Nvidia CEO Jensen Huang is as bullish about the future of his company as ever, and has repeated feelings that Deepseek will not affect sales, he said in his latest revenue call on Wednesday.

Speculation that Deepseek’s R1 model needs to require much less chips to train has driven a record drop in Nvidia’s stock price last month.

However, during the revenue call, Huang touted the R1 as “a great innovation,” emphasizing that IT and other “inference” models are great news for Nvidia as they require more computing.

“Inference models could consume 100 times more calculations, and future inference models would consume more calculations,” says Huang. “The Deepseek R1 sparked global enthusiasm. It’s a great innovation, but more importantly, it opened up a world-class inference AI model. Almost every AI developer has applied it.”

Nvidia sales show no signs of slowing down. Nvidia reported another record-breaking quarter with revenues reaching $39.3 billion, surpassing both its own forecast and Wall Street estimates. He said revenues are expected to rise again for the next quarter.

Nvidia’s data center sales almost doubled in 2024, up 16% from the previous quarter, according to a revenue release from Tech Giants.

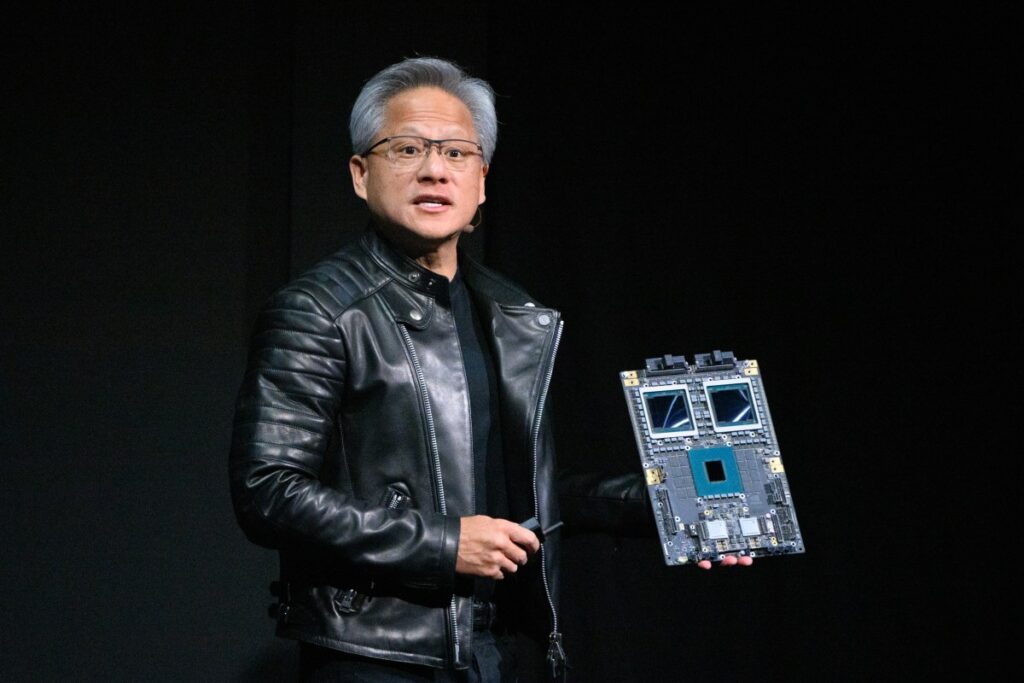

During the call, Huang touted Nvidia’s latest Blackwell chip as being custom built for inference, saying current demand was “extraordinary.”

“We will grow strong in 2025,” Huang said.

In fact, despite panic over DeepSeek last month, the AI chip market has shown no signs of cooling.

Since then, Meta, Google and Amazon have all announced large-scale AI infrastructure investments and have collectively committed hundreds of millions of people going forward.

Source link