It’s May 15, 2025! Sorry, we were off yesterday. But today’s slate makes up for it. We’re back with your daily roundup of the latest tech startup funding news.

From space manufacturing and wireless power to biotech breakthroughs and AI note-taking, today’s deals span every corner of innovation.

Topping the list is Entrata, which secured a $200 million investment from Blackstone at a $4.3 billion valuation to scale its property management software empire. Not far behind is Sprinter Health, pulling in $55 million to bring on-demand diagnostics and preventive care straight to patients’ homes.

Deep tech had its moment too: Zeno Power raised $50 million to build next-gen nuclear batteries for space and defense, while Wi-Charge closed $20 million to cut the cord with its long-range wireless charging tech.

In the AI and SaaS world, Granola landed $43 million to supercharge its collaborative note-taking platform, and Row Zero emerged with $10 million to bring big-data intelligence to enterprise spreadsheets.

Whether it’s solving cancer, building reusable satellites, or rethinking domestic help, today’s funding round-up proves the innovation train isn’t slowing down.

Here’s who raised, how much, and why it matters.

Sprinter Health Raises $55M Series B for At-Home Healthcare Services

Sprinter Health, a Menlo Park, CA-based mobile healthcare provider, raised $55 million in a Series B round led by General Catalyst. Andreessen Horowitz (a16z Bio+Health) and other existing investors, including GV (Google Ventures) and Accel, also participated.

The fresh capital will be used to expand Sprinter’s at-home preventive healthcare services and scale its operations and technology. Sprinter Health’s platform combines a tech-driven logistics system with a full-stack medical practice to provide in-home diagnostics (blood draws, screenings, etc.) and virtual care coordination. The new funding brings the startup’s total raised to over $125 million to date, supporting its mission to re-engage patients with convenient, proactive care at home.

Funding Details:

Startup: Sprinter Health

Investors: General Catalyst (lead); Andreessen Horowitz (Bio+Health); GV; Accel

Amount Raised: $55M

Total Raised: $125M

Funding Stage: Series B

Funding Date: May 15, 2025

Fieldstone Bio Raises $5M Seed Round for Environmental Microbe Sensors

Fieldstone Bio, a biotech startup developing microbes capable of detecting substances like TNT and arsenic, has secured $5 million in seed funding. The investment, led by Ubiquity Ventures with participation from E14 and LDV Capital, will enable the company to transition from lab testing to real-world applications.

Funding Details:

Startup: Fieldstone Bio

Investors: Ubiquity Ventures (lead), E14, LDV Capital

Amount Raised: $5 million

Total Raised: $5 million

Funding Stage: Seed

Funding Date: May 15, 2025

Hedra Secures $32M Series A to Enhance AI Video Generation

Hedra, known for its AI-driven video generation and editing suite powered by the Character-3 model, has raised $32 million in a Series A round led by Andreessen Horowitz. The platform enables users to create videos featuring AI-generated characters, facilitating innovative content creation. The funds will be used to expand the team and establish a New York City office to support growth into enterprise marketing applications and further product development.

Funding Details:

Startup: Hedra

Investors: Andreessen Horowitz (lead), a16z Speedrun, Abstract, Index Ventures

Amount Raised: $32 million

Total Raised: $44 million

Funding Stage: Series A

Funding Date: May 15, 2025

Entrata Receives $200 Million Investment from Blackstone, reaches $4.3 billion valuation

Lehi, UT-based startup Entrata has received a $200 million minority investment from funds managed by Blackstone at a $4.3 billion valuation. Entrata provides a comprehensive operating system for multifamily apartment communities, offering software for leasing, accounting, facilities management, and resident engagement.

The strategic investment from Blackstone will enable Entrata to expand its technology platform to more property owners and operators and accelerate innovation in its product suite. By centralizing tasks like work orders, payments, and communications in one platform, Entrata helps property managers streamline operations and improve the resident experience. (Entrata’s prior backers include Silver Lake and other VCs, though total funding to date was not disclosed in this announcement.)

