It’s Tuesday, June 3, 2025, and we’re back with your daily funding snapshot of where venture capital is flowing and which startups are shaping the next wave of tech innovation.

Today’s lineup spans everything from brain-computer interfaces to cross-border fintech, cybersecurity, and synthetic biology. Whether it’s Elon Musk’s Neuralink pulling in a $650 million Series E to push the limits of neurotechnology, or Impulse Space raising $300 million to reposition satellites in orbit, the sheer scale and diversity of capital bets reflect a startup ecosystem charging ahead with purpose.

Funding Highlights

Neuralink leads the pack with a massive $650 million raise backed by a who’s who of Silicon Valley investors. Space-tech contender Impulse Space landed $300 million to scale its orbital transfer vehicles. Meanwhile, European fintech Scalable Capital secured $175 million to expand its retail investing platform, and Israel’s Zero Networks brought in $55 million to help enterprises lock down internal threats. Also notable: Speedata’s $44 million raise to rethink data processing hardware and Antheia’s $56 million boost to bioengineer critical drug ingredients.

Investor Activity

Today saw heavy participation from major VCs like Sequoia, Thrive Capital, Highland Europe, Index Ventures, and SoftBank’s SB Payment Service. Across early and growth stages, these investors are doubling down on real-world AI applications, frontier biotech, defense-grade cybersecurity, and scalable SaaS infrastructure.

From pre-seed stealth launches to global expansion rounds, today’s funding snapshot captures a venture market that isn’t just alive—it’s accelerating.

Here’s the full breakdown of the 10 deals we tracked today, complete with investor context, startup focus, and funding details.

Speedata Raises $44M Series B for Data Analytics Hardware

Speedata, a Tel Aviv–based chip startup developing a specialized Analytics Processing Unit (APU) for big data and AI workloads, has raised $44 million in a Series B funding round. The round was led by existing backers – including Walden Catalyst Ventures, 83North, Koch Disruptive Technologies, Pitango First, and Viola Ventures – bringing the company’s total capital raised to $114 million.

The company says its purpose-built APU addresses analytics bottlenecks at the hardware level (unlike GPUs repurposed for data tasks) and delivers dramatically better performance. Speedata reports that a single APU can replace racks of standard servers, drastically speeding up analytics jobs. The new funding will be used to scale up product development, commercialize the chip architecture (targeting platforms like Apache Spark), and expand Speedata’s sales and operations globally.

Funding Details:

Startup: Speedata

Investors: Walden Catalyst Ventures (lead), 83North, Koch Disruptive Technologies, Pitango First, Viola Ventures (also strategic: Lip-Bu Tan, Eyal Waldman)

Amount Raised: $44M

Total Raised: $114M

Funding Stage: Series B

Funding Date: June 3, 2025

Ciroos Raises $21M Seed Round for AI Ops Assistant

Ciroos, an AI startup building tools for operations teams, emerged from stealth with $21 million in funding to launch its “SRE Teammate” – an AI assistant for DevOps and SRE (site reliability engineering) workflows. The round was led by Energy Impact Partners (EIP) with participation from angel investors.

Ciroos’ platform is designed to help enterprise operations teams handle the growing complexity of incident management. For example, the company says its AI agent can handle noisy, repetitive alerts and tasks so that engineers can resolve issues up to 90% faster. The new capital will be used to finalize the product launch, hire engineering and go-to-market talent, and support early sales efforts. Ciroos’ founders – veterans from Cisco, AWS, and Gigamon- believe that automating routine work with AI can transform how in-house legal or ops teams function, effectively creating a new class of “AI operations” tools across industries.

Funding Details:

Startup: Ciroos

Investors: Energy Impact Partners (lead), angel investors

Amount Raised: $21M

Total Raised: $21M

Funding Stage: Seed

Funding Date: June 3, 2025

Nomupay Raises $40M Series C for Cross-Border Payments

Nomupay, an Irish fintech startup that simplifies cross-border merchant payments, has raised $40 million in a Series C round led by SB Payment Service (SBPS, part of SoftBank) at a $290 million valuation. Nomupay’s platform enables merchants to accept a wider range of local payment methods (APMs) across Asia, Europe, the Middle East, and the U.S. without needing local entities. The new funding, coming just five months after a $37M Series B, brings Nomupay’s total raised to about $120 million.

