Anthropic (lead investor in Series E)

Stage Focus: Late-stage frontier AI

Funding Insight: Lightspeed stepped up in a major way this year by leading Anthropic’s $3.5B Series E round. That move wasn’t just about capital — it was a signal to the market that Lightspeed sees safety-focused foundational models as a defining part of the AI story. With this bet, the firm moved from generalist to high-conviction leader in next-gen AI alignment and infrastructure.

9. Amazon (Seattle, USA)

Estimated 2025 AI Investments: Up to $4 billion

Key AI Startup Funded: Anthropic

Stage Focus: Strategic and infrastructure-aligned partnerships

Funding Insight: Amazon committed up to $4B to Anthropic, continuing a multi-year trend of major cloud players embedding themselves deeper into AI labs. This investment wasn’t just a check — it came with tighter cloud service agreements and broader integration across AWS. Amazon’s strategy is clear: back the brains behind frontier models while keeping cloud revenue close.

10. Durable Capital Partners (Bethesda, USA)

Estimated 2025 AI Investments: $537 million

Key AI Startup Funded: KoBold Metals (co-led Series C)

Stage Focus: Climate tech + AI crossover

Funding Insight: Durable made a strong move into AI-adjacent innovation by co-leading KoBold Metals’ $537M round. The company uses machine learning to explore new mineral deposits — and Durable’s support reflects a growing interest in AI’s real-world industrial applications. It’s a pick that blends climate impact, deep tech, and long-term resource strategy.

11. T. Rowe Price (Baltimore, USA)

Estimated 2025 AI Investments: $537 million

Key AI Startup Funded: KoBold Metals

Stage Focus: Growth equity

Funding Insight: T. Rowe Price joined Durable in the KoBold deal, pushing institutional capital into AI-powered resource exploration. The move shows how traditional asset managers are warming up to sector-specific AI startups, especially those positioned to benefit from energy and climate tailwinds. It wasn’t a flashy pick — but it was a smart one.

12. Prosperity7 Ventures (Riyadh, Saudi Arabia)

Estimated 2025 AI Investments: $305 million

Key AI Startup Funded: Together AI (Series B)

Stage Focus: Mid-to-late stage, frontier tech

Funding Insight: Prosperity7 backed Together AI’s $305M Series B, making one of its most notable AI moves to date. The fund, part of Saudi Aramco, is increasingly placing bets on deep tech with long-term global potential. This deal marked its interest in infrastructure-level AI and reflected a growing trend of Gulf capital targeting transformative software platforms.

13. General Catalyst (Cambridge, USA)

Estimated 2025 AI Investments: Over $3.8 billion

Key AI Startups Funded: Anthropic, Together AI

Stage Focus: Growth and mission-driven AI

Funding Insight: General Catalyst took a mission-aligned approach to AI in 2025, backing both Anthropic and Together AI. These aren’t just headline grabs — they’re part of a broader thesis on AI that’s safe, scalable and value-aligned. Their bets were spread across multiple late-stage rounds but tied together by a strong belief in responsible innovation.

14. SGW Global (USA)

Estimated 2025 AI Investments: $480 million

Key AI Startup Funded: Lambda (co-led Series D)

Stage Focus: Deep infrastructure and compute

Funding Insight: Scott Hassan’s family office, SGW Global, made waves by co-leading Lambda’s $480M round — a massive move into AI infrastructure. Known for being selective and engineering-led, SGW’s backing gave the round significant technical credibility. It also showed that the serious money is moving beyond LLMs and into the chips, clusters, and stacks that support them.

15. Andra Capital (San Francisco, USA)

Estimated 2025 AI Investments: $480 million

Key AI Startup Funded: Lambda

Stage Focus: High-growth infrastructure plays

Funding Insight: Andra joined SGW Global in Lambda’s Series D — doubling down on GPU-native cloud platforms. While Andra isn’t as splashy as Sand Hill giants, this investment proved it’s keeping up with the infrastructure momentum behind generative AI and model training. Lambda’s growth gave Andra the kind of runway it looks for in late-stage bets.

16. Tiger Global (New York, USA)

Estimated 2025 AI Investments: $100 million

Key AI Startup Funded: EnCharge AI (Series B)

Stage Focus: Hardware and edge AI

Funding Insight: Tiger Global backed EnCharge AI’s $100M Series B, a bet on accelerating inference at the edge. While Tiger dialed down its public presence this year, it quietly re-entered the AI race through strategic bets like this one. The EnCharge deal was about owning the efficiency layer — an increasingly important part of the model deployment stack.