Funding Details:

Startup: Entrata

Investors: Blackstone (funds managed by Blackstone, minority stake)

Amount Raised: $200M

Total Raised: Not disclosed

Funding Stage: Minority Investment

Funding Date: May 15, 2025

Zeno Power Raises $50M Series B for Nuclear Battery Development

Seattle-based Zeno Power raised $50 million in Series B funding to advance its development of compact “nuclear batteries” for defense and space applications. The round was led by Hanaco Ventures, with participation from Seraphim (a space tech fund), Balerion Space Ventures, JAWS, and other investors.

Zeno Power’s devices are long-duration power systems that provide reliable energy in frontier environments such as undersea infrastructure, satellites, and lunar landers. The new capital will be used to grow the team and scale manufacturing capabilities to meet demand. Zeno has secured over $60M in R&D contracts from the U.S. Department of Defense and NASA, and with this round, the company’s total funding climbs to over $70 million.

Funding Details:

Startup: Zeno Power

Investors: Hanaco Ventures (lead); Seraphim Space; Balerion Space Ventures; JAWS; RiverPark Ventures (among others)

Amount Raised: $50M

Total Raised: over $70M

Funding Stage: Series B

Funding Date: May 15, 2025

Alpheus Medical Raises $52M Series B for Ultrasound-Based Brain Cancer Therapy

Alpheus Medical, a Chanhassen, MN-based clinical-stage oncology company, raised $52 million in a Series B round to advance its novel brain cancer treatment. The financing was co-led by HealthQuest Capital and Samsara BioCapital, with participation from existing investors including OrbiMed, Action Potential Venture Capital, BrightEdge (American Cancer Society’s fund), the Brain Tumor Investment Fund, and the Sontag Foundation.

Alpheus is developing a tumor-selective therapy activated by low-intensity ultrasound (with an oral drug) to treat glioblastoma and other brain tumors. The Series B funds will support a Phase 2B clinical trial of the therapy in newly diagnosed glioblastoma patients. Alpheus’s approach aims to non-invasively destroy cancer cells across the brain by activating a drug with ultrasound, without surgery or systemic side effects.

Funding Details:

Startup: Alpheus Medical

Investors: HealthQuest Capital (co-lead); Samsara BioCapital (co-lead); OrbiMed; Action Potential VC; BrightEdge; Brain Tumor Investment Fund; Sontag Innovation Fund

Amount Raised: $52M

Total Raised: Not disclosed

Funding Stage: Series B

Funding Date: May 15, 2025

Therini Bio Secures $39M Series A Extension for Neurodegenerative Disease Therapies

Sacramento-based Therini Bio raised an additional $39 million in Series A financing, extending its Series A total to $75 million. Therini Bio is developing fibrin-targeting immunotherapies to treat neurodegenerative diseases driven by vascular dysfunction (like Alzheimer’s disease).

The extension round brought in new investors Angelini Ventures and Apollo Health Ventures, alongside existing backers such as SV Health Investors (Biotech Fund), the Dementia Discovery Fund, MRL Ventures, Sanofi Ventures, Eli Lilly & Co., Dolby Family Ventures, and the Foundation for a Better World. The funding will be used to conduct Phase 1b trials of Therini’s lead antibody (THN391) in Alzheimer’s and diabetic macular edema, and to develop a fibrin/VEGF bispecific treatment. Therini’s approach targets toxic fibrin deposits that cause chronic inflammation in the brain, aiming to halt the underlying drivers of neurodegeneration.

Funding Details:

Startup: Therini Bio

Investors: Angelini Ventures; Apollo Health Ventures (new leads); SV Health Investors; Sanofi Ventures; Eli Lilly and Company; Dolby Family Ventures (among others)

Amount Raised: $39M (Series A extension)

Total Raised: $75M (Series A total)

Funding Stage: Series A (extension)

