Hong Kong, Hong Kong, February 20, 2025, Chain Wire

Hong Kong-based investment group Avenir Group has emerged as a leading institutional player in the digital asset market, with a recent disclosure revealing a $599 million investment in Bitcoin ETFs. This strategic move not only highlights Avenir’s confidence in the future of digital assets, but also marks pivotal moments in brand evolution and business strategy.

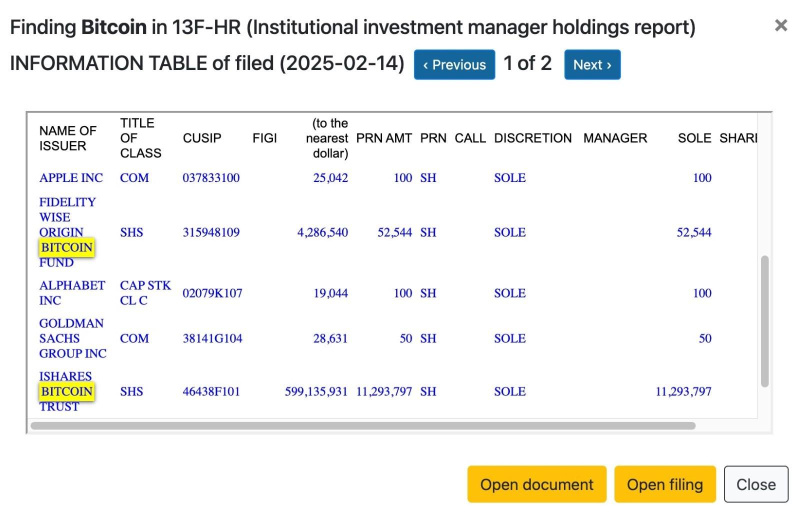

*Avenir Group holds 11.3 million shares of IBIT, worth approximately $599 million

Major institutional investments in Bitcoin ETFs

Avenir Group’s latest 13F filing revealed a significant increase in Bitcoin ETF exposure, placing it as the owner of Asia’s largest Bitcoin ETFS. As of December 31, Avenir owns 11.3 million shares of BlackRock’s Ishares Bitcoin Trust (IBIT), worth approximately $599 million. This strategic investment makes Avenir the largest holder of Bitcoin ETFs in Asia, highlighting its commitment to digital assets and financial innovation.

The institutional surge in Bitcoin ETFs will accelerate mainstream adoption

The latest SEC 13F filing reveals an increasing institutional appetite for Bitcoin ETFs. According to a K33 survey, institutional investors held 25.4% of their Spot Bitcoin ETF assets by the fourth quarter of 2024, totaling $26.8 billion. Throughout the quarter, key institutions such as investment companies, hedge funds, banks and pension funds increased their holdings significantly.

Originally founded as a family office for Li Lin, Avenir Group has evolved into a major investment group specializing in financial innovation and emerging technologies. The company’s multi-asset, multi-strategic approach spans quantitative trading, open markets, private equity and digital asset investments. Under its umbrella, DeepTrade operates independently as a high frequency trading team, while Avenir Foundation focuses on technical education and innovation.

Avenir Group firmly believes that, together with the fusion of financial innovation and emerging technologies, the convergence of digital assets with traditional finance will redefine global markets. Working on compliance and globalization, Avenir is strategically positioned to promote long-term, sustainable growth in the industry. With deep industry insights, exceptional investment performance, a unique data model and a robust risk management system, Avenir Group continues to unlock new frontiers in Web3 and digital asset investment.

Demonstrate commitment to the crypto ecosystem

Avenir’s increasing investment in Bitcoin ETFs is consistent with strategic initiatives to drive innovation in the digital asset market. In September 2024, the company launched a $500 million crypto partnership program, working with top-tier quantitative trading teams around the world. The program can tackle the key challenges of crypto trading for high-performance teams with advanced technology. By promoting a technology-driven, highly efficient trading ecosystem, Avenir strengthens its commitment to the long-term growth and evolution of the global digital asset market.

About Avenir Group

Founded by Li Lin and named after the French word “better future,” Avenir Group is a pioneering investment group specializing in financial innovation and investment in emerging technologies. With its global presence across the US, UK, Japan, Singapore and Hong Kong, the company leverages deep industry insights, excellent performance, self-development data models and risk management systems to maintain its key positions in Web3 and digital assets I will. Sector.

The group also operates sub-brand deep trading focused on high-frequency trading in the cryptocurrency market, supporting technical education and innovation, promoting global technology development and supporting talent cultivation. It runs an Avenir Foundation.

For more information, users can visit https://avenir.hk/.

contact

Marketing & Intelligence Director

Shawn Su

Avenir Group

shawn.su@avenir.hk

Source link