17. Salesforce Ventures (San Francisco, USA)

Estimated 2025 AI Investments: $3.5 billion

Key AI Startup Funded: Anthropic

Stage Focus: Strategic AI integrations and cloud alignment

Funding Insight: Salesforce Ventures joined Anthropic’s $3.5B Series E, reinforcing its shift from CRM-centric bets to platform-wide AI. This wasn’t just about capital — it tied into Salesforce’s broader push to embed generative AI into every layer of its enterprise stack. The move echoed its prior investment in OpenAI and showed its continued commitment to staying relevant in the AI arms race.

18. Reid Hoffman (California, USA)

Estimated 2025 AI Investments: $24.6 million

Key AI Startup Funded: Manas AI (seed round)

Stage Focus: Early-stage AI ethics and governance

Funding Insight: Reid Hoffman returned to early-stage investing in 2025 with a $24.6M seed commitment to Manas AI. The firm focuses on AI governance and value alignment — themes Hoffman has spoken about publicly for years. This was a personal bet as much as a financial one, blending philosophy, policy, and innovation in ways only a LinkedIn co-founder could pull off.

19. Kleiner Perkins (Menlo Park, USA)

Estimated 2025 AI Investments: $141 million

Key AI Startup Funded: Hippocratic AI (Series B)

Stage Focus: AI + Healthcare

Funding Insight: Kleiner Perkins led Hippocratic AI’s $141M Series B, pushing into AI-powered healthcare solutions with a strong compliance and safety backbone. The name said it all — this was AI built to “do no harm.” For Kleiner, it marked a deeper dive into vertical AI tools that blend high trust with high impact.

20. Elad Gil (California, USA)

Estimated 2025 AI Investments: $250 million

Key AI Startup Funded: Abridge (Series D)

Stage Focus: Healthtech and Productivity AI

Funding Insight: Elad Gil co-led Abridge’s $250M Series D, backing AI that improves clinical workflows. Abridge automatically turns doctor-patient conversations into medical documentation — saving time and reducing burnout. Gil’s pick reinforced his pattern of backing unsexy, high-utility tools that become embedded in everyday systems.

21. IVP (Menlo Park, USA)

Estimated 2025 AI Investments: $250 million

Key AI Startup Funded: Abridge

Stage Focus: Later-stage enterprise AI

Funding Insight: IVP joined the Abridge round, adding more institutional muscle to a company already gaining adoption in hospitals and clinics. Their involvement showed confidence in AI’s ability to quietly transform large industries, starting with one of the most paperwork-heavy: healthcare.

22. Bessemer Venture Partners (San Francisco, USA)

Estimated 2025 AI Investments: $250 million

Key AI Startup Funded: Abridge

Stage Focus: Practical AI in mature industries

Funding Insight: Bessemer backed Abridge alongside IVP and Elad Gil, adding their stamp to one of the most grounded AI healthtech startups of the year. Known for their focus on durable SaaS companies, Bessemer saw Abridge as a product-first team solving a very real, very expensive problem for hospitals — documentation overload.

23. CapitalG (Mountain View, USA)

Estimated 2025 AI Investments: $250 million

Key AI Startup Funded: Abridge

Stage Focus: Enterprise AI with operational impact

Funding Insight: Alphabet’s growth fund, CapitalG, joined the Abridge syndicate — aligning with its thesis of backing real-world use cases with strong market pull. Abridge fit the mold: B2B, highly repeatable, and scalable across enterprise healthcare. CapitalG’s involvement also signaled Alphabet’s desire to support AI applications outside the lab and inside regulated environments.

24. CVS Health Ventures (USA)

Estimated 2025 AI Investments: $250 million

Key AI Startup Funded: Abridge

Stage Focus: Strategic health AI

Funding Insight: CVS didn’t just watch from the sidelines — they jumped into Abridge’s $250M round as a strategic investor. For a traditional healthcare company, that’s a big move. Their participation points to a shift in how legacy players are starting to back — and rely on — AI startups to streamline core services.

25. ARK Invest (St. Petersburg, USA)

Estimated 2025 AI Investments: $480 million

Key AI Startup Funded: Lambda

Stage Focus: AI infrastructure and long-term frontier bets

Funding Insight: ARK Invest backed Lambda’s $480M round, adding generative AI infrastructure to its innovation-driven portfolio. This was one of ARK’s most high-conviction moves in the AI space. With Cathie Wood’s eye on exponential growth categories, Lambda offered a way to gain exposure to the GPU-heavy backbone of the AI race.

