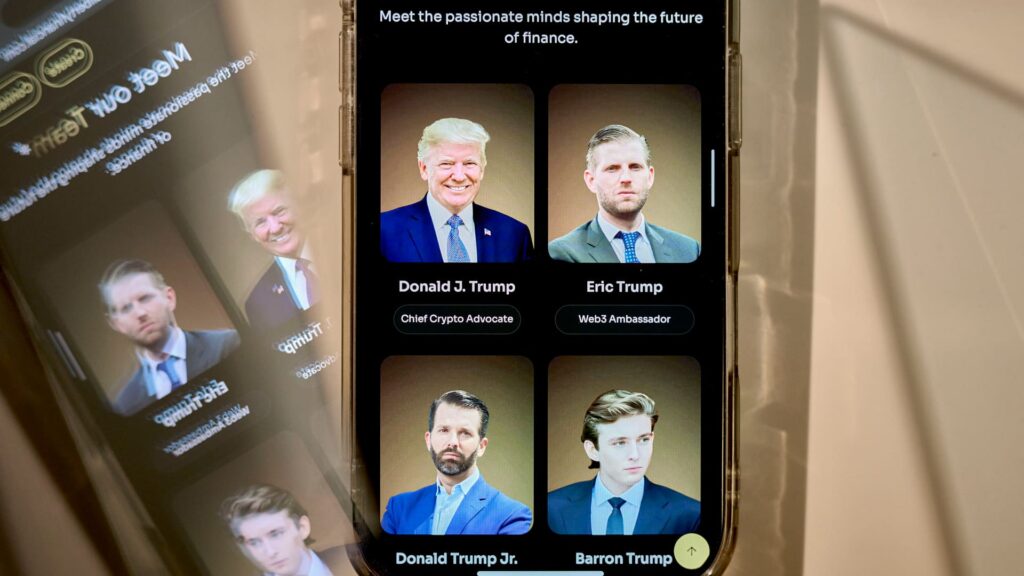

The World Liberty Financial website was adapted on a smartphone in New York, USA on Wednesday, February 12th, 2025.

Gabby Jones | Bloomberg | Getty Images

The Senate passed the Genius Act on Tuesday. This is a groundbreaking bill that will establish the first federal guardrail of the silly stubcoins awarded by the US dollar, creating a regulated pathway for private companies to issue digital dollars with federal blessings.

The bill was passed by 68-30 votes.

It’s a milestone day for the crypto industry. It invested around $250 million in the 2024 cycle, and has now been elected what is considered the most procryptic congress in US history, and is also elected for President Donald Trump’s vast digital assets empire.

“The Genius Act protects consumers, enables responsible innovation and protects control of the US dollar,” said Sen. Kirsten Gillibrand of Dn.Y., one of the bill’s sponsors.

The bill still faces the hurdles of the Republican-owned home, but the Senate passage marks a turning point, not just because of technology, but also because of the political influence behind it.

The Genius Act stands for Guidelines and Establishment of National Innovation for the US Stablecoins Act, and sets up industry guardrails, including full reserve support, monthly audits, and anti-money laundering compliance.

It also opens the