The US has blocked one of Nvidia’s fastest growing markets, causing billions of fallout. The repression of exports may have ended the biggest bets of non-US companies.

Nvidia said Tuesday that it will cost $5.5 billion in fees this quarter after it forced new US export rules to force a suspension of sales of H20 AI chips to China and other regions. Investors did not underestimate the news. Inventory fell 6% due to after-hours trading.

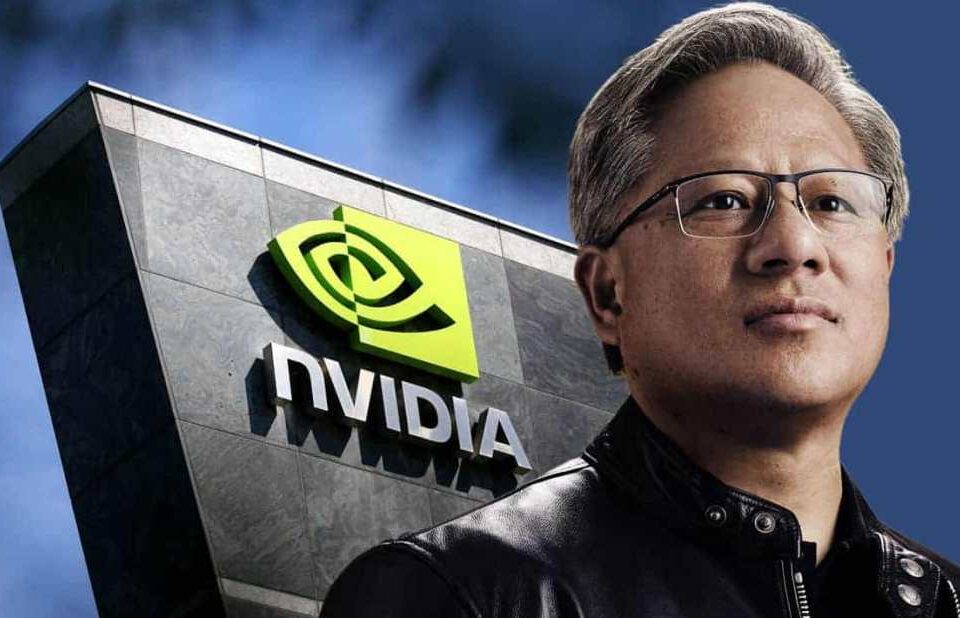

Nvidia’s AI chip sales to China have been criticized by new US restrictions

The company disclosed in an SEC filing that as of April 9, the US government is currently requesting licenses to export H20 chips to China and several other countries. That limit appears to be indefinite.

“On April 9, 2025, the US Government, or USG notified Nvidia Corporation, or the company, that USG, along with China (including Hong Kong and Macau) and D: five countries, or its headquarters or ultimate parent, to achieve the combined bands of H20 integrated circuits and H20’s Memory bandwids bandwids. That’s what Nvidia said in the submission.

The chip giant stated, “USG is dealing with the risk that licensing requirements will be used or repurposed on Chinese supercomputers. On April 14, 2025, USG informed the company that licensing requirements will be effective in an unspecified future.”

“The company’s first quarter of fiscal year 2026 will end on April 27, 2025. The results for the first quarter are expected to include charges of up to approximately $5.5 billion related to H20 products in terms of inventory, purchase commitments and related reserves,” Nvidia said.

This is the most obvious indication that Nvidia’s fierce growth could be slowed down due to tightening US controls. Washington has steadily cracked down on AI chip exports since 2022 with the aim of maintaining strong hardware from China’s military programs. The H20 chip was a workaround for Nvidia. This is a China-centric version that has been stripped up enough to comply with previous restrictions. In 2024, it attracted an estimated $1.2-15 billion.

However, the workaround appears to have ended.

Nvidia CEO Jensen Huang said in February’s revenue that sales to China have already been cut in half before restrictions. He added that local competition is intensifying. Huawei – Not a problem in the past – has been on Nvidia’s annual competitor list for the second year in a row.

China is the fourth largest market in Nvidia, after the US, Singapore and Taiwan. In its latest annual report, the company said 53% of total sales will go to buyers still based in the US.

According to Nvidia’s annual report, China is the fourth largest region by sales, according to the US, Singapore and Taiwan. 53% of that sale went to US companies during the fiscal year ended January,” CNBC reported.

The H20 chip is similar to Nvidia’s high-end H100 and H200 models sold elsewhere, but lags in bandwidth and interconnect speed. It is built on the Hopper Architecture, which was released in 2022 by Nvidia. The company then shifted its focus to the latest chips, based on its new Blackwell platform.

Nvidia Blackwell

Still, the H20 was important. Earlier this year, it promoted research by Deepseek, the Chinese AI company behind the R1 model that shook the AI scene.

And things could get even stronger. Starting next month, Nvidia will need to address new export restrictions related to what the US calls the “AI Proliferation Rules.” The company warns that such policies could undermine technology leadership and weaken competition worldwide.

To keep up with the shift rules, Nvidia has already moved some of its operations, such as testing and distribution, from China.

At Nvidia’s developer meeting in March, Huang was asked directly about China’s restrictions. His reaction? “We follow the law.” But he also says that half of the world’s AI researchers are Chinese, many of whom work in US labs.

The company is expected to report its first quarter fiscal revenue on May 28th. There is a good chance that this issue will control the call.

🚀Want to share the story?

Submit your stories to TechStartUps.com in front of thousands of founders, investors, PE companies, tech executives, decision makers and tech leaders.

Please attract attention

Source link