26. Nvidia (Santa Clara, USA)

Estimated 2025 AI Investments: $480 million

Key AI Startup Funded: Lambda

Stage Focus: Hardware-aligned AI cloud

Funding Insight: Nvidia didn’t just sell GPUs this year — it also joined Lambda’s round to stay close to the infrastructure layer it helped create. The move blurred the lines between customer, supplier, and investor. With demand for AI compute surging, investing in Lambda gave Nvidia another way to capitalize on the boom.

27. G Squared (Chicago, USA)

Estimated 2025 AI Investments: $480 million

Key AI Startup Funded: Lambda

Stage Focus: Late-stage tech infrastructure

Funding Insight: G Squared jumped into Lambda’s massive Series D, betting on the infrastructure behind the AI gold rush. Known for backing tech that scales globally, G Squared saw Lambda’s GPU-native cloud as a key piece of the puzzle — the kind of tool serious AI companies can’t function without.

28. Super Micro (San Jose, USA)

Estimated 2025 AI Investments: $480 million

Key AI Startup Funded: Lambda

Stage Focus: Strategic infrastructure plays

Funding Insight: Super Micro, best known for building the machines powering AI workloads, took a different route this year — writing a check into Lambda. It was a rare move for a hardware company, but a smart one. Backing Lambda gave Super Micro a deeper foothold in the growing market for AI-native cloud compute.

29. ICONIQ Growth (San Francisco, USA)

Estimated 2025 AI Investments: $180 million

Key AI Startup Funded: ElevenLabs (co-led Series C)

Stage Focus: Audio AI and next-gen content

Funding Insight: ICONIQ co-led ElevenLabs’ $180M Series C, betting big on voice generation as a mainstream creative tool. The firm’s support helped legitimize AI-generated audio as more than a novelty — it’s now a category. ICONIQ’s brand gave the round both capital and credibility.

30. NEA (Menlo Park, USA)

Estimated 2025 AI Investments: $180 million

Key AI Startup Funded: ElevenLabs

Stage Focus: Growth-stage applied AI

Funding Insight: NEA joined the ElevenLabs round with its usual mix of long-term thinking and growth-stage discipline. Their thesis: AI tools that help people create — and consume — faster are going to win. ElevenLabs’ traction across content creators, educators, and media firms made it a solid fit for NEA’s scale-focused model.

31. World Innovation Lab (WiL) (USA/Japan)

Estimated 2025 AI Investments: $180 million

Key AI Startup Funded: ElevenLabs

Stage Focus: Cross-border applied AI

Funding Insight: WiL’s participation in ElevenLabs showed its strategy in action: back high-leverage software that can scale across continents. The fund, with roots in Silicon Valley and Japan, liked the multilingual angle of ElevenLabs’ product — a key driver of its global upside.

32. Valor Equity Partners (Chicago, USA)

Estimated 2025 AI Investments: $180 million

Key AI Startup Funded: ElevenLabs

Stage Focus: AI in content and creator tools

Funding Insight: Valor joined the ElevenLabs round, continuing its push into applied AI that touches real users. Known for backing Tesla and SpaceX early, Valor’s move here was a bet that synthetic voice won’t just live in sci-fi — it’ll be everywhere from TikTok to the boardroom.

33. Endeavor Catalyst (USA)

Estimated 2025 AI Investments: $180 million

Key AI Startup Funded: ElevenLabs

Stage Focus: Emerging market tech and creator economy

Funding Insight: Endeavor Catalyst brought a global lens to the ElevenLabs syndicate. Their investment strategy often centers around breakout tech with international pull — and ElevenLabs’ multilingual voice tech matched that vision. This wasn’t just about AI—it was about distribution at scale.

34. Lunate (Abu Dhabi, UAE)

Estimated 2025 AI Investments: $180 million

Key AI Startup Funded: ElevenLabs

Stage Focus: Strategic Gulf-backed frontier AI

Funding Insight: Lunate’s entry into ElevenLabs marked a growing trend: Gulf investors quietly becoming serious AI players. With deep capital and long time horizons, Lunate’s backing hinted at more than just return-seeking — it was a positioning play in global AI infrastructure.

35. Sequoia Capital (Menlo Park, USA)

Estimated 2025 AI Investments: $300 million

Key AI Startup Funded: Harvey (led Series D)

Stage Focus: Legaltech and professional services AI

Funding Insight: Sequoia led Harvey’s $300M Series D — a move that placed legal AI front and center. While AI-generated contracts might raise eyebrows, Sequoia saw a huge opportunity in automating billable hours. It wasn’t hype-chasing; it was about owning the rails for the next-gen professional services stack.

