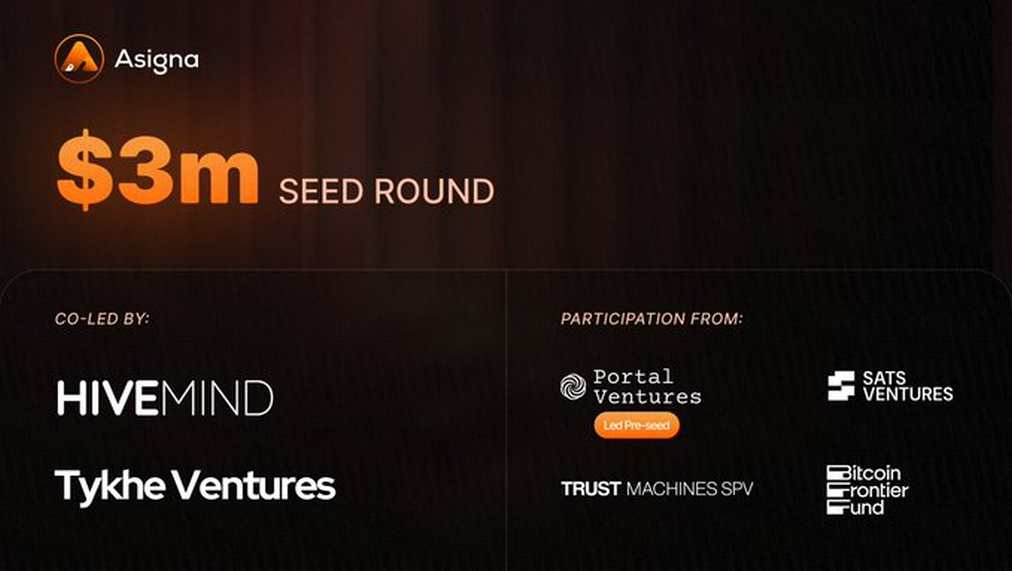

Asyña, the project behind Bitcoin and its Layer 2 protocol’s unlawful smart multi-sigvault, has rolled out a major V2 upgrade and pushed it forward by securing fresh funds of $3 million. The round was led by Hivemind Capital and Tykhe Block Ventures and was supported by a lineup of SATS ventures, trust machines and angel investors. Portal Ventures led Asinya’s previous seed round along with Bitcoin Frontier Fund.

For those new to the company, Assigna is a smart safe system that helps teams, DAOs and institutions manage Bitcoin’s finances safely. Vault supports $1.1 billion in assets and serves as a security layer to prevent hacking, internal conflicts, or access issues.

What stands out is that it supports standard wallet functionality and allows users to interact directly with protocols such as DAPP, decentralized exchanges, and ordinances, runes, and BRC-20.

“With Assigna, institutions and large holders are creating basic infrastructures to securely and confidently participate in the evolving Bitcoin ecosystem,” said Viven, co-founder of Assigna. “Robust, transparent, programmable non-sided solutions have critical needs, and multisig infrastructure is at the heart of this transformation.”

The new V2 release adds built-in apps. This allows users to interact directly with Bitcoin-based applications from within the Multisig Vault environment. Users can also get customizable dashboards for portfolio tracking and exchange between Bitcoin assets and BTC from the same interface.

Developers are not excluded either. Assigna has released the Connecting SDK and Multisig SDK, allowing developers to connect their user Multisig wallet directly to their own apps on Bitcoin and Stack. You can manage transactions, sign messages, move funds, and process contract deployments.

Other new features include customizable permissions for subaccounts, email notifications, governance tools, privacy controls, advanced UTXO management, and Vault Signers.

“What’s unique about Assigna is that unlike many other Onchain smart wallet implementations, there’s no risk of smart contracts, it’s completely native to the Bitcoin layer. It can’t interact directly with private keys. Account owners can sign transactions. “That means these multi-signa wallets will not be frozen or lost, regardless of what happens to Assigna.”

Bitcoin reached $108,135 at the end of last year, and interest in Bitcoin-based infrastructure is booming as ETF inflows far outweigh mining supplies. Bitcoin Defi is already rocketing its $6 billion total and is climbing fast. The Assigna team sees a great opportunity here, especially for institutions who want to participate without giving up security or custody.

The new funding will help Assigna grow its offering for corporate customers, particularly those looking for safe access to staking and lending products through more hands-on concierge-style services.

“We are pleased to announce that Kayla Phillips, senior investment principal at Hivemind Capital. “We are thrilled to support their mission to provide robust, transparent, non-radical solutions to the evolving Bitcoin ecosystem.”

Founded in 2022, Assigna operates a smart multi-signature vault system for Bitcoin and its Layer 2 protocols. With over $1.1 billion in assets protected, the platform is built for teams, DAOs and institutions that require multi-party management of shared funds. Assigna supports direct wallet interaction with Dapps, Dexs, and Bitcoin-Native protocols, providing flexibility without sacrificing security.

🚀Want to share the story?

Submit your stories to TechStartUps.com in front of thousands of founders, investors, PE companies, tech executives, decision makers and tech leaders.

Please attract attention

Source link