Just a week after announcing its plans to ship masses for the Ascend 910c AI chip, it helped fill the gap left by Nvidia in China. In a new analysis from Semianalysis, Huawei’s CloudMatrix 384 system is powered by the Ascend 910C chip and uses NVIDIA’s latest GB200 NVL72 rack system with the H100 GPU for several key areas.

Announced by NVIDIA earlier this year, the GB200 NVL72 is a massive configuration of 72 Blackwell GPUs and 36 Grace CPUs. Especially for workloads such as large-scale language model inference, it brings significant upgrades to the H100, providing up to 30x faster AI task processing and 25x better energy efficiency.

Huawei Ascend 910c AI Chip

Huawei and China now have AI system features that can beat Nvidia’s.

On April 16, 2025, Semianalysis revealed that Huawei’s CloudMatrix 384 is also superior to Nvidia’s GB200 NVL72.

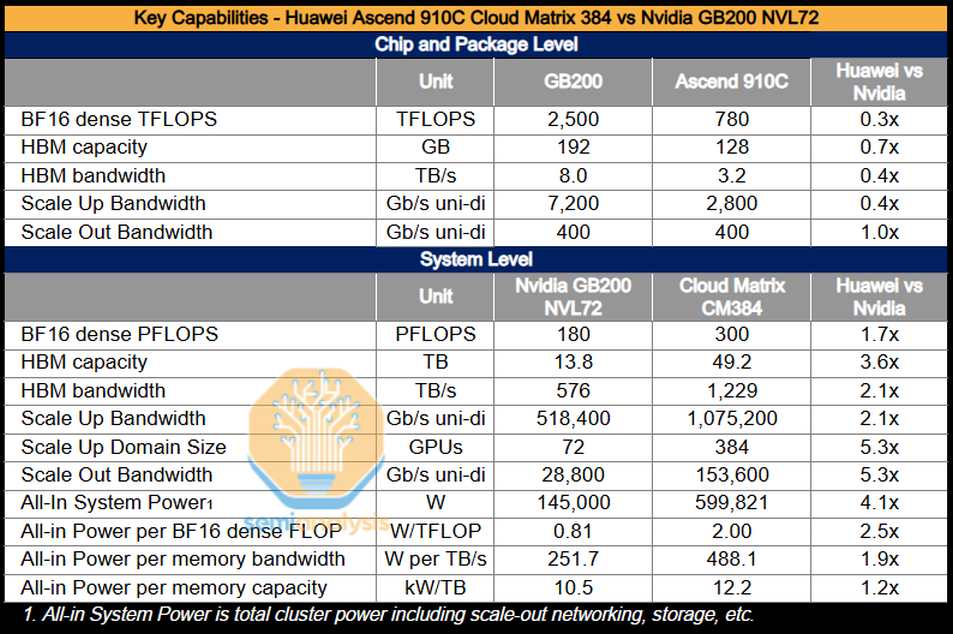

“The full cloud matrix system is now able to offer dense BF16 computing of 300 PFLOPS, almost twice the GB200NVL72. Aggregated memory capacity over 3.6x and 2.1x memory bandwidth, Huawei and China have AI system capabilities that beat Nvidia’s.

According to Semianalysis, Huawei’s Ascend Chip can be technically manufactured with Smic, but is far from a completely domestic product. It still relies on the global supply chain, including HBM memory from Korea, major wafer production from TSMC, and the use of chip manufacturing equipment from the US, Netherlands and Japan. Semianalysis notes that while China is making progress, many of Huawei’s successes are skating closer to existing export controls. The report argues that if the US government wants to slow China’s progress in AI, it should shift its focus to loopholes in these supply chains.

Huawei may be behind the generation of chip technology, but its system-level strategy is ahead of what Nvidia and AMD currently offer. So, what enhances Huawei’s CloudMatrix 384?

CloudMatrix 384 sews 384 ASCEND 910C chips together in a complete mesh network. The logic is simple. Each ascender chip delivers about one-third of the performance of Nvidia’s Blackwell GPUs, but on a massive scale, it packs five times the chips.

Huawei prepares the next strike, the Ascend 910d

Performance news has surfaced, as the Wall Street Journal reported that Huawei is preparing to test the new Ascend 910D chip built to compete directly with Nvidia’s H100. The company has already approached several Chinese tech companies to launch the trial of the 910D, aiming to offer something stronger than the H100.

“Huawei Technologies is preparing to test the latest and most powerful artificial intelligence processors. The company hopes to be able to replace the high-end products of US chip giant Nvidia,” the Wall Street Journal reported.

According to the WSJ, initial samples of the 910D are expected by late May, and mass production will continue shortly after. The move is seen as another clear effort by Huawei to build a homemade alternative to Nvidia’s AI control, particularly after excluded US export controls from Nvidia’s most advanced products.

Meanwhile, the CNBC segment adds some confusion and incorrectly suggests that Huawei’s big performance jump comes from the 910D. Semianalysis quickly pointed out that the credits belong to the 910C chip. This is in production and is already running in a real world development.