Funding Date: May 15, 2025

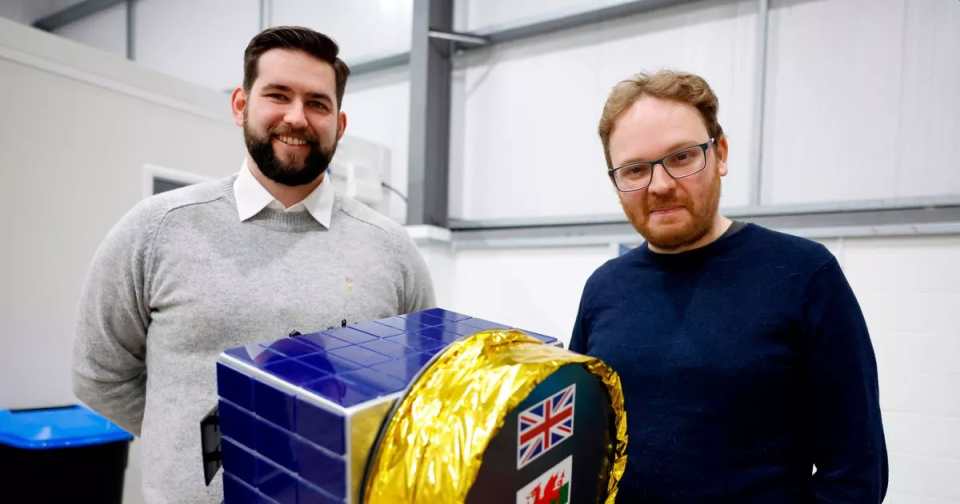

Space Forge Raises £22.6M Series A for In-Space Manufacturing Satellites

UK-based Space Forge, headquartered in Cardiff, Wales, raised £22.6 million in Series A funding to scale its in-space manufacturing technology. The round was led by the NATO Innovation Fund, with participation from Europe’s World Fund, the UK’s National Security Strategic Investment Fund (NSSIF), and British Business Bank (through its Regional Angels Programme), and other space-focused investors.

Space Forge is developing reusable satellites (ForgeStar platforms) to produce high-performance materials in microgravity and return them to Earth. The infusion of capital will accelerate the development of ForgeStar-2 and support the planned 2025 launch of ForgeStar-1, the company’s first returnable manufacturing satellite. By manufacturing certain “super materials” in orbit, Space Forge aims to enable new low-carbon technologies on Earth that benefit from the superior properties of space-made materials.

Funding Details:

Startup: Space Forge

Investors: NATO Innovation Fund (lead); World Fund; NSSIF (UK government); British Business Bank (Regional Angels Programme); SpaceVC; Helium Three (among others)

Amount Raised: £22.6M

Total Raised: Not disclosed

Funding Stage: Series A

Funding Date: May 15, 2025

Granola Raises $43M Series B for AI-Powered Note-Taking Platform

Granola, a London-based startup providing an AI-driven note-taking and transcription platform, raised $43 million in Series B funding at a $250 million valuation. The round was led by former GitHub CEO Nat Friedman and entrepreneur Daniel Gross’s firm (NFDG), with participation from existing investors Lightspeed Venture Partners (via partner Mike Mignano) and Spark Capital (via partner Nabeel Hyatt).

Several notable angels, including founders from Vercel, Replit, Shopify (Tobi Lütke), Linear, Intercom, Ramp, and others, also joined the round. Granola’s product is an AI-powered notepad that transcribes meetings and allows teams to organize and query their collective knowledge. With the new funds, Granola will grow its team in London and accelerate the development of collaboration features for its platform. (The company previously raised a $4.25M seed round in 2023 and a $20M Series A in 2024, bringing its total funding to roughly $67 M.)

Funding Details:

Startup: Granola

Investors: Nat Friedman & Daniel Gross (NFDG, lead); Lightspeed Venture Partners (Mike Mignano); Spark Capital (Nabeel Hyatt); plus several tech founders as angels

Amount Raised: $43M

Total Raised: Not disclosed

Funding Stage: Series B

Funding Date: May 15, 2025

Solestial Closes $17M Series A for Space-Based Solar Power Manufacturing

Tempe, AZ-based Solestial closed a $17 million Series A round to scale its production of solar panels for use in outer space. The funding was led by AE Ventures, with new investors Crosscut Ventures, Zeon Ventures, and Mitsubishi Electric’s ME Innovation Fund joining the cap table, alongside existing backers Airbus Ventures, General Purpose VC, Industrious Ventures, Stellar Ventures, and Techstars.