36. Coatue (New York, USA)

Estimated 2025 AI Investments: $300 million

Key AI Startup Funded: Harvey

Stage Focus: Foundation model applications

Funding Insight: Coatue backed Harvey alongside Sequoia, bringing its usual data-first approach to the legal AI space. The firm saw a strong market pull for AI tools that serve law firms, not replace them. Their bet was simple: anything that can shrink lawyer time without shrinking margins is going to be a winner.

37. OpenAI Startup Fund (San Francisco, USA)

Estimated 2025 AI Investments: $300 million

Key AI Startup Funded: Harvey

Stage Focus: AI-native software built on OpenAI’s ecosystem

Funding Insight: The OpenAI Startup Fund backed Harvey to help build real-world applications on top of its own models. The investment wasn’t just financial — it came with access to tooling, infrastructure, and early model features. OpenAI is playing the long game here, nurturing startups that deepen its own platform’s stickiness.

38. GV (Mountain View, USA)

Estimated 2025 AI Investments: $300 million

Key AI Startup Funded: Harvey

Stage Focus: Enterprise SaaS and applied AI

Funding Insight: GV (formerly Google Ventures) joined the Harvey round, reinforcing its strategy of backing AI that solves painful, expensive problems. In a sea of flashy demos, Harvey stood out for building something lawyers actually wanted — and GV moved fast to lock in its spot.

39. Meta (Menlo Park, USA)

Estimated 2025 AI Investments: Part of the $10B round

Key AI Startup Funded: Databricks

Stage Focus: Strategic AI alignment

Funding Insight: Meta quietly joined Databricks’ mega-round, signaling its intent to stay close to the AI infrastructure it increasingly depends on. Rather than chase model supremacy, Meta’s move suggested a different strategy — build the pipes, and partner for the rest.

40. Breakthrough Energy Ventures (USA)

Estimated 2025 AI Investments: $537 million

Key AI Startup Funded: KoBold Metals

Stage Focus: Climate-focused AI

Funding Insight: Bill Gates’ Breakthrough Energy Ventures backed KoBold Metals again, doubling down on AI for clean energy exploration. KoBold’s work in identifying rare earth elements using machine learning plays directly into the clean energy transition. This wasn’t a software play — it was about the materials that power the future.

41. Hangzhou City Investment Fund (China)

Estimated 2025 AI Investments: $138 million

Key AI Startup Funded: Zhipu AI

Stage Focus: Domestic large language models

Funding Insight: Hangzhou’s investment in Zhipu AI highlighted China’s strategy of building national champions in AI. While global headlines focus on U.S.-based models, China is quietly channeling local capital into its own LLM efforts — and this fund is a key part of that push.

42. Zhuhai Huafa Group (China)

Estimated 2025 AI Investments: $69 million

Key AI Startup Funded: Zhipu AI

Stage Focus: Strategic regional AI development

Funding Insight: Zhuhai Huafa Group joined the Zhipu AI funding effort with a $69M commitment — a move that aligns with China’s regional investment approach to AI independence. Local funds are doubling down on homegrown LLMs, and Huafa’s investment signals confidence in Zhipu’s ability to compete with global players on its own turf.

43. Chengdu Hi-Tech Investment Group (China)

Estimated 2025 AI Investments: $42 million

Key AI Startup Funded: Zhipu AI

Stage Focus: Public-private innovation partnerships

Funding Insight: Chengdu Hi-Tech’s $42M investment in Zhipu rounded out a trio of Chinese institutions funding the company’s scale-up. As a state-linked investment vehicle, Chengdu’s support suggests more than commercial interest — it’s part of a broader national goal to control the next wave of AI development internally.

44. Fidelity (Boston, USA)

Estimated 2025 AI Investments: Part of $6 billion

Key AI Startup Funded: xAI

Stage Focus: Late-stage mega-rounds

Funding Insight: Fidelity participated in Elon Musk’s $6B raise for xAI — a company aiming to compete with OpenAI, Anthropic, and Google. The move echoed Fidelity’s strategy of anchoring large, late-stage rounds in high-upside tech bets. Even with minimal product traction, xAI’s name power was enough to pull in legacy institutions.

