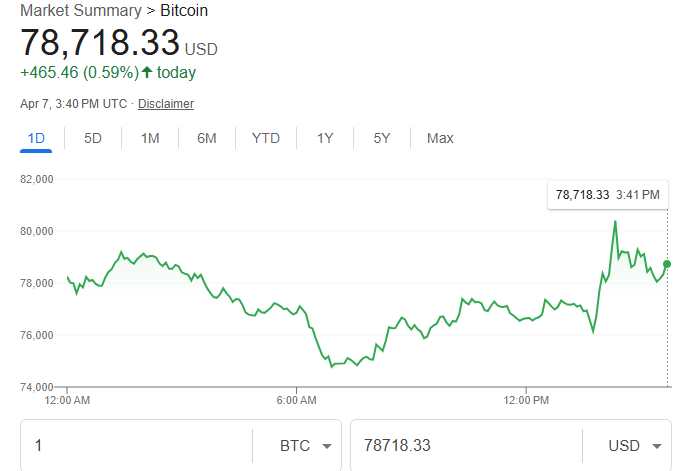

After steadily holding on to the stock sale last week, Crypto Markets finally bent over. Bitcoin, which had already fallen nearly 5% last week, extended its slide on Monday. During the Asian trading session, I was very touched on the new 2025 Low $74,508.

Since then, he has hovered around $76,000 at the time of writing and retrieved some of the ground. However, the broader trend remains below. Bitcoin is currently trading at $78,718 at the time of writing.

trigger? The escalating world trade war.

The market was a hit after President Donald Trump proposed new tariffs last Wednesday. China responded to US imports with a 34% collection. The fallout has not only hammered Crypto, but also reduced the Asian market.

“Bitcoin (BTC) will recover some of its initial losses as of Monday’s writing after reaching a new low of $74,508 during an Asian trading session, and trade around $76,000 as of Monday’s writing, FXStreet reported.

The deeper trade war has hit Crypto Markets hard, liquidating 452,976 leveraged positions and wiped out $139 billion in the last 24 hours. At the same time, US institutional interests are declining, with Bitcoin spot ETFs seeing net flow of $172.69 million last week.

Meanwhile, other major tokens have earned even bigger hits. Ether, Solana and XRP all fell violently. This records two digit losses before managing partial recovery. Ether, the second largest cryptocurrency after Bitcoin, is still down about 5%.

After China fought back against Trump-era tariffs, pressure on crypto was intensified, already sucking up investors. According to Coinglas, roughly $1.2 billion in bullish crypto positions have been wiped out in the last 24 hours.

“This was the turning point,” Julius Bear analyst Manuel Vilgas told The Wall Street Journal. He explained that the market decline would require agencies to expose crypto, pushing some of them beyond the risk threshold.

Publicly traded crypto companies also did not escape selling. Shares of software company MicroStrategy changed Bitcoin Bull under CEO Michael Saylor and fell sharply in pre-market trading.

Thaler never stays quiet during market volatility, but tweeted on Friday. “Bitcoin offers resilience in a world full of hidden risks.”

🚀Want to share the story?

Submit your stories to TechStartUps.com in front of thousands of founders, investors, PE companies, tech executives, decision makers and tech leaders.

Please attract attention

Source link