Solestial is developing radiation-hardened silicon solar cells and ultrathin, flexible solar modules that can self-heal from radiation damage under sunlight. The company will use the funds to expand its manufacturing capacity to 1 MW/year for its space-grade photovoltaics, which is about equal to the annual output of all U.S. and EU space solar manufacturers combined. By driving down the cost of space solar power, Solestial aims to deliver abundant energy for satellites and space missions over long durations.

Funding Details:

Startup: Solestial

Investors: AE Ventures (lead); Crosscut Ventures; Zeon Ventures; Mitsubishi Electric ME Innovation Fund; Airbus Ventures; Techstars (existing)

Amount Raised: $17M

Total Raised: Not disclosed

Funding Stage: Series A

Funding Date: May 15, 2025

Wi-Charge Raises $20M Series C for Long-Range Wireless Power Technology

Israel-based Wi-Charge secured $20 million in Series C funding to advance its long-range wireless charging solutions. The round was led by Standard Investments (the investment arm of Standard Industries) with participation from both existing and new investors, including the European Innovation Council’s EIC Fund.

Wi-Charge’s patented infrared-based system can safely deliver several watts of power across a room to charge devices like phones and smart home gadgets automatically, over the air. The company will use the funds to scale up manufacturing, integrate its technology with OEM partners, expand global distribution, and grow its commercialization team. After a decade of R&D resulting in 200+ patents, Wi-Charge is moving toward mass deployment of its wireless power tech to cut the cord on everyday electronics.

Funding Details:

Startup: Wi-Charge

Investors: Standard Investments (lead); EIC Fund (notable new investor); existing investors (undisclosed)

Amount Raised: $20M

Total Raised: Not disclosed

Funding Stage: Series C

Funding Date: May 15, 2025

Adyton Announces $11M Funding Round for Defense Operations Software

Dallas-based Adyton (a public-benefit corporation) announced an $11 million funding round to expand its mobile software platform for military operations. The round was led by Venrock, with participation from Khosla Ventures, Liquid 2 Ventures, Alumni Ventures, Initialized Capital, Kindred Ventures, and Leblon Capital.

Adyton’s product, the Adyton Operations Kit (AOK), is a mobile-first app that digitizes and automates Department of Defense workflows, providing commanders real-time data on personnel, equipment, and munitions from the field. The company (founded by former U.S. Special Forces officers) also announced a new multi-year deployment contract worth up to $7M with the U.S. Navy to roll out AOK to thousands of sailors. The fresh funds will help Adyton accelerate product development and scale deployments across the U.S. Armed Forces to increase readiness and operational agility at the tactical edge.

Funding Details:

Startup: Adyton

Investors: Venrock (lead); Khosla Ventures; Liquid 2 Ventures; Alumni Ventures; Initialized Capital; Kindred Ventures; Leblon Capital

Amount Raised: $11M

Total Raised: Not disclosed

Funding Stage: N/A (Early-stage round)

Funding Date: May 15, 2025

Kincell Bio Raises $22M for Cell Therapy Manufacturing Expansion

Kincell Bio, a contract development and manufacturing organization (CDMO) for cell therapies, raised $22 million in growth funding to expand its operations. The Research Triangle Park, NC- and Gainesville, FL-based startup’s round was led by NewSpring Capital (via its healthcare strategy) with participation from existing investor Kineticos Life Sciences.

Kincell Bio plans to use the funds to accelerate the expansion of its cGMP manufacturing capabilities and enhance process development services for emerging cell therapy companies. Led by CEO Mark Bamforth (a biotech industry veteran), Kincell focuses on helping developers of CAR-T, CAR-NK, stem cell, and gene-modified cell therapies by providing efficient manufacturing and analytical services from early clinical stages through commercial launch. The company’s streamlined approach aims to shorten development timelines for innovative immunotherapies.

Funding Details:

Startup: Kincell Bio

Investors: NewSpring Capital (lead, healthcare fund); Kineticos Life Sciences (existing)

Amount Raised: $22M

Total Raised: Not disclosed

Funding Stage: N/A (Growth funding)

Funding Date: May 15, 2025

Imprint Labs Raises $15M in Philanthropic Funding for Forensic Immunology Research

New York-based Imprint Labs, a focused research organization (FRO) building “forensic immunology” tools, raised $15 million in philanthropic funding to advance its mission. The funding round was backed by high-profile philanthropists Eric and Wendy Schmidt, Convergent Research (which incubates FROs), biotech investor Peter Reinhart, and the New York City Economic Development Corporation (NYCEDC).

