Last month, Brett Adcock, founder of Robotics Startup’s Figure AI, claimed in an X post that his company is “currently the most popular private stock in the secondary market.”

However, the company sent out a halt and assumed letter to at least two brokers operating the secondary market, those brokers told TechCrunch. These people said the AI suspension and assumption letter demanded that the company’s stock be stopped marketing.

Both brokers said they received the letter for the first time after Bloomberg reported in mid-February that it was seeking a $1.5 billion round at a $39.5 billion valuation.

A spokesperson for Figure AI told TechCrunch that he would send such letters when the broker does not allow the stock to be sold, suggesting that there is a long history of sending such letters.

“This year, when we discovered that unauthorized third-party brokers were stocks in marketing without approval from the board of directors of the figure, the company sent a halt asking the fraudulent brokers to stop, as they did before when other fraudulent brokers were found. “We do not allow secondary market transactions of stocks without board of directors’ approval, and the company continues to protect against unnecessary third-party brokers in the market.”

Because a person is a private company rather than a public company, investors cannot freely and easily sell the stock without an event that specifically recognizes the company. This limitation is why the secondary market has emerged entirely, including alternatives that offer investors an alternative way to get cash from stocks prior to IPOs. For example, a loan that is protected by startup stocks that can be repaid when the company is published.

The secondary market, which is on the receiver of the figure’s letter, told TechCrunch that it has other theories as to why some CEOs are responsible for sales in the market.

Existing shareholders were trying to sell their shares at a price below the new hope valuation of $39.5 billion, these brokers said. Both brokers told TechCrunch that some companies are plaguing prospects that their lower-priced secondary shares can compete with the new round.

Without commenting specifically on the diagram case, Sim Desai, founder and CEO of secondary share MarketPlace Hiive, told TechCrunch that companies sometimes block direct secondary sales because they believe “it’s a zero-sum game.”

Desai naturally argues that the opposite can be true. Active secondary market trading could attract more attention on key stocks with new pay increases.

However, if secondary market activity cannot promote interest in the primary round, the problem may lie in the assessment itself. “If someone is struggling to sell something, it’s not just a capital availability, it’s just a feature of price and valuation,” Desai said.

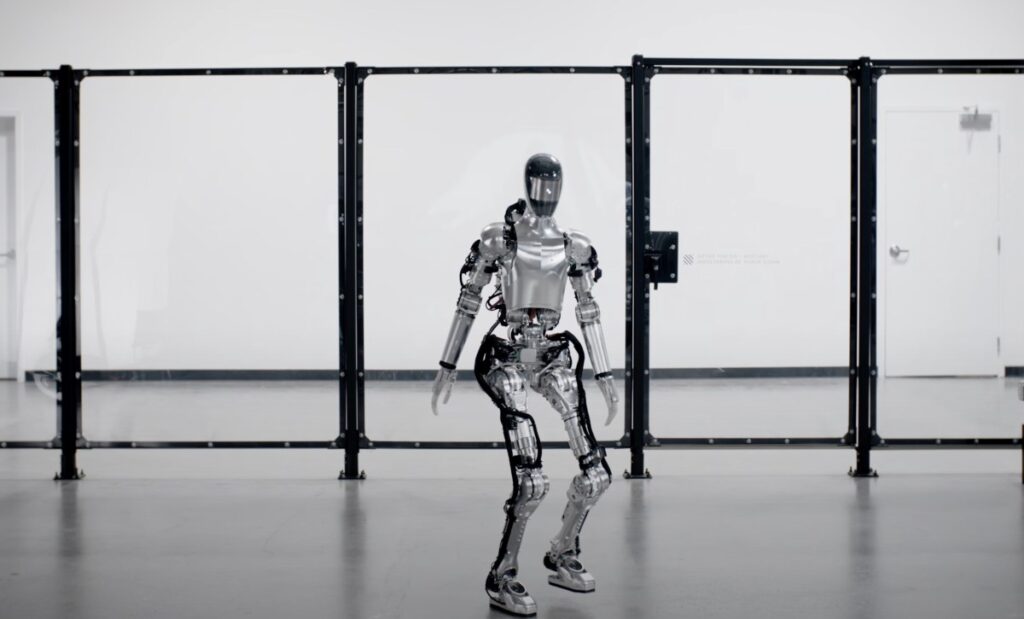

The figure has also recently been the subject of several news articles, explaining the advancements in the figure with Marquee’s customer BMW. In at least one case, the figure responded, saying that there is so much inaccuracy in this article that he is threatening to be sued.

How many numbers will AI raise next, and what ratings it is something we still can’t see. It should also be decided whether existing investors can cash out early on secondary transactions.

Source link