In November, CEO and co-founder Peter Carlson reported on a shake-up at North Bolt after he resigned. Four months later, the Swedish electric car manufacturer filed for bankruptcy in Sweden.

Once considered a key player in promoting European electric vehicles, Northvolt was under pressure on its $5.8 billion in debt after burning billions of dollars in funds. Recent reports show that the company’s financial problems are deeper than many people expected.

Northvolt, who announced the bankruptcy on Wednesday, said it filed for bankruptcy after “a thorough effort to explore all available measures to ensure the company’s viable financial and operational future.”

“Like many companies in the battery sector, Northvolt faces a series of compounding challenges that erode financial conditions, including rising capital costs, geopolitical instability, supply chain disruptions and changing market demand,” Northvolt said.

The company cited several issues that crossed the edge, including rising capital costs, geopolitical instability, supply chain disruptions, and changing market demand. “Added to this background, the company faces important internal challenges in increasing production in a way that was expected by its highly complex industry and unexpected involvement with others,” Northbolt said.

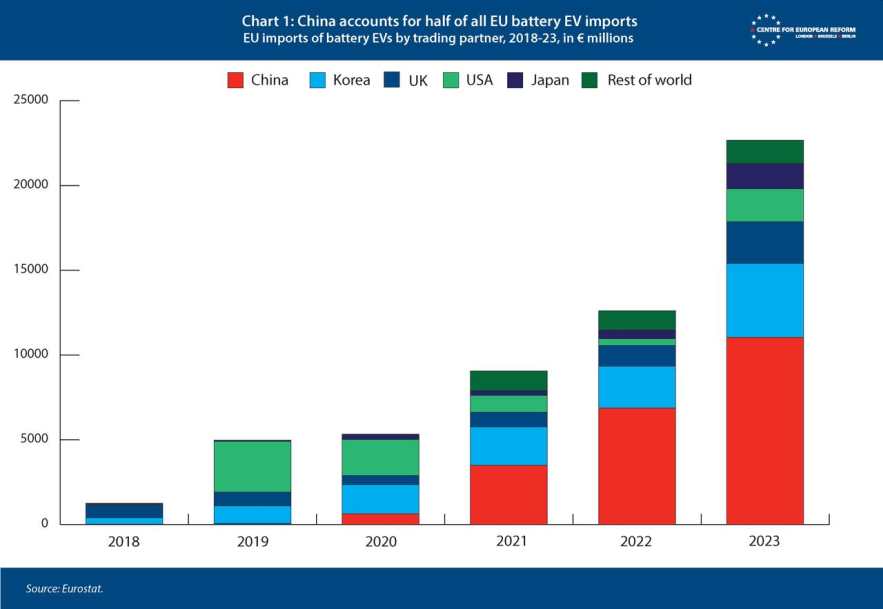

The bankruptcy marks a major setback against European goals of building a self-sufficient EV battery supply chain and reducing dependency on Chinese manufacturers such as CATL and BYD.

Northvolt was seeking financial support during the ongoing Chapter 11 restructuring in the US that began in November. “Despite liquidity support from our lenders and key counterparties, the company has not been able to secure the financial conditions necessary to continue in its current form,” the company said.

The Swedish court-appointed fiduciary oversees the bankruptcy process, including the sale of the company’s assets and the settlement of unpaid obligations.

North Bolt rises and falls

According to Bloomberg, the North Bolt struggle has been exacerbated as the German auto sector faces increased pressure from low-cost Chinese EV imports over the past three years. The collapse of startups will hit Europe’s plans to secure a battery supply chain. Northbolt once operated under the slogan “Make Oil History.”

Bankruptcy filings occur despite last-minute efforts to stabilize your finances. A few days before submission, a report of a $9.5 million proposal from Swedish investors was revealed to cover immediate cash needs. This followed Northvolt’s attempt to raise 200 million euros in short-term funding, reflecting the depth of the financial crisis.

Northvolt’s troubles began in June when BMW canceled billion-dollar orders. The decision was not headlined since then, but caused a series of set-ups that led to bankruptcy. Northvolt had attracted investments from major players such as Goldman Sachs Asset Management, Denmark’s Pension Fund ATP, Baillie Gifford and several Swedish entities. Volkswagen and BMW are also important partners, highlighting the scale of the fallout.

By late June, Volkswagen, which had held a 23% stake, appeared willing to step out financially. However, VW’s recession in European and Chinese markets has resulted in factory closures and looming layoffs in Germany. The company then withdrew from planned investments in August and reduced its commitment to buying batteries from North Volt.

Efforts to secure $300 million bridge funds involving lenders, creditors and clients also failed by October. On Friday, Carlson confirmed that VW would not provide further support and seal the fate of North Bolt.

Northvolt’s debt includes a $330 million conversion loan from Volkswagen, scheduled for December 2025, in addition to its financial burden.

Founded in 2016 by former Tesla executive Peter Carlson and former Airbus manager Paolo Celti, Northvolt has attracted attention for EVS and energy storage lithium-ion batteries. The company has established a partnership with Volkswagen, BMW and ABB with the aim of providing sustainable, high-quality batteries for the European green energy future. However, delays and escalation costs have led to the elucidation of their finances.

Source link