After the market closed on Wednesday, Nvidia closed its first quarter revenue for 2026 on April 27th.

Many people in the industry will want to hear how recent whiplash surrounding US chip export restrictions will affect Nvidia’s international chip business and future guidance, but not everyone considers it to be Nvidia’s most important outcome.

Kevin Cook, a senior equity strategist at Zacks Investment Research, has been following Nvidia for a decade and believes that TechCrunch’s deployment of single-rack exuspale computers, which has begun deliveries with the new GB200 NVL72 hardware company deployment (FEERURE), is a much more important area for shareholders to look out for.

These GB200 NVL72 machines include 72 GPUs and cost around $3 million. Cook said despite strong demand and high expectations this year, the disruption around Deepseek in late January caused many analysts, halving estimates for the unit’s delivery.

Cook added that there is no clear metric yet on how things are going, as this is the first quarter when the company shipped the machines.

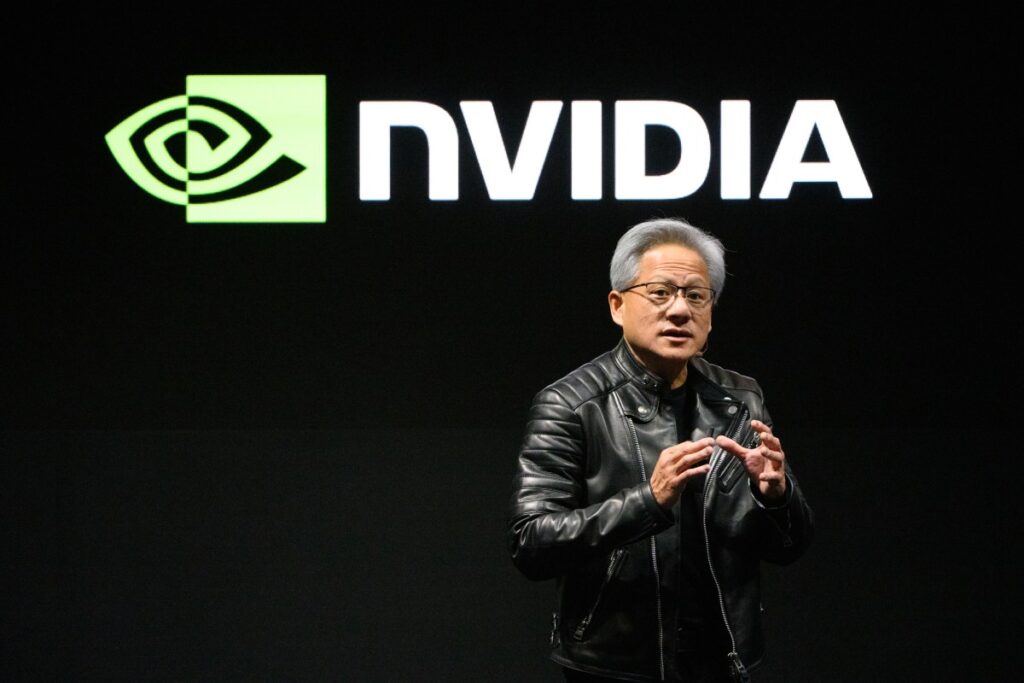

“If it’s Jensen [Huang] They say they are going to deliver 10,000 units in the second quarter, and the streets are very impressed,” Cook said. “That’s a big viable number. 10,000 is $30 billion for a $3 million product. I think they’re going to do less than 5,000.”

Cook added that these results will begin to paint a picture of Enterprise’s appetite for the latest AI technologies. Just like how consumers upgrade to the latest iPhone each year, do businesses upgrade their AI hardware whenever new systems are announced? Cook isn’t sure. Whether a company adopts its behavior can have a major impact on NVIDIA.

Cook predicted, based on what the company says about US export controls, will have an immediate impact on Nvidia’s stock. However, he does not believe that it will have a long-term impact on Nvidia’s valuation or stock price in the same way as the demand for the GB200 NVL72.

Nvidia’s stock price proves it can recover from short-term market responses, he added.

“We basically had a flash crash, but it’s backed up quickly,” Cook said of Nvidia’s stock price after chip export restrictions were announced. “It’s unique to Nvidia. Many companies have hiccups, but Nvidia has the biggest moat. They’re the most resilient in this. It’s ironic that they have this problem with China.

Even if chip export restrictions remain or become even more severe in China, Cook argued that Nvidia has no trouble finding customers elsewhere. The company currently sells to all major hyperscalers and may continue to see strong demand for AI chips. He added that the recent announcement about Stargate’s new project in the Middle East will likely be another victory for the company.

For Cook, his guidance really comes down to the GB200 NVL72 unit.

“As long as delivery is expected to be exceptionally stable, whatever revenue fluctuations this quarter, I think it’ll be on the back burner as the wind is on the sails for the rest of the year,” Cook said.

Source link