The company plans to use the capital to expand regionally (adding more payment methods in Japan and elsewhere), pursue acquisitions of related fintech firms, and scale its sales and operations. For instance, Nomupay intends to add Japanese APMs and SBPS (SoftBank) card support to its platform, and double down on recruiting and marketing to onboard more merchants globally. These moves aim to help Nomupay serve growing demand from Western and Asian companies entering new markets with complex payment needs.

Funding Details:

Startup: Nomupay

Investors: SB Payment Service (SoftBank subsidiary, lead)

Amount Raised: $40M

Total Raised: ~$120M

Funding Stage: Series C

Funding Date: June 3, 2025

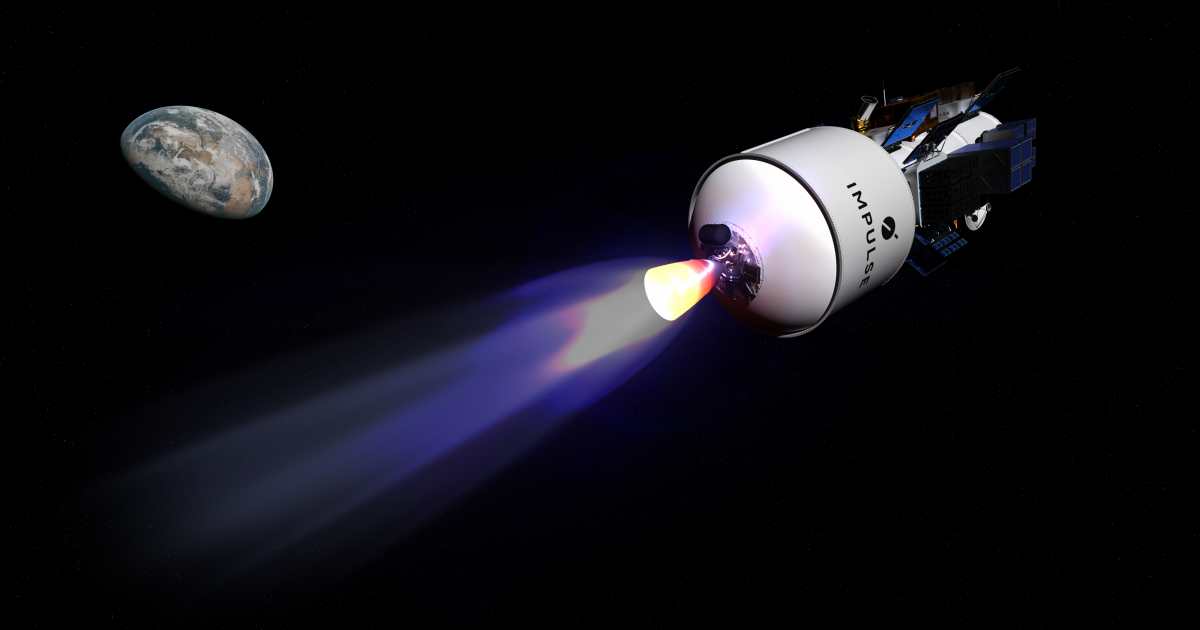

Impulse Space Raises $300M Late-Stage Round for Satellite “Tugs”

Impulse Space, a U.S. space technology startup founded by former SpaceX engineer Tom Mueller, has raised $300 million in a late-stage funding round led by Linse Capital. Impulse Space develops orbital transfer vehicles (known as “space tugs”) that can relocate satellites to precise orbits.

The latest round brings Impulse’s total funding to $525 million. With rideshare missions (multiple satellites on one launch) increasing, demand for such in-space mobility is growing. Impulse plans to use the funds to scale up production of its Mira and Helios vehicles, expand its engineering and manufacturing teams, and accelerate R&D for long-duration orbital transport missions. This will enable satellite operators (including commercial, civil, and defense clients) to deploy spacecraft more flexibly and cost-effectively without needing custom launches.

