According to an updated application on Thursday, it will be released two weeks after virtual care provider Omada Health submitted it to be published to test the volatile IPO market, and will raise up to $158 million.

The San Francisco-based startup, known for its digital programs for chronic diseases such as pre-diabetes, diabetes and hypertension, is priced stocks ranging from $18 to $20. Under the ticker “Omda”, it plans to provide 7.9 million shares to Nasdaq. Depending on the final pricing, the total rating could be higher and share the dilution.

This is a notable moment for the relatively quiet digital health space in terms of IPOs. Digital physiotherapy startup Hinge Health broke the silence when he debuted earlier this month. Omada’s IPO is currently closely behind, showing renewed interest in high-tech-ready care models.

Omada is nothing new to the scene. The company was founded in 2012 by Sean Duffy, Andrew Dimichele and Adrian James. Duffy remains CEO and has pitched the company’s IPO as an opportunity for new investors to take part in their next phase of growth. “Thank you to our future shareholders for learning more about Omada,” he wrote in the submission. “I encourage you to take part in our journey.”

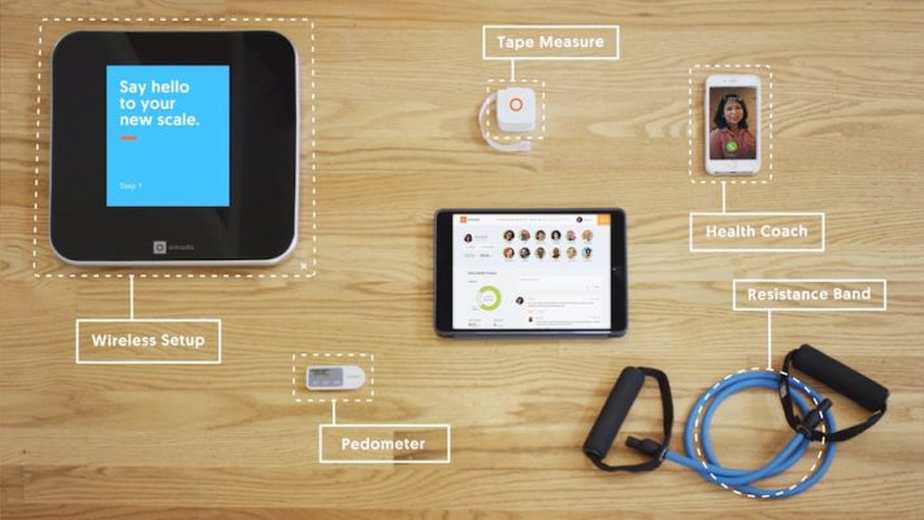

The company offers virtual care programs for chronic diseases such as diabetes, hypertension and prediabetes. It supports patients outside the traditional clinic structure and works with primary care to occupy its position as a “inter-visit care model.” Omada offers the program through its employer, health plans and health systems, and has billed more than 2,000 customers and 679,000 members at the end of the first quarter.

Startups describe their model as “inter-visit care,” positioning themselves as a complementary layer rather than replacing traditional healthcare providers.

Financially, Omada is steadily growing. First quarter revenues rose to $55 million, up 57% year-on-year, up from $35.1 million. The company generated revenue of $169.8 million in 2024, up 38% from the previous year, CNBC reported.

In the first quarter of this year alone, revenues rose 57% to $55 million. Losses also narrowed, falling from $19 million last year at the same time to $9.4 million in the first quarter. Overall in 2024, Omada reported a net loss of $47.1 million compared to $67.5 million in 2023.

The IPO is led by Morgan Stanley, Goldman Sachs and Jpmorgan Chase. Supporters include heavyweights such as Andreessen Horowitz, Fidelity and Us Venture Partners.

With over 156 million Americans living with at least one chronic illness, Omada bets on the growing demand for scalable, virtual care, especially among employers who are pressured to cut healthcare costs. The startup offers personalized care plans that combine clinical support with behavioral health programs. This was the first virtual provider to join Healthcare Improvement’s Leadership Alliance Institute, and would like to be seen as part of a traditional healthcare system, not as a replacement.

Omada’s supporters include well-known investors such as Andreessen Horowitz, Fidelity’s FMR LLC, and US venture partners.

Submitting an IPO comes at a strange time. Klarna and Stubhub put their plans on ice. Changes in tariff policy and concerns about inflation have made public debut even more risky. Still, Omada doesn’t just move forward. In March, Hinge Health (another digital health player focusing on physiotherapy) was published and updated investors with fresh revenue.

It remains to be seen whether the offering will elicit the same investor enthusiasm seen during the digital health boom. But for now, Omada is betting that he still has an appetite for tech-driven care.

🚀Want to share the story?

Submit your stories to TechStartUps.com in front of thousands of founders, investors, PE companies, tech executives, decision makers and tech leaders.

Please attract attention

Source link