45. BlackRock (New York, USA)

Estimated 2025 AI Investments: Part of $6 billion

Key AI Startup Funded: xAI

Stage Focus: Strategic exposure to foundational AI

Funding Insight: BlackRock joined Fidelity and others in the xAI raise, giving the deal blue-chip credibility. This wasn’t just a bet on Musk — it was a hedge against being left out of the foundational model wars. BlackRock’s backing gave xAI access to long-term capital and opened the door to public market pathways later.

46. Kingdom Holding Company (Saudi Arabia)

Estimated 2025 AI Investments: $400 million+

Key AI Startup Funded: xAI

Stage Focus: High-profile strategic investments

Funding Insight: Kingdom Holding put more than $400M into xAI — one of the biggest single commitments to the company outside the U.S. The move shows how Saudi capital is increasingly flowing into AI, not just infrastructure and energy. This wasn’t just a financial play — it was a geopolitical positioning move, too.

47. Qatar Investment Authority (Qatar)

Estimated 2025 AI Investments: Part of $6 billion

Key AI Startup Funded: xAI

Stage Focus: Sovereign strategic tech investments

Funding Insight: QIA joined the syndicate backing xAI, continuing its long-term strategy of aligning with high-visibility tech platforms. With sovereign funds expanding beyond infrastructure and real estate, QIA’s move into core AI suggests growing interest in technologies that can shape future influence — not just future profits.

48. Premji Invest (India)

Estimated 2025 AI Investments: $141 million

Key AI Startup Funded: Hippocratic AI

Stage Focus: Healthcare-focused applied AI

Funding Insight: Premji Invest backed Hippocratic AI’s $141M Series B, adding a global dimension to the healthcare AI narrative. As one of India’s most prominent family offices, its participation reflects growing global alignment on responsible AI use in critical sectors like health and medicine.

49. Oman Investment Authority (Oman)

Estimated 2025 AI Investments: Part of $6 billion

Key AI Startup Funded: xAI

Stage Focus: Diversification into AI infrastructure

Funding Insight: Oman’s sovereign wealth fund joined the xAI round as part of its strategy to diversify away from oil and into future-defining technologies. With a relatively modest track record in venture, this investment marked a notable shift — one that put Oman on the global AI investor map.

50. Vy Capital (Dubai, UAE)

Estimated 2025 AI Investments: Part of $6 billion

Key AI Startup Funded: xAI

Stage Focus: High-growth global tech

Funding Insight: Vy Capital rounded out the xAI syndicate, strengthening its ties with Elon Musk and the emerging stack of alternative AI labs. Known for backing bold founders and fast-moving tech, Vy’s move here was part conviction, part access — and fully on brand.

This list reflects real capital committed in 2025. These investors aren’t just buzzword-hunting — they’re placing serious bets on what AI becomes next.

AI Companies To Invest In

The table below provides a summary view of the top 50 investors in AI startup companies for 2025 — including investor names, AI companies they funded, estimated capital committed, country of origin, and deal timing.

Table: Summary of Top 50 AI Investors in 2025 (by Investment Amount)

Rank

Investor Name

Companies Invested (2025)

2025 Amount Invested (est.)

Country/HQ

Date (2025)

1

SoftBank

OpenAI; Skild AI

~$15–25 billion (OpenAI); $500 million (Skild AI)

Japan

Jan 2025

2

Thrive Capital

Databricks

$10 billion (led Series J round)

USA (New York)

Jan 2025

3

Andreessen Horowitz (a16z)

Databricks; ElevenLabs

Participated in the $10 billion Databricks round; co-led $180 million ElevenLabs Series C

USA (California)

Jan–Feb 2025

4

DST Global

Databricks

Participated in a $10 billion round

Hong Kong

Jan 2025

5

GIC

Databricks

Participated in a $10 billion round

Singapore

Jan 2025

6

Insight Partners

Databricks

Participated in a $10 billion round

USA (New York)

Jan 2025

7

WCM Investment Mgmt.

Databricks

Participated in a $10 billion round

USA (California)

Jan 2025

8

Lightspeed Ventures

Anthropic

Led $3.5 billion Series E

USA (California)

Mar 2025

9

Amazon.com

Anthropic

Up to $4 billion commitment (part of $2 billion round)

USA

Jan 2025

10

Durable Capital Partners

KoBold Metals

Co-led $537 million Series C

USA

Jan 2025

11

T. Rowe Price

KoBold Metals

Co-led $537 million Series C

USA

Jan 2025

12

Prosperity7 Ventures

Together AI

Co-led $305 million Series B

Saudi Arabia

Mar 2025

13

General Catalyst

Anthropic; Together AI

Participated in $3.5 billion Anthropic Series E; co-led $305 million Together AI round