Funding Details:

Startup: Impulse Space

Investors: Linse Capital (lead)

Amount Raised: $300M

Total Raised: $525M

Funding Stage: Late Stage

Funding Date: June 3, 2025

Scalable Capital Raises €155M Growth Round for Digital Investing

Scalable Capital, a leading European digital wealth management and investment platform, has secured €155 million (about $175M) in its largest funding round to date. The round was co-led by Sofina and Noteus Partners, with participation from existing investors Balderton Capital, Tencent and HV Capital, bringing Scalable’s total funding to over €470 million (>$535M). Scalable Capital lets retail investors trade stocks, ETFs, crypto and more, and also offers professionally managed portfolios.

Scalable Capital will use the fresh capital infusion exclusively for expansion (not day-to-day operations), including investing in new products and marketing to attract more users. In particular, Scalable aims to roll out family-oriented financial planning features and expand into new markets, using the funds to offer “even more people in Europe the best options for their investments.” CEO Erik Podzuweit said the round “is a clear endorsement” of Scalable’s vision to become the leading retail investment platform in Europe.

Funding Details:

Startup: Scalable Capital

Investors: Sofina (lead), Noteus Partners (lead), Balderton Capital, Tencent, HV Capital

Amount Raised: $175M (≈€155M)

Total Raised: >$535M (≈€470M)

Funding Stage: Series E

Funding Date: June 3, 2025

Antheia Raises $56M Series C for Synthetic Biology Biomanufacturing

Antheia, a Menlo Park-based biotech startup, has raised $56 million in a Series C round to scale its synthetic biology platform for pharmaceutical ingredients. The financing was led by the Global Health Investment Corporation and Singapore’s EDBI. Antheia engineers yeast cells to produce complex drug molecules (key starting materials and APIs) that traditionally come from plants.

By programming yeast to convert sugars into these compounds, Antheia can produce ingredients in weeks rather than years. For example, the company recently completed a commercial-scale shipment of thebaine (a component of Narcan) – a milestone showing its technology can reliably substitute plant-based supply. With the new funding, Antheia will expand its commercialization of thebaine and other high-demand ingredients prone to shortages. It will also build out U.S. manufacturing capacity and work with EDBI to launch additional products in Asian markets. In essence, Antheia aims to use the capital to bring multiple biosynthetic drugs to market annually, addressing global drug shortages with sustainable biomanufacturing.

Funding Details:

Startup: Antheia

Investors: Global Health Investment Corporation (lead), EDBI (lead)

Amount Raised: $56M

Total Raised: ~$129M

Funding Stage: Series C

Funding Date: June 3, 2025

Neuralink Raises $650M Series E for Brain-Computer Interfaces

Neuralink, Elon Musk’s neurotechnology startup developing brain–computer interface (BCI) implants, announced it has closed a $650 million Series E funding round. The round included participation from many investors (such as ARK Invest, DFJ Growth, Founders Fund, G42, Human Capital, Lightspeed, Qatar Investment Authority, Sequoia Capital, Thrive Capital, Valor Equity, and Vy Capital).

Neuralink’s implantable “brain chip” system is designed to help people with paralysis or sensory impairments control computers and devices with their thoughts. The company said the new funding will be used “to accelerate our path to bringing life-changing capabilities to more people,” including advancing human trials of its implant to restore functions like movement, speech, and even vision. Neuralink has already begun human trials and earned FDA breakthrough designations for restoring sight to the blind, and this infusion of capital will speed up the development and commercialization of its next-generation BCI technology.

Funding Details:

Startup: Neuralink

Investors: ARK Invest, DFJ Growth, Founders Fund, G42, Human Capital, Lightspeed, Qatar Investment Authority (QIA), Sequoia Capital, Thrive Capital, Valor Equity, Vy Capital

Amount Raised: $650M

Total Raised: $650M (this round)

Funding Stage: Series E

Funding Date: June 3, 2025

Zero Networks Raises $55M for Cybersecurity Segmentation Platform

Zero Networks, an Israeli cybersecurity startup, announced it has raised $55 million in mid-stage funding. The round was led by Highland Europe, with participation from F2 Venture Capital, PICO Venture Partners, Venrock, and USVP, bringing the company’s total funding to over $100 million.

