The US crackdown on AI chip exports is not working as planned. Lawmakers now want to try something more offensive. The “kill switch” built into Nvidia’s chips blocks unauthorized use in China.

The latest initiative comes after years of export controls that failed to block access to China’s advanced chips. Despite restrictions, companies like Huawei are bounced back on domestic alternatives, while Chinese companies continue to keep their pipeline alive through trade loopholes. Now, the US wants to control not only where the chips go, but how they are being used.

“U.S. lawmakers will implement the law in the coming weeks and verify the location of artificial intelligence chips like those made by Nvidia after sales,” Reuters reported.

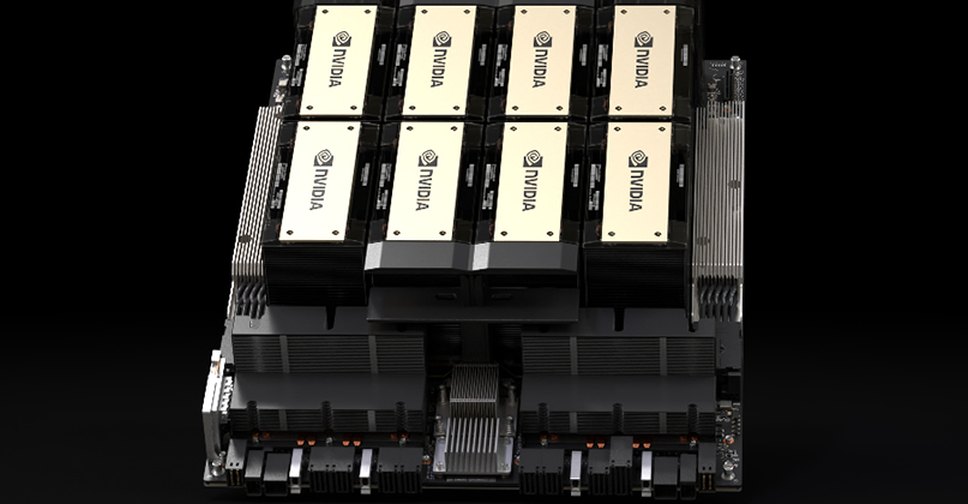

The report comes just a month after the Trump administration issued a new rule requiring NVIDIA to secure a license to ship H20 chips to China. The H20 was built for the Chinese market, but these plans are now frozen. Companies like Baidu, Tencent and Bytedance are rushing to adjust, but Huawei is stepping in to fill the gap.

Washington has been trying to stop the rise in Chinese technology for five years. Huawei collapsed and collided violently before bouncing off on the Mate 60 Pro, powered by homemade 5G chips from China’s top chip maker Smic. The move caught US regulators off guard and raised serious doubts about the effectiveness of existing sanctions.

US export control failed. Now lawmakers want to lock down nvidia ai chip using kill switches to block access in China

Now, U.S. Representative Bill Foster, a Democrat and trained particle physicist in Illinois, says it’s time to go further. He is preparing legislation that could change how AI chips are regulated after they leave our soil. Future bills require Nvidia’s AI chips in particular to include embedded tracking technology.

“This is not an issue in the imagination, it’s a problem now,” Foster told Reuters. “At some point, we discover that the Chinese Communist Party, or its troops, are busy designing weapons using a large array of chips, or are working just as directly (artificial general information) as nuclear technology.”

Foster’s suggestions don’t stop at pursuing. His bill gives authorities the authority to remotely shut down chips used without a proper license. In other words, a “kill switch.” According to him, there is already a technology to do this.

It’s a bold move, but not entirely from character, given how US policies on AI and chip exports have changed. Nvidia says it can’t trace where all the chips are, especially as Chinese companies still acquire them through secondary markets and difficult-to-detect workarounds.

The push gains traction. Lawmakers on both sides of the aisle support the idea with support from the House Selection Committee on Chinese members, including Democrat Raja Krishnamuti and Republican John Mourenar. The bill hasn’t been put in place yet, but Foster hopes to move forward within the next few weeks.

Foster’s bill aims to address what many consider to be obvious weaknesses. Once the AI chip is exported, no one knows where it will go. Nvidia openly admits that it cannot track chips after they are sold. However, technical professionals and foster parents already have the ability to exist. In fact, many of the tracking techniques are already built into Nvidia chips and have not been activated or enforced.

Google already uses similar tracking methods for its internal AI chips, according to sources familiar with its operations. Their chips help to secure servers and identify geographic locations where delays are common accordingly. This method measures the time the chip takes to communicate with the server, depending on the known speed of light.

Tim Fist, engineer and director of the Institute for Progress, believes this will give regulators a better handle on export enforcement.

“BIS doesn’t know what chips to target as a potential high priority to investigate after going abroad,” Fist told Reuters. “By checking the location, they put buckets of chips at least in the world, which are very likely not smuggled, and justifying further investigation.”

The second part of Foster’s plan is more aggressive. This is an AI chip that cannot be launched unless it is operated under a valid US export license. Think of it as a software-level kill switch. Technically it’s more difficult to implement, but ideas are no longer off the table.

This happens when chip smuggling returns to the spotlight. The investigation has found the investigation, including a recent case in Singapore, where a recent case in Singapore (one of the Chinese citizens) was accused of a scam involving a server believed to be running a banned Nvidia chip.

Deepseek, a Chinese AI company that built the model using restricted chips, raised more alarm bells in Washington. The company’s system reportedly rivaled US products despite the chips being off limits.

For last fiscal year ending January 26th, China accounted for $17 billion in Nvidia’s revenue, or about 13% of its total. That includes sales to Hong Kong. However, according to Reuters and other reports, many chips banned under export regulations continue to flow into the country, often through fraudulent resellers and shell companies.

Foster’s law gives the Department of Commerce six months to finalize tracking requirements. Although bipartisan support is built, detailed coordination with manufacturers such as Nvidia is required, especially for the precise implementation of the chip shutdown mechanism.

Nvidia declined to comment on the proposed law.

Still, it is clear that the US is defending. Location tracking and kill switches may be the next tool in Washington’s efforts to stop China from operating AI systems with its American-made brain.

As AI is now considered a national security issue, the push to strengthen exports is intensifying. And in the current political situation where anything seems possible, I feel that the kill switch proposal is far less fetched than it was once.

The original tip curb dates back to 2022 and aims to cut China off from technology that can promote military development. Pressure has been covered ever since. In February, President Trump proposed slap 25% tariffs on semiconductor-related imports.

Still, for all the efforts to isolate China, it remains a large customer. Nvidia reported $171.1 billion in revenue for fiscal 2025 from the region, including Hong Kong.

🚀Want to share the story?

Submit your stories to TechStartUps.com in front of thousands of founders, investors, PE companies, tech executives, decision makers and tech leaders.

Please attract attention

Source link