USA

Mar 2025

14

SGW (Scott Hassan FO)

Lambda (AI cloud)

Co-led $480 million Series D

USA

Feb 2025

15

Andra Capital

Lambda (AI cloud)

Co-led $480 million Series D

USA

Feb 2025

16

Tiger Global

EnCharge AI

Led $100 million Series B

USA

Mar 2025

17

Salesforce Ventures

Anthropic

Participated in $3.5 billion Series E

USA

Mar 2025

18

Reid Hoffman

Manas AI

Launched with $24.6 million seed funding

USA

Jan 2025

19

Kleiner Perkins

Hippocratic AI

Led $141 million Series B

USA

Jan 2025

20

Elad Gil

Abridge

Co-led $250 million Series D

USA

Feb 2025

21

IVP (Insight Venture Partners)

Abridge

Co-led $250 million Series D

USA

Feb 2025

22

Bessemer Venture Partners

Abridge

Participated in a $250 million round

USA

Feb 2025

23

CapitalG (Google)

Abridge

Participated in a $250 million round

USA

Feb 2025

24

CVS Health Ventures

Abridge

Participated in a $250 million round

USA

Feb 2025

25

ARK Invest

Lambda (AI cloud)

Participated in a $480 million round

USA

Feb 2025

26

Nvidia

Lambda (AI cloud)

Participated in $480 million round

USA

Feb 2025

27

G Squared

Lambda (AI cloud)

Participated in $480 million round

USA

Feb 2025

28

Super Micro

Lambda (AI cloud)

Participated in $480 million round

USA

Feb 2025

29

ICONIQ Growth

ElevenLabs

Co-led $180 million Series C

USA

2025

30

NEA (New Ent. Associates)

ElevenLabs

Participated in a $180 million round

USA

2025

31

World Innovation Lab (WiL)

ElevenLabs

Participated in a $180 million round

USA/Japan

2025

32

Valor Equity Partners

ElevenLabs

Participated in a $180 million round

USA

2025

33

Endeavor Catalyst

ElevenLabs

Participated in a $180 million round

USA

2025

34

Lunate (AD)

ElevenLabs

Participated in a $180 million round

UAE

2025

35

Sequoia Capital

Harvey (AI legal)

Led $300 million Series D

USA

Mar 2025

36

Coatue Management

Harvey (AI legal)

Participated in a $300 million round

USA

Mar 2025

37

OpenAI Startup Fund

Harvey (AI legal)

Participated in a $300 million round

USA

Mar 2025

38

GV (Google Ventures)

Harvey (AI legal)

Participated in a $300 million round

USA

Mar 2025

39

Meta Platforms

Databricks

Invested in $10 billion Series J

USA

Jan 2025

40

Breakthrough Energy Ventures

KoBold Metals

Participated in $537 million Series C

USA

Jan 2025

41

Hangzhou City Inv. Fund

Zhipu AI

Invested ¥1 billion (~$138 M) in funding

China

Mar 2025

42

Zhuhai Huafa Group

Zhipu AI

Invested ¥500 million (~$69 M)

China

Mar 2025

43

Chengdu Hi-Tech Fund

Zhipu AI

Invested ¥300 million (~$42 M)

China

Mar 2025

44

Fidelity Investments

xAI (Elon Musk’s AI startup)

Participated in $6 billion Series C

USA

Dec 2024 (cont. 2025)

45

BlackRock

xAI

Participated in $6 billion Series C

USA

Dec 2024 (cont. 2025)

46

Kingdom Holding

xAI

Invested ~$400 million in Series C

Saudi Arabia

Dec 2024 (cont. 2025)

47

Qatar Investment Authority

xAI

Participated in $6 billion Series C

Qatar

Dec 2024 (cont. 2025)

48

Premji Invest

Hippocratic AI

Participated in $141 million Series B

India

Jan 2025

49

Oman Investment Authority

xAI

Participated in $6 billion Series C

Oman

Dec 2024 (cont. 2025)

50

Vy Capital

xAI

Participated in $6 billion Series C

UAE

Dec 2024 (cont. 2025)

Each investor is ranked by their 2025 AI investment amount. The table lists the AI startups they funded in 2025, the estimated amounts invested (in USD), their HQ country, and the date (or year) of those investments. (Investments in late 2024 that led into or continued in 2025 are marked with Dec 2024 (cont. 2025).) All figures are estimates based on funding round disclosures or reports for 2025.

Source link