Zero Networks offers a network access control and microsegmentation platform that helps companies contain cyber threats (like ransomware) by restricting lateral movement inside networks. Its technology simplifies complex segmentation policies so that security teams can isolate breaches at the source. The new capital will be used to expand Zero Networks’ operations across North America, Europe, the Middle East, Africa and Asia-Pacific and meet surging demand for proactive network defense. In short, Zero aims to use the funds to accelerate hiring, sales, and customer support globally while advancing its platform to block attacks before they spread

Funding Details:

Startup: Zero Networks

Investors: Highland Europe (lead), F2 Venture Capital, PICO Venture Partners, Venrock, U.S. Venture Partners (USVP)

Amount Raised: $55M

Total Raised: >$100M

Funding Stage: Series B

Funding Date: June 3, 2025

Stable Money Raises $20M Series B for Fixed-Income Investing

Stable Money, a fintech platform that enables retail investors to access high-yield cash and fixed-income products, has raised $20 million in a Series B funding round. The round was led by Fundamentum Partnership (a fund co-founded by Nandan Nilekani).

Stable Money says it will use the fresh capital to enhance its product suite, scale operations, and drive customer acquisition across its markets. The startup focuses on making traditionally hard-to-access investment products (like foreign fixed deposits and bonds) easy and transparent. The new funding will help Stable Money broaden its offering of fixed-income solutions and grow its user base in India and Southeast Asia.

Funding Details:

Startup: Stable Money

Investors: Fundamentum Partnership (lead)

Amount Raised: $20M

Total Raised: $20M

Funding Stage: Series B

Funding Date: June 3, 2025

Wordsmith AI Raises $25M Series A for Legal AI Agents

Wordsmith AI, a legal tech startup, has raised $25 million in a Series A funding round led by Index Ventures. Wordsmith AI provides an AI platform that embeds fleets of “legal AI agents” within companies to automate routine legal tasks. For example, its technology can rapidly process contracts and extract clauses so that in-house legal teams work faster (Wordsmith calls the resulting specialists “legal engineers”).

The Index Ventures investment (which follows Wordsmith’s $5M seed round) will be used to scale out its platform and customer base. Wordsmith AI counts clients like Deliveroo and Remote, and the company says the funding will help it expand its AI tools and continue transforming how enterprises handle legal and compliance workflows.

Funding Details:

Startup: Wordsmith AI

Investors: Index Ventures (lead)

Amount Raised: $25M

Total Raised: $30M

Funding Stage: Series A

Funding Date: June 3, 2025

Funding Summary Table

Startup

Investors (Lead & Notable)

Amount Raised

Total Raised

Funding Stage

Funding Date

Speedata

Walden Catalyst Ventures (lead), 83North, Koch Disruptive Tech, Pitango, Viola, Lip-Bu Tan, Eyal Waldman

$44M

$114M

Series B

June 3, 2025

Ciroos

Energy Impact Partners (lead), angel investors

$21M

$21M

Seed

June 3, 2025

Nomupay

SB Payment Service (SoftBank, lead)

$40M

~$120M

Series C

June 3, 2025

Impulse Space

Linse Capital (lead)

$300M

$525M

Late Stage

June 3, 2025

Scalable Capital

Sofina (lead), Noteus Partners (lead), Balderton, Tencent, HV Capital

$175M

>$535M

Series E

June 3, 2025

Antheia

Global Health Investment Corp. (lead), EDBI (lead)

$56M

~$129M

Series C

June 3, 2025

Neuralink

ARK Invest, DFJ Growth, Founders Fund, G42, Human Capital, Lightspeed, QIA, Sequoia, Thrive, Valor, Vy

$650M

$650M

Series E

June 3, 2025

Zero Networks

Highland Europe (lead), F2 VC, PICO VP, Venrock, U.S. Venture Partners

$55M

>$100M

Series B

June 3, 2025

Stable Money

Fundamentum Partnership (lead)

$20M

$20M

Series B

June 3, 2025

Wordsmith AI

Index Ventures (lead)

$25M

$30M

Series A

🚀 Want Your Story Featured?

Get in front of thousands of founders, investors, PE firms, tech executives, decision makers, and tech readers by submitting your story to TechStartups.com.

Get Featured

Source link