Berlin, Germany, June 18, 2025, Chain Wire

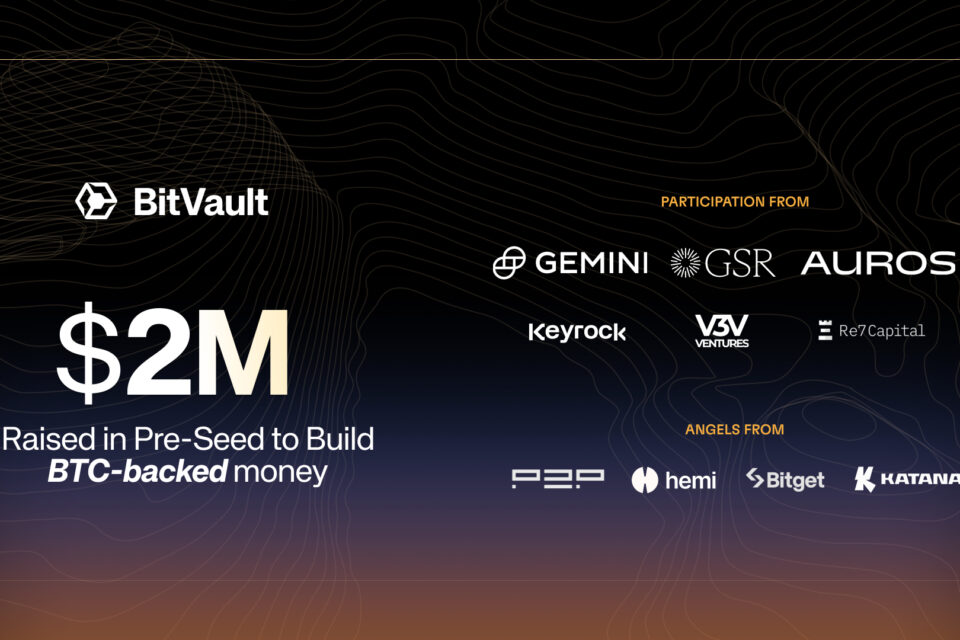

Bitvault, a defi protocol aimed at redefineing the role of Bitcoin in Stablecoin Infrastructure, has announced the end of the pre-seed round of $2 million. Strategic investors include GSR, Gemini, Auros, and Keyrock. It joins Bitvault to build what it calls “the next era of money backed by BTC.”

The pay raise supports the launch of BVUSD, Bitvault’s radicalized stubcoin backed by Bitcoin derivatives, and SBVUSD, a yield variant powered by GSR with institutional trading strategies.

Bitvault acts as Katana’s Core Stub Coin Protocol. This is a new Defi-First chain incubated by Polygon Lab and GSR, prioritizing deep liquidity and user rewards, leveraging authorized forks from Lixie V2 to leverage authorized lenders, user set interest rates and automated liquidation infrastructure.

“Bitcoin was built for the moment of fracture, and Bitvault was built to use it,” said Michay Kisselgof, a core contributor to Bitvault and Vaultcraft. “We have onboarded GSR, Auros and Keyrock in particular as strategic investors.

Stub coin at inflection point

Bitvault arrives amid increasing demand for stability in cryptocurrency in a fragmented global financial environment. Unlike fiatbacked stubcoins like USDC and algorithmic options like Ethena’s USDE, BVUSD is collateralized by BTC derivatives.

Only whitelisted institutional borrowers can build BVUSD in bulk, but anyone can use Stablecoins to crush BVUSD. Defi users can earn returns by staking BVUSD to SBVUSD. This leverages the Delta-Neutral and Arbitrage strategy managed by GSR. It is a globally recognized crypto investment company specializing in market creation, OTC trading and options.

Alain Kunz, director of GSR, who participated in the round, said: “BitVault’s approach with experience in facility-grade yield strategies positions it for success. We are particularly excited about its deployment in Katana, the defi-centric chain that helped us incubate. By introducing BTC, Bitvault will add to Katana’s evolving ecosystem and guide BTC to realize Katana’s more productive role.

From liquid to katana

Bitvault is a friendly fork of liquid V2 that has been redesigned for institutional use under a licensed deployment agreement with Likiti AG. This protocol blends automated, non-governance mechanisms with authorized borrowers, providing stability while retaining core deficiencies such as direct redemption and configurable yield strategies.

Future Vcrut tokens will manage future protocol parameters and serve as a reward mechanism for stability providers and liquidity contributors.

Incubated by Polygon Labs and GSR, the launch at Katana positions BitVault at the heart of the new liquidity and settlement network across the EVM chain. The initial integrations include multi-chine “bit” points campaigns related to Vault infrastructure, Morpho Money Markets, Sushi Amms, and Vcruct Distribution.

What’s next?

Bitvault plans to deploy MainNet in Katana in June 2025, integrating Defi Ecosystems with a broad range of centralized liquidity venues. The team plans to expand the Stablecoin Suite to support additional BTC-based collateral assets, and is actively onboarding institutional borrowers.

About BitVault

Bitvault is a Defi protocol that provides cryptographic native solutions for money through BVUSD, a BTC-backed Stablecoin, and Sbvusd, which is responsible for the yield. This protocol is designed to provide institutional grade capital-efficient stubcoins with user set interest rates, multi-collate backing, and enhanced liquidity mechanisms.

For media enquiries or partnership information:

press@bitvalt.finance

BitVault.Finance

docs.bitvalt.finance

@bitvaltfinance

contact

BitVault Team

BitVault.Finance

info@bitvalt.finance

🚀Want to share the story?

Submit your stories to TechStartUps.com in front of thousands of founders, investors, PE companies, tech executives, decision makers and tech leaders.

Please attract attention

Source link