Imprint Labs is developing experimental and machine-learning techniques to decode the immune system’s memory (from B cells and T cells) to uncover hidden causes of chronic diseases. With this funding, Imprint Labs will scale up its research into immune cell “archives” – essentially reading the body’s history of infections and exposures – to identify triggers of conditions like autoimmune and neurodegenerative diseases. The organization was incubated at Cornell Tech and represents a novel model of research funding, relying on philanthropy to tackle long-term scientific challenges.

Funding Details:

Startup: Imprint Labs

Investors: Eric & Wendy Schmidt (philanthropists); Convergent Research; Peter Reinhart; NYCEDC

Amount Raised: $15M

Total Raised: Not disclosed

Funding Stage: Philanthropic funding

Funding Date: May 15, 2025

Metafoodx Raises $9.4M for AI-Driven Kitchen Operations Platform

Metafoodx, based in San Jose, CA, raised $9.4 million to expand its AI-powered food operations platform. The round was led by Trustbridge Partners, with participation from BlueRun Ventures and ScalableVision Capital. Metafoodx’s solution uses computer vision and AI to help commercial kitchens reduce food waste, optimize production, and ensure food safety compliance.

For example, the platform’s 3D AI scanner can automatically capture an item’s image, weight, and temperature and log it against the menu for real-time inventory and waste tracking. With the new funding, Metafoodx will grow its operations and continue developing its automation technology for kitchens. The goal is to enable cafeterias, restaurants, and food service providers to run more efficiently and sustainably through data-driven insights and automation.

Funding Details:

Startup: Metafoodx

Investors: Trustbridge Partners (lead); BlueRun Ventures; ScalableVision Capital

Amount Raised: $9.4M

Total Raised: Not disclosed

Funding Stage: N/A (Early-stage funding)

Funding Date: May 15, 2025

Algoma Raises $2.3M Seed Funding for AI-Driven Real Estate Development

New York City-based Algoma secured $2.3 million in seed funding to advance its AI-native real estate development platform. The round was led by Zacua Ventures, with participation from SOSV, Iron Prairie Ventures, DOMiNO Ventures, Compose VC, and angel investors. Algoma’s software helps real estate developers instantly evaluate site feasibility and “turn an address into a deal” by analyzing zoning, market data, construction costs, and more within minutes.

By aggregating factors like capacity calculations, pro forma financials, and even design massing, the platform gives developers quick go/no-go insights for potential projects. The seed funds will be used to expand Algoma’s operations and accelerate product development, allowing more developers to leverage AI for faster decision-making in property development.

Funding Details:

Startup: Algoma

Investors: Zacua Ventures (lead); SOSV; Iron Prairie Ventures; DOMiNO Ventures; Compose VC

Amount Raised: $2.3M

Total Raised: Not disclosed

Funding Stage: Seed

Funding Date: May 15, 2025

Row Zero Raises $10M Seed Round for Big-Data Enterprise Spreadsheet

Seattle’s Row Zero emerged from stealth with $10 million in seed funding to build an enterprise spreadsheet platform for big data. The investment was led by IA Ventures, with participation from Trilogy Equity Partners, Founder’s Co-op, Ludlow Ventures, K9 Ventures, Functional Capital, and angel investor Wes McKinney (creator of pandas).

Row Zero is developing a cloud-connected spreadsheet that links directly to data warehouses (Snowflake, Databricks, Redshift, etc.) and provides granular security controls (like row-level security and restricted exports) to make spreadsheets enterprise-ready. The new funding will be used to accelerate product development, integrate AI features, and support more enterprise workflows (e.g., ERP and CRM integrations). Having previously raised $3M in pre-seed funding, Row Zero’s total funding now stands at $13 M.

