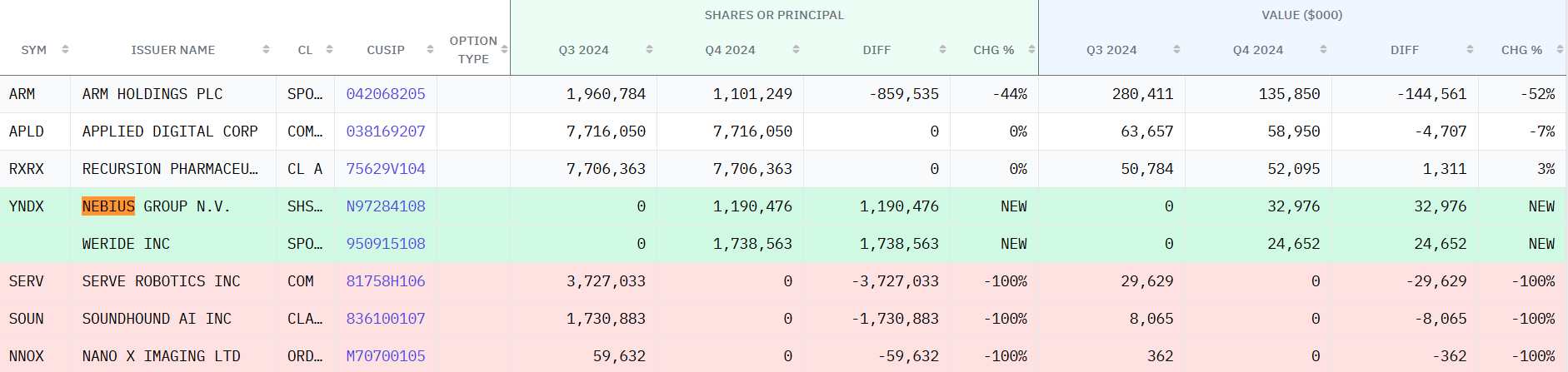

Nvidia is shaking its investment portfolio and has made some major moves with AI and autonomous drive space. According to a 13F-HR regulatory submission released on Friday, the chip giant reduced its interest in British chipmaker Armholding by 44%, pulling its interest from Serve Robots and Soundhound AI.

One of the biggest standouts? A new bet from China-based autonomous driving startup Nvidia. The company announced it had 1.7 million shares and a width of 1.7 million shares as of the quarter ended December 31st. The news has spiked 96% of stocks in pre-market trading, reflecting market confidence in Nvidia’s latest investments.

“The Santa Clara, California-based company reported new holdings, including 1.7 million shares in Chinese autonomous driving startup Weride Inc in the quarter ended December 31, and added 96 shares in pre-market trading. Increased by %.

The news has raised $440.5 million through US IPOs and private placements just three months after Weride’s public debut.

The latest submission revealed 1.2 million shares of Nvidia, the AI cloud company Nebius Group, and shares rose 6% after disclosure.

Meanwhile, Nvidia has significantly reduced its position in ARM Holdings, cutting 1.1 million shares from 43.8%. The move comes after Nvidia tried to acquire weapons in a famous deal earlier.

As part of the portfolio shift, Nvidia has finished Saab Robotics, a startup in sidewalk delivery robots, with Saab stocks down 31%. AI Chip Giant also withdraws shares from Israel-based MedTech Company Nano-X Imaging, with pre-market trading down 4%.

Another company that feels the impact of Nvidia’s exit is Soundhound AI, a voice assistant developer. After disclosure, the stock hit 10%.

Nvidia’s latest investments and exits reflect a broader shift in strategy, doubling AI-driven mobility while moving away from specific automation and MedTech bets. Market response suggests that Nvidia could be on a big scale, especially in the future, in the technology sector without drivers.

Founded in 2017 by Qing Lu, Tony Han and Yang Li, Werid made history as China’s first L4 autonomous driving startup. The company has gathered support from key players such as the Renault-Nissan Mitsubishi Alliance and the GAC Group, strengthening its position in the autonomous driving space.

Weride’s over 200 teams include engineers and executives who worked for Google, Facebook, Microsoft and Baidu, bringing industry expertise to an AI-driven mobility strategy. Before it was released, the startup secured $1.444.2 billion in 11 rounds and received support from 41 investors, including Carlisle Group and Idinvest Partners.

width

Source link