After a few weeks of predictions, Omada’s health will be officially made public.

The virtual chronic care startup priced an IPO at $19 per share on Thursday, landing in the middle of its expected range. The offering includes 7.9 million shares, raising approximately $150 million.

Founded in 2012, the company currently trades on Nasdaq under the ticker “Omda”. According to CNBC, the $19 price range will be around $1.1 billion in valuation at 2022 locations.

Famous supporters include US venture partners Andreesen Horowitz and Fidelity’s FMR LLC.

This marks the second digital health IPO in a few weeks. This is a sign that the market may eventually loosen after a long, dry spell. Physiotherapy Startup Hinge Health was released on NYSE last month.

More signs of life? Crypto Firm Circle Internet debuted on Thursday, with Etoro starting trading last month, with Chime Financial coming up next.

Omada was founded over a decade ago by Sean Duffy, Andrew Dimichele and Adrian James. The latter two then went on. Duffy remains CEO and has pitched the company’s IPO as an opportunity for new investors to take part in their next phase of growth.

With over 156 million Americans living with at least one chronic illness, Omada bets on the growing demand for scalable, virtual care, especially among employers who are pressured to cut healthcare costs.

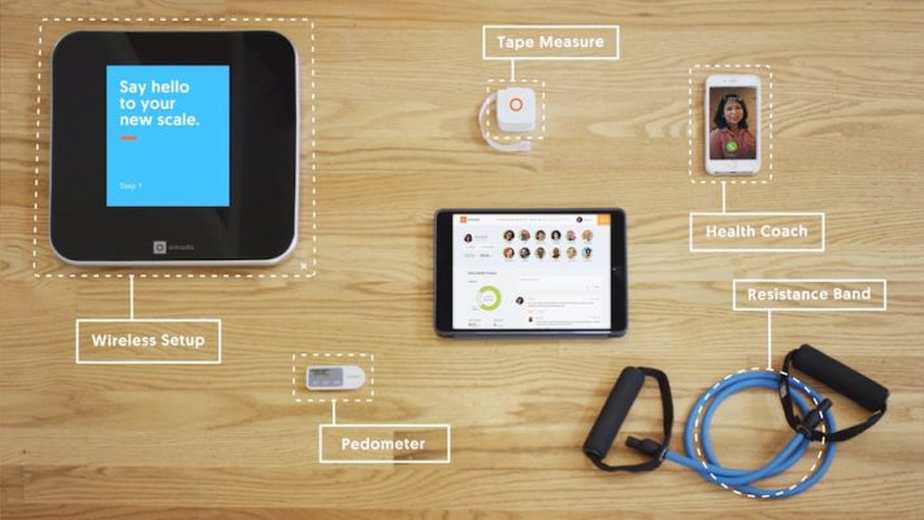

The startup offers personalized care plans that combine clinical support with behavioral health programs. This was the first virtual provider to join Healthcare Improvement’s Leadership Alliance Institute, and would like to be seen as part of a traditional healthcare system, not as a replacement.

Omada’s recent figures show solid growth. First quarter revenue jumped to $55 million, 57% year-on-year. In 2024, revenues rose 38% to $169.8 million, up 38% from $122.8 million the previous year. Losses are also narrowing, with net losses falling to $9.4 million in the first quarter, down from $19 million a year ago.

Its supporters include well-known investors, including Andreessen Horowitz, Fidelity’s FMR LLC, and US venture partners, who each own nearly 10% of the company.

This is a promising start for digital health companies looking to re-enter the open market, which has just begun to thaw.

🚀Want to share the story?

Submit your stories to TechStartUps.com in front of thousands of founders, investors, PE companies, tech executives, decision makers and tech leaders.

Please attract attention

Source link