British fintech company Revolut has just crossed a major milestone with a record $1.5 billion in net profit for 2024, the Unicorn startup announced Thursday. Profits skyrocketed 149% year-on-year, due to strong performance across business units.

Revenue jumped to 72% to £3.1 billion ($4 billion), with the company’s assets division (where stocks and crypto trading services exist) growing at its fastest, up nearly 300%, according to figures published on its website. Subscription revenues also rose, rising 74% to £423 million.

Key highlights from Revolut’s 2024 performance:

Our global customer base grew 38% to 52.5 million, and our total customer balance increased 66% to $38 billion (£30 billion).

Group revenues increased 72% to $4 billion (£3.1 billion) from $2.2 billion (£1.8 billion) in 2023.

Profitability Milestone: Net profit for the fourth consecutive year. Pre-tax profit reached $1.4 billion (£1.1 billion), net profit was $1 billion (£790 million), and net profit margin rose 26% from 19% in 2023.

The company’s loan book has grown by 86% to £979 million, and it is also seeing its client deposits lift. Together, they increased their interest income by 58% to £790 million.

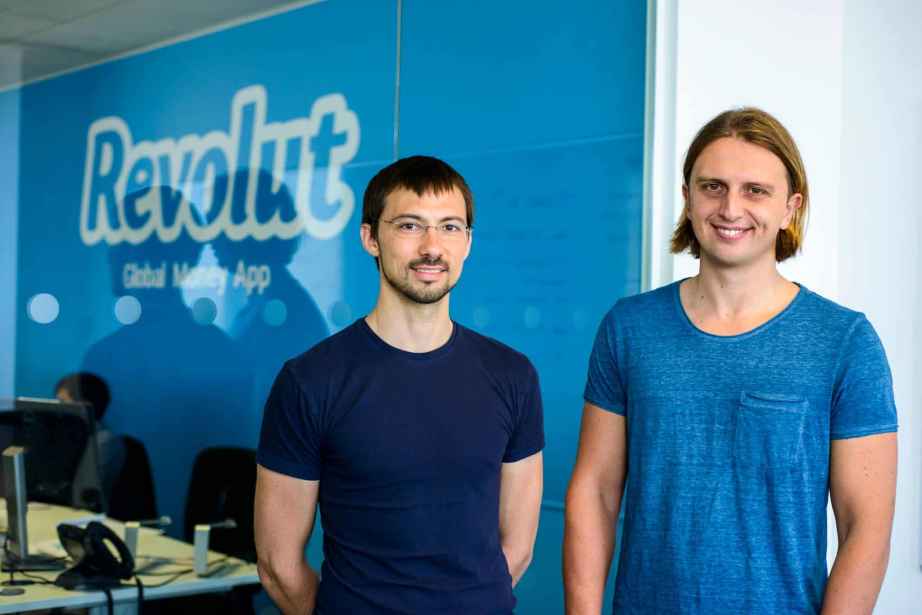

Founded in 2015 by former Credit Suisse trader Nikolay Storonsky (CEO) and former Duce Bank developer Vlad Yatsenko, Revolut started with a simple goal. It’s about removing hidden fees and making financial services easier to use. Everything is handled through that app. There is no printed form, not a branch.

“2024 was a groundbreaking year for Revolut. We have seen our customers accelerate their growth and welcome nearly 15 million new users worldwide, as well as being more involved in adopting a wider range of services in both retail products and Revolut businesses.

The London-based company was last valued at $33 billion in 2021 and is preparing to launch a full bank in the UK later this year. The startup was valued at $45 billion after a secondary stock sale in August 2024.

Revolut received a restricted banking license from the Prudential Regulation Authority last July. This has led to the “mobilization” phase. This is the period during which the company builds its infrastructure before it is fully operational. Revolut is still waiting for approval to move its 11 million UK customers into the new banking industry.

Once live, the bank will be able to offer products such as loans, overdrafts and, ultimately, mortgages.

“Customers trust banks,” Revolut CFO Victor Stinga told CNBC. “Therefore, this transitioning customer means that they will use Revolut as their primary bank account.”

He added that one of the biggest opportunities to become a licensed bank is access to government-supported deposit protection. Through the Financial Services Compensation Regime, UK bank customers can reclaim up to £85,000 in the event of a lender collapse. This helps build trust and helps Revolut gain more users.

Stinga also said lending is one of the company’s biggest focus areas for the upcoming company. Revolut already offers credit cards and personal loans to some parts of the EU and hopes to bring similar products to the UK

Revolut’s UK chief Francesca Carlesi told the Wall Street Journal that gaining full banking status in the UK is a key part of global expansion and a step towards future IPOs.

“My main strategic focus is to make Revolut a major bank for everyone in the UK,” she said.

The future path is not easy. Rivals like Monzo and Starling got off to a head start with full banking licences a few years ago. However, with profits rising and banking licences ongoing, Revolut is currently well located to compete head on.

🚀Want to share the story?

Submit your stories to TechStartUps.com in front of thousands of founders, investors, PE companies, tech executives, decision makers and tech leaders.

Please attract attention

Source link