Funding Details:

Startup: Row Zero

Investors: IA Ventures (lead); Trilogy Equity Partners; Founder’s Co-op; Ludlow Ventures; K9 Ventures

Amount Raised: $10M

Total Raised: $13M

Funding Stage: Seed

Funding Date: May 15, 2025

Verdi Raises C$6.5M Seed to Automate Farm Irrigation with AI

Canadian agtech startup Verdi (Vancouver, BC) raised C$6.5 million in seed funding to expand its AI-powered farm automation platform. The round was led by SVG Ventures (Thrive), with participation from NEC X, Ponderosa Ventures, Elemental Impact, Genome BC, One Small Planet, Waterpoint Lane, Dangerous Ventures, and others. Verdi provides modern automation tools for agriculture – its retrofit devices and software can automate irrigation and crop maintenance tasks on existing farm infrastructure, helping farmers save labor and increase yields.

With the new funding, Verdi plans to enter new regions, advance its AI platform, and deepen partnerships with major agribusinesses. The company’s vision is to build climate-resilient food systems by using sensors and AI to optimize water usage and farm operations at scale. Including this round, Verdi has raised a total of approximately C$9.5M to date.

Funding Details:

Startup: Verdi

Investors: SVG Ventures (Thrive) (lead); NEC X; Ponderosa Ventures; Elemental Impact; Genome BC; One Small Planet (among others)

Amount Raised: C$6.5M

Total Raised: C$9.5M

Funding Stage: Seed

Funding Date: May 15, 2025

Pronto Raises $2M to Scale On-Demand House Help Service in India

Pronto, based in Gurgaon, India, raised $2 million to expand its on-demand house help services platform. The funding was led by Bain Capital Ventures. Pronto’s mobile app lets users book household helpers (cleaning, laundry, etc.) in as little as 10 minutes or schedule regular help, providing a tech-enabled solution for domestic services.

The startup operates 24/7 and offers an instant “10-minute guarantee” for last-minute bookings. With this seed funding, Pronto will open new hubs and extend its service area across Gurgaon, as well as hire additional staff to meet growing demand. By formalizing and streamlining access to domestic workers, Pronto aims to modernize India’s house help market and improve reliability for both customers and workers.

Funding Details:

Startup: Pronto

Investors: Bain Capital Ventures (lead)