CloudMatrix 384 vs GB200 NVL72: By Number

Huawei’s CloudMatrix 384 is more than just a powerful set of chips. This is a complete system built for training and training. The architecture connects all 384 ASCEND 910C chips to an optical mesh network. When Semianalysis lined it up against Nvidia’s GB200 NVL72, the results were clear.

This is where Huawei’s CloudMatrix 384 pulls forward.

Calculated Power: 300 petaflops of BF16 performance, ~150 petaflops of about twice as much GB200 NVL72.

Memory capacity: 49.2 terabytes for HBM and about 3.6 times the 13.8 terabytes for HBM3E’s GB200.

Memory Bandwidth: 1229 terabytes per second, more than twice as much as 576 terabytes of the GB200.

These benefits are important because AI workloads rely heavily on computational strength, memory size and bandwidth. Fastest training and faster model inference means the difference between staying ahead or falling behind in areas such as scientific research, autonomous vehicles, and generation AI.

The GB200 NVL72 already offers a larger improvement over the H100, so Huawei’s edge suggests that the CloudMatrix 384 can outperform H100-based systems.

However, Huawei has an inevitable trade-off. The CloudMatrix 384 consumes almost four times more energy than NVIDIA’s GB200 NVL72, achieving 2.3 times more performance per watt. Huawei wins with the Brute Force, but Nvidia still holds the crown for efficiency.

Clearing chip mix up

The rush reporting a breakthrough for Huawei has caused some confusion. CNBC cited the findings of Semianalysis in its April 28 segment, but its performance link was falsely praised by the new Ascend 910D chip.

“According to Semianalysis, their solutions have now surpassed Nvidia in some key metrics,” said CNBC’s Kristina Partsinevelos in an interview (video below)

In fact, as the Wall Street Journal and Semian Alicis made clear, the 910D is still in the testing phase and there is no validated performance data yet. The wave-making system (CloudMatrix 384) is built with Ascend 910c, which is shipped to customers like Bytedance.

When it comes to raw chip performance, Nvidia’s H100 still outperforms the single Ascend 910c. The only H100 supplies 4 PetaFlops FP8s and 3.35 terabytes per second of bandwidth. The 910C hits around 2.4 PetaFlops FP16, or about 60% of the performance of the H100.

The advantage of Huawei comes from scale, not individual chip strength. The way to link hundreds of 910C chips in a high-speed optical network allows the CloudMatrix 384 to surpass H100-based systems. Without that scale, the 910C alone is not enough.

Sanction Factors

The rise of Huawei is not just about technological milestones, but about surviving and innovating under sanctions.

Since the US blacklisted the company in 2019, Huawei has been blocked from accessing top chip manufacturers such as TSMC and high-end memory suppliers. But it found a workaround. According to Semianalysis, Huawei indirectly uses TSMC’s 7NM process by working through third parties like Sophgo. It also used intermediaries to source HBM2E memory chips from Samsung, leaving NVIDIA’s new HBM3E technology in just two generations.

While Huawei was moving forward, US restrictions tightened the ropes on Nvidia’s Chinese operations. By 2025, not only was H100 exports banned, but also the downgraded H20 chips were blocked, cutting Nvidia’s potential Chinese revenues and forcing a $5.5 billion amortization.

Huawei seized the moment and planned to ship around 1 million 910C chips in 2025 to meet the burgeoning demand within China.

The market responded quickly. Nvidia’s shares fell by about 2% after news of Huawei’s performance improvements were broken. This is an indication that investors are looking at the tech battle very closely.

I’m still trying

Despite a big performance victory, Huawei is not free. The big challenges remain:

Energy Demand: Running a data center with 3.9 times the power consumption is not as easy as it consumes more.

Technology Gap: Huawei’s chips are built using older 7NM technology and slower HBM2E memory compared to NVIDIA’s advanced HBM3E.

Software Ecosystem: Nvidia’s CUDA framework continues to be a central part of AI development, and Huawei’s software is still on the back.

The Ascend 910D could be the next test. According to the WSJ, the 910D is expected to be a direct challenge when the H100 becomes available. But for now it’s the Ascend 910C, a system-level design for the CloudMatrix 384, giving Nvidia a real competition.

This fight isn’t just about tips anymore. It’s about who can build a better system, scale faster and survive the pressures of global politics.

source:

Semiaanalysis, “Huawei AI CloudMatrix 384: China’s answer to NVIDIA GB200 NVL72”, April 16, 2025

The Wall Street Journal, April 27, 2025 (Ascend 910D test)

CNBC, April 2025 (Market commentary and 910D error)

Reuters, DCD (Nvidia sanctions, H20 amortization)

Tom’s Hardware (Rise 910c Performance Benchmark)

🚀Want to share the story?

Submit your stories to TechStartUps.com in front of thousands of founders, investors, PE companies, tech executives, decision makers and tech leaders.

Please attract attention

Source link