Tether, the world’s largest stubcoin plagued by scandals and government investigations, sells some of its Bitcoin holdings valued at around $8 billion to match proposed US stubcoin regulations You may need to do that.

According to a recent report by JPMorgan analysts, Tether could be forced to offload approximately $8 billion in Bitcoin Holdings chunks to comply with new US regulations. Current estimates suggest that only 66% to 83% of tether reserves are in line with the proposed requirements. This means there could be a major change in asset allocation on the horizon.

“Tether may need to sell non-compliant assets, including Bitcoin, precious metals, corporate paper and secured loans, to comply with proposed US stubcoin regulations.”

Tether is one of the largest Bitcoin buyers and currently holds around 85,000 BTC. If you decide to sell and stop buying, or if it’s more likely, Bitcoin can again go well below $10,000.

Proposed laws, including the Stablecoin Transparency and Accountability Act and the US Stablecoin Innovation Guidance and Instantivent Act (Genius Act), promote licensing, stricter risk management, and stubcoin issuance Full reserve backing for those.

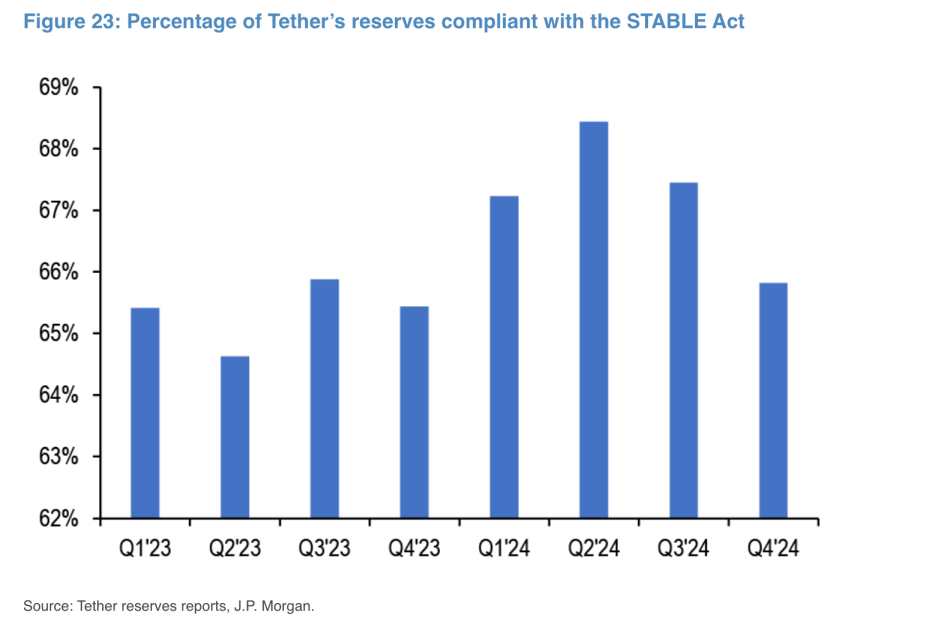

Analysts at JP Morgan, led by Nikolaos Panigirtzoglou, reported Wednesday that Tether reserves met only 66% of the House of Representatives’ stable compliance requirements. These figures show that the tether compliance ratio has been slipping since mid-2024, consistent with the rapid growth of stable supply.

Credit: JPMorgan

To stay within the rules, Tether may need to settle assets such as Bitcoin, precious metals, corporate paper, and secured loans and shift their reserves to secure holdings like the US Treasury Department.

If Bitcoin is fully backed up, why should Tether sell Bitcoin?

So here’s the real question: if the tether is assumed to be 1:1 backed by US dollars or equivalent assets, why do you even need to sell Bitcoin to comply with Stablecoin regulations? Wait?

This raises two major concerns.

Booking Transparency – If USDT was actually supported by cash or cash equivalent assets, then Bitcoin sales aren’t even part of the conversation. The fact that it raises eyebrows. Exposure to Volatile – Stability is intended to be stable. But what happens if some of that spare is in Bitcoin? It beats the overall purpose of being a “stable” coin, right?

Tether CEO Paolo Aldoino doesn’t stifle his response and suggest that their perspective could be colored by the fact that their perspective is not holding Bitcoin himself. I didn’t take a jab to a JP Morgan analyst.

These regulations are still debated and it is unclear how they will ultimately turn out. Whether Tether is forced to sell Bitcoin Stash depends on how these policies develop.

As reported in 2023, Tether bought $222 million worth of Bitcoin to support the world’s largest Stablecoin, USDT. At the time, Tether also said he would invest 15% of his net profit in Bitcoin as part of his efforts to “diversify” his preparations to support USDT tokens.

Source link