Amount Raised: $2M

Total Raised: Not disclosed

Funding Stage: Seed/Early-stage

Funding Date: May 15, 2025

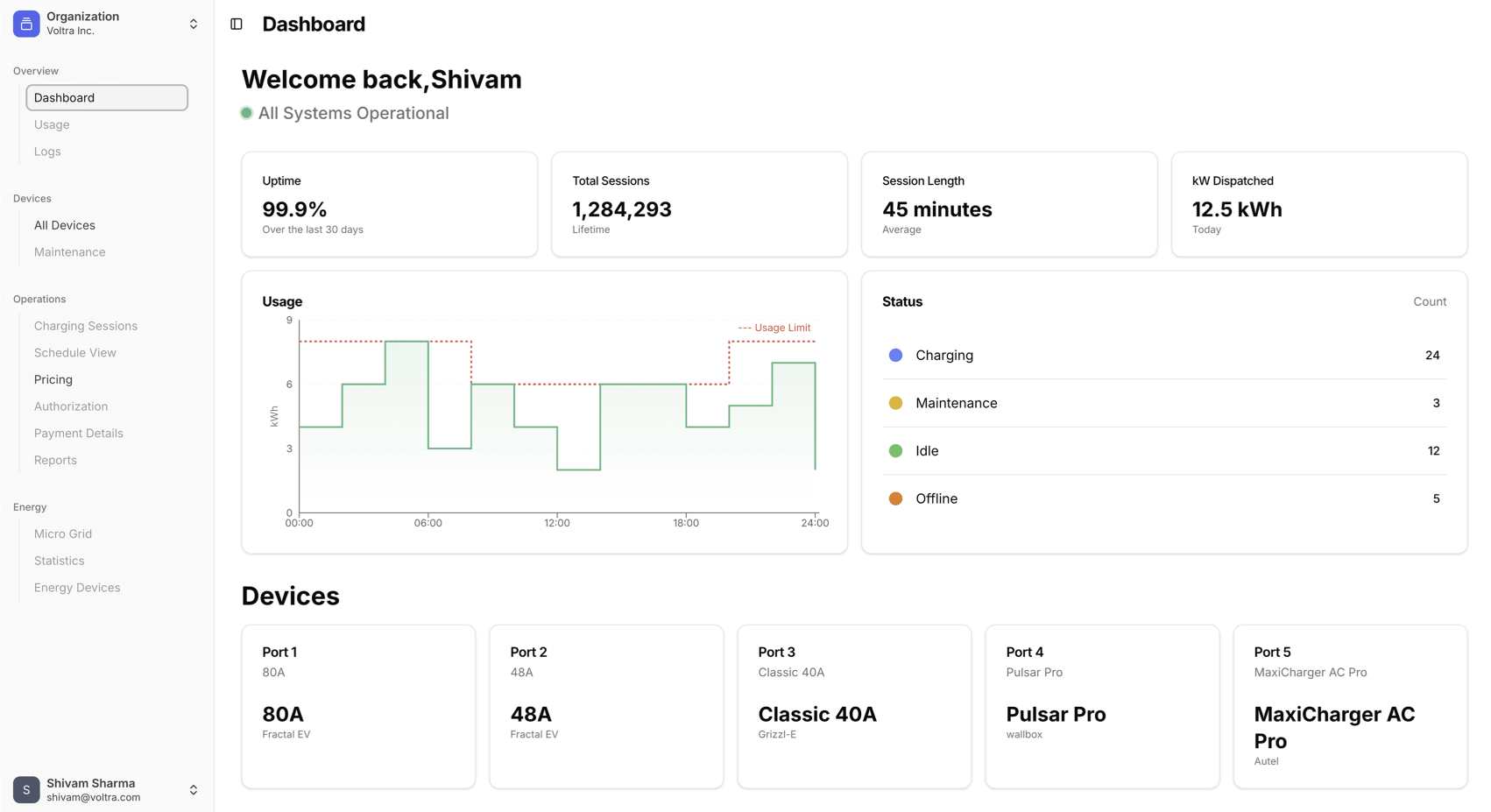

Voltra Raises $1.8M Pre-Seed for Energy Infrastructure Software

Canadian startup Voltra has raised $1.8 million in pre-seed funding to develop software systems for next-generation energy infrastructure. The round was led by Contrary (venture fund), with participation from Hanover Capital and Velocity Fund. Voltra’s first product, called Charge, helps operators integrate and control EV chargers, batteries, and microgrids to create a more decentralized and resilient electric grid.

The company’s platform aims to improve the efficiency and reliability of EV charging networks by coordinating energy storage and distribution in real time. The new capital will be used to expand Voltra’s operations and accelerate product development. Co-founded in 2023 by Alexander Stratmoen and Aryan Afrouzi, Voltra is working to modernize energy infrastructure with software-defined management for distributed energy resources.

Funding Details:

Startup: Voltra

Investors: Contrary (lead); Hanover Capital; Velocity Fund

Amount Raised: $1.8M

Total Raised: Not disclosed

Funding Stage: Pre-Seed

Funding Date: May 15, 2025

Repliers Receives Undisclosed Funding to Advance Real Estate Data Platform

Toronto-based Repliers, which offers an AI-powered real estate data search platform, received an additional funding round (amount undisclosed) from Scale Shift Ventures. This follow-on investment builds on Repliers’ initial seed funding from July 2024.

Repliers’ technology allows users, such as developers and proptech firms, to query real estate information using natural language and advanced search tools. Its platform includes a developer playground for testing APIs, an AI-powered NLP search for property listings, and even an AI image search feature to find properties via photos. The new funding will help Repliers accelerate product innovation and expand go-to-market efforts as it continues to refine how real estate data is accessed and analyzed. (Note: The specific amount and stage of this round were not disclosed.)

Funding Details:

Startup: Repliers

Investors: Scale Shift Ventures (follow-on investor)

Amount Raised: Not disclosed

Total Raised: Not disclosed

Funding Stage: Seed (additional funding)

Funding Date: May 15, 2025

Prosperos Raises $250K to Grow Fintech Platform for Latino Communities

Prosperos, a Salinas, CA-based fintech startup focused on the Latino market, raised $250,000 from Mendoza Impact as an extension of its early funding. Mendoza Impact joined a group of existing investors that includes FEBE Ventures, BAT VC, Tekton Ventures, and Courtyard Ventures.

