Circle Internet does something else when it’s published. This time, I have more grounded expectations.

The Stablecoin publisher said Tuesday that it is aiming for a valuation of up to $6.7 billion on a fully diluted basis as part of its much-anticipated US IPO. Circle and some of its early backers are trying to raise up to $624 million, offering prices between $24 million and $26, Reuters reported.

The news comes less than two months after Circle filed the S-1 with the SEC and listed it on the New York Stock Exchange, under the ticker symbol “CRCL.”

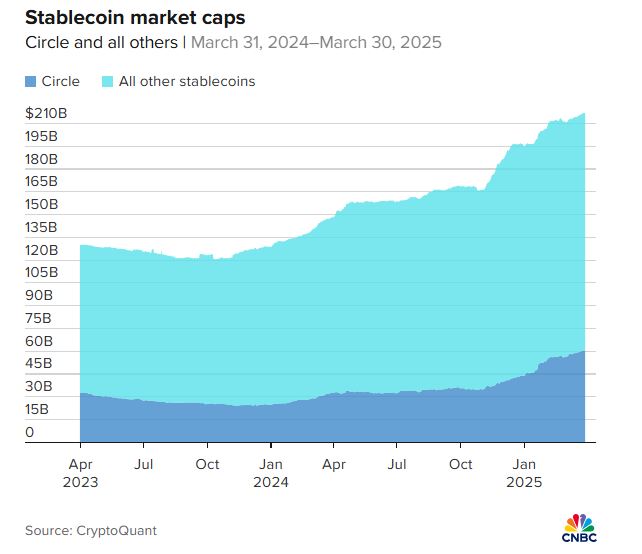

The circle’s pitch landed as crypto companies were finding new interest on Wall Street, aiding in a more friendly regulatory tone and market sentiment. The company’s core business is at the heart of USDC, the second largest Stablecoin behind Tether, with more than $60 billion in distribution.

There is also a noticeable political tailwind. The Trump administration is more open to crypto, indicating a shift towards what is called a more “rational” approach to regulating digital assets. This created space for companies like Circle to test the open market again.

“The outlook for Crypto IPOS is better than any point in the last three years or so,” said Matt Kennedy, senior strategist at Renaissance Capital.

Circle is expected to provide 9.6 million shares, with Accel, General Catalyst and other shareholders offloading 14.4 million. Cathie Wood’s Ark Invest has already expressed interest in scooping up its $150 million shares.

Circle’s IPO Push Mark marks Crypto’s biggest public movement since Coinbase

This is one of the largest crypto lists since Coinbase’s 2021 debut. It also shows that more crypto companies are repeating themselves in the open market again following Galaxy Digital’s recent move to NASDAQ earlier this month.

The circle had previously been trying to make public in a $9 billion SPAC deal backed by Bob Diamond, but fell apart in the second half of 2022.

“Currently, the circle shows that it is back in the open market, but a 25% lower rating reflects more realistic market conditions and bubble-up expectations.”

Focused stub coin

Founded in 2013, Circle is best known for issuing USDC, a Stablecoin that charges dollars used throughout crypto transactions, defi, and payments. The company also launched an euro, which is fixed to the euro.

The IPO could bring clearer rules and further promote institutional adoption, just as the US Senate advances a stable bill.

JP Morgan analysts hope that the Stablecoin market will swell from $500 billion to $750 billion over the next few years. This is a big jump from the current level.

The circle will be listed under the ticker symbol CRCL on the New York Stock Exchange. The IPO is led by JP Morgan, Citigroup and Goldman Sachs.

The circle is the second largest stubcoin by market capitalization. With around $60 billion in circulation, USDC is behind 67% of the tethers, accounting for around 26% of the Stablecoin market. However, USDC’s growth is recovering. That market capitalization increased 36% this year, compared to Tether’s 5%.

Credit: CNBC

The broader stubcoin sector is also gaining momentum, some being helped by a more favorable political situation. The crypto industry hopes Congress will pass legislation focused on stubcoin later this year. Former President Donald Trump recently said he hopes lawmakers will get bills on their desks before the August break.

🚀Want to share the story?

Submit your stories to TechStartUps.com in front of thousands of founders, investors, PE companies, tech executives, decision makers and tech leaders.

Please attract attention

Source link