Nvidia swept San Jose this year, bringing a record 25,000 attendees to the San Jose Convention Center and surrounding downtown buildings. Many workshops, lectures and panels were so packed that people had to lean against the wall or sit on the floor.

Nvidia is currently at the top of the AI world, with record finances, empty profit margins and no serious competitors yet. However, the coming months are at unprecedented risks as they face changing priorities from top US tariffs, deepseeks and AI customers.

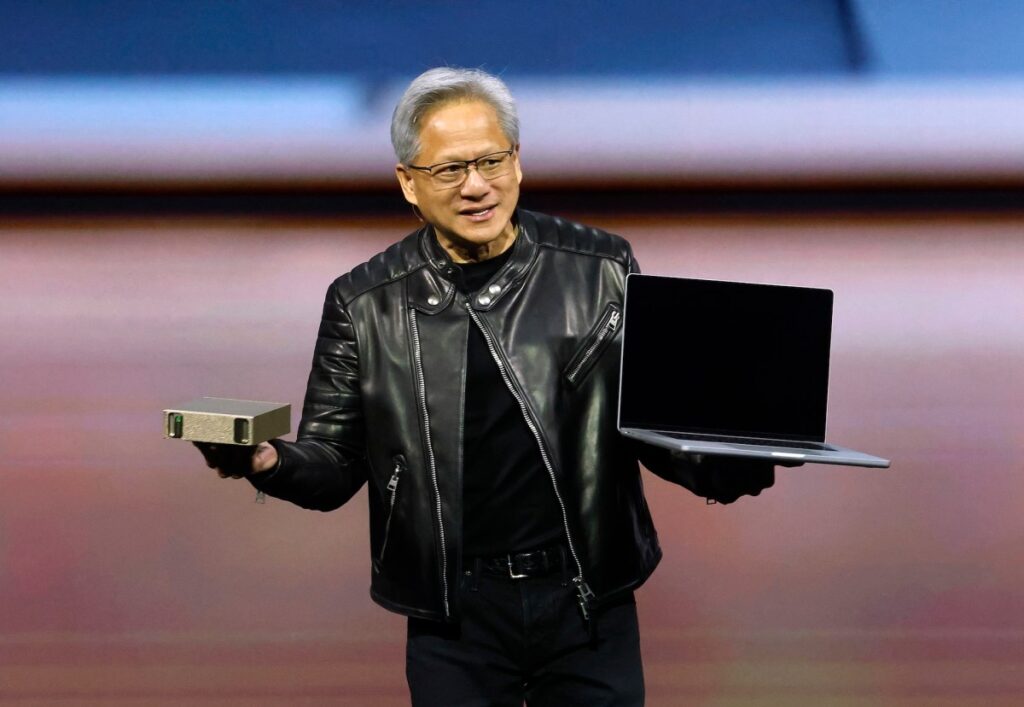

At GTC 2025, Nvidia CEO Jensen Huang tried to project confidence, unveiling a powerful new chip, a personal “supercomputer” and of course, a really cute robot. This was a thorough sales pitch. This is intended to allow investors to get caught up in Nvidia’s Nosediving stocks.

“The more you buy, the more you save,” fans said at the time of Tuesday’s keynote speech. “It’s even better than that. The more you buy now, the more you will make.”

Inference boom

Above all, Nvidia at GTC this year has sought to assure participants and the rest of the world that demand for its chips will not slow anytime soon.

In his keynote address, Huang argued that almost “the whole world was wrong.” China’s AI Lab Deepseek, which released a highly efficient “inference” model called the R1 earlier this year, has piqued fear among investors that Nvidia’s monster chips may no longer be needed to train competitive AI.

However, Huang repeatedly argues that power-hungry reasoning models actually drive more demand for company chips. At GTC, Huang showed off Nvidia’s next Vera Rubin GPUS, claiming to run inference (i.e., running AI models) at a rate that is nearly twice as high as Nvidia’s current Blackwell chip.

Nvidia’s threat to Huang reduced the amount of time it took to deal with it. This was a startup company like Cerebras, Groq and other low-cost inference hardware and cloud providers. Almost all hyperscalars have also developed custom chips for inference, if not training. AWS has Graviton and Imeferntia (reportedly reportedly being actively discounted), Google has TPUs, and Microsoft has Cobalt 100.

Along the same vein, the high-tech giants, which are currently highly dependent on Nvidia chips, including Openai and Meta, aim to reduce their relationship through internal hardware efforts. If they and other rivals mentioned above are successful, they will almost certainly weaken Nvidia’s Stranglehold in the AI chips market.

That’s probably why Nvidia’s stock price fell by around 4% following Huang’s keynote. Investors may be offering hopes for a “last thing,” or perhaps an accelerated launch window. In the end, they didn’t get either.

Tariff tension

Nvidia also tried to ease worries about tariffs in GTC 2025.

The US has not imposed tariffs on Taiwan (Nvidia gets the majority of its tips), and Huang has argued that in the short term, tariffs will not cause “severe damages.” However, he stopped committing to Nvidia being protected from long-term economic impacts.

Nvidia has clearly received the Trump administration’s “America First” message, and while Huang has pledged to spend hundreds of billions of dollars on US manufacturing with GTC, it will help the company diversify its supply chain. This is also a huge cost for NVIDIA, where a valuation of hundreds of millions of dollars depends on healthy profit margins.

New business

To sow and grow companies other than the Core Chips line, GTC’s Nvidia has turned its attention to new investments in Quantum, an industry the company has historically ignored. On GTC’s first quantum day, Huang apologised to the CEO of a major quantum company for causing a minor inventory crash in January 2025 after suggesting that the technology would not be of much use for the next 15-30 years.

On Tuesday, NVIDIA announced that it will open a new center in Boston, NVAQC, and work with “major” hardware and software markers to advance quantum computing. Of course, the center is equipped with an Nvidia chip. This, the company said, will allow researchers to simulate the models needed for quantum systems and quantum error correction.

In the near future, Nvidia sees what it calls a “personal AI supercomputer” as a potential new revenue maker.

At GTC, the company launched DGX Spark (formerly known as Project Digit) and DGX Station. Both are designed to allow users to prototype, tweak and execute AI models at different sizes at the edge. Neither exactly is cheap – they retail for thousands of dollars – but Huang boldly declared that they represent the future of personal PCs.

“This is a computer in the age of AI,” Huang said in his keynote address. “This is what a computer should look like, and this is what the computer will do in the future.”

We’ll immediately check if the customer agrees.

Source link