Prosperos is building a mobile financial platform tailored to serve the 400 million Latinos across the Americas, aiming to provide accessible banking and credit services to a traditionally underserved demographic. The fresh capital will support Prosperos in expanding its operations and developing its platform further. Co-founded by Vinay Pai and Salvador Chavez, Prosperos leverages modern fintech tools to help Latino users save, invest, and access financial products in a culturally relevant way. (Total funding to date was not disclosed.)

Funding Details:

Startup: Prosperos

Investors: Mendoza Impact (lead); (previous: FEBE Ventures, BAT VC, Tekton Ventures, Courtyard Ventures)

Amount Raised: $250K

Total Raised: Not disclosed

Funding Stage: Pre-Seed/Angel

Funding Date: May 15, 2025

Funding Summary Table

Startup

Investors (Lead and notable investors)

Amount Raised

Total Raised

Funding Stage

Funding Date

Sprinter Health

General Catalyst (lead); a16z Bio+Health; Accel

$55M

$125M

Series B

May 15, 2025

Entrata

Blackstone (lead, minority stake)

$200M

Not disclosed

Minority Investment

May 15, 2025

Zeno Power

Hanaco Ventures (lead); Seraphim Space; Balerion

$50M

$70M+

Series B

May 15, 2025

Alpheus Medical

HealthQuest & Samsara (co-leads); OrbiMed; BrightEdge

$52M

Not disclosed

Series B

May 15, 2025

Therini Bio

Angelini Ventures; Apollo Health (leads); SV Health; Eli Lilly

$39M

$75M

Series A (extension)

May 15, 2025

Space Forge

NATO Innovation Fund (lead); World Fund; NSSIF (UK)

£22.6M

Not disclosed

Series A

May 15, 2025

Granola

Nat Friedman & Daniel Gross (lead); Lightspeed; Spark

$43M

Not disclosed

Series B

May 15, 2025

Solestial

AE Ventures (lead); Crosscut; Mitsubishi Electric

$17M

Not disclosed

Series A

May 15, 2025

Wi-Charge

Standard Investments (lead); EIC Fund

$20M

Not disclosed

Series C

May 15, 2025

Adyton

Venrock (lead); Khosla Ventures; Liquid 2

$11M

Not disclosed

– (Early-stage round)

May 15, 2025

Kincell Bio

NewSpring Capital (lead); Kineticos Life Sciences

$22M

Not disclosed

– (Growth funding)

May 15, 2025

Imprint Labs

Eric & Wendy Schmidt (lead donors); Convergent Research

$15M

Not disclosed

Philanthropic Funding

May 15, 2025

Metafoodx

Trustbridge Partners (lead); BlueRun Ventures

$9.4M

Not disclosed

– (Early-stage)

May 15, 2025

Algoma

Zacua Ventures (lead); SOSV; Iron Prairie

$2.3M

Not disclosed

Seed

May 15, 2025

Row Zero

IA Ventures (lead); Trilogy Equity; Founders Co-op

$10M

$13M

Seed

May 15, 2025

Verdi

SVG Ventures/Thrive (lead); NEC X; Ponderosa

C$6.5M

C$9.5M

Seed

May 15, 2025

Pronto

Bain Capital Ventures (lead)

$2M

Not disclosed

Seed

May 15, 2025

Voltra

Contrary (lead); Hanover Capital

$1.8M

Not disclosed

Pre-Seed

May 15, 2025

Repliers

Scale Shift Ventures (lead investor)

Not disclosed

Not disclosed

Seed (extension)

May 15, 2025

Prosperos

Mendoza Impact (lead); (FEBE Ventures, others prior)

$250K

Not disclosed

Pre-Seed/Angel

May 1

🚀 Want Your Story Featured?

Get in front of thousands of founders, investors, PE firms, tech executives, decision makers, and tech readers by submitting your story to TechStartups.com.

Get Featured

Source link