Design platform Figma has secretly filed the documents with the Securities and Exchange Commission to make public, the company announced Tuesday.

Filing dropped the day that was hot on social media after sending a letter of halt and denial to Lovable, the rise of AI DEV tool startups, using the term “DEV mode.”

The potential IPO comes more than a year after Adobe and Figma agreed to terminate their $2 billion acquisition, following regulatory pressures in the UK, which they first announced in late 2022.

“Figma, Inc. has secretly submitted a draft registration statement for the SEC and Form S-1 in connection with the proposed initial offering of Class A common stock. This is not an offer to sell or solicit any offers to purchase securities,” the company said in a blog post.

Figma added: “The number of shares and price ranges for the potential offering have not yet been determined. Future offers, solicitations or sales of securities will be made after the SEC review process is completed in accordance with the registration requirements of the Securities Act.”

Based in San Francisco, Figma is widely used by product teams to build and collaborate on digital designs. Its browser-based software has become a go-to tool for businesses prototyping websites and apps. In the 2024 tender offer, Figma was valued at $12.5 billion.

“There are two paths for venture-funded startups to go down,” Figma co-founder and CEO Dylan Field told Verge last year. “You’ll be acquired or published. And we’ve thoroughly explored the acquisition route.”

The Figma movement comes at an uncertain time for Tech IPOs. After the freeze that began in late 2021, there was high hopes for a rebound under the Trump administration.

However, this month alone, Klarna and Stubhub put their IPO plans on hold following market uncertainty linked to Trump’s tariff announcement. Chime, which submitted secretly, also suspended its own list. According to a CNBC report, Car-Sharing platform Turo pulled out a prospectus three years later on at IPO Limbo in February.

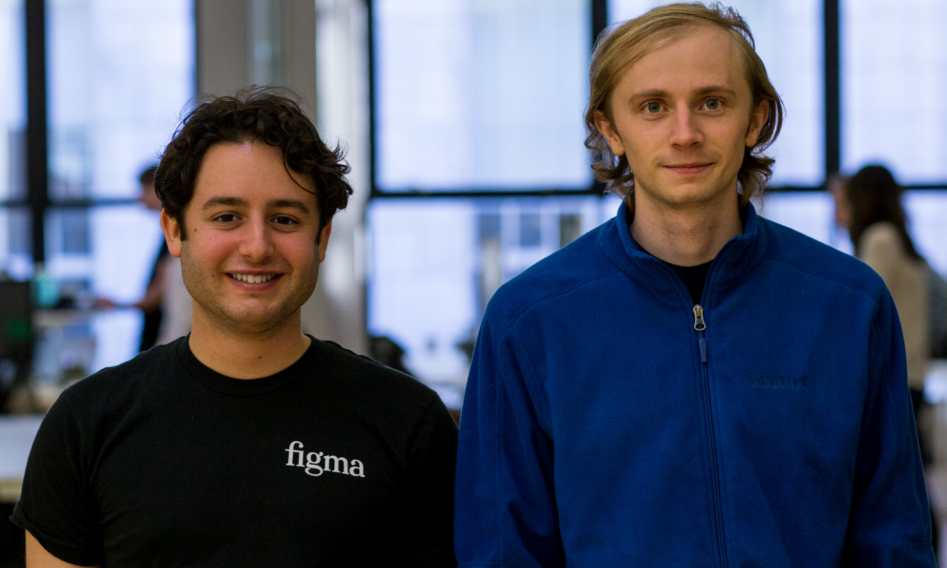

Founded in 2012 by Dylanfield and Evan Wallace, Fitma has built a reputation for allowing teams to brainstorm and repetition in real time. Customers include Zoom, Airbnb, and Coinbase.

The startup is backed by Silicon Valley investors Who’s Who, Andreessen Horowitz, Sequoia Capital, Durable Capital, Index Ventures, Greylock Partners and Kleiner Perkins. As of early last year, Figma had generated approximately $600 million in annual revenue.

🚀Want to share the story?

Submit your stories to TechStartUps.com in front of thousands of founders, investors, PE companies, tech executives, decision makers and tech leaders.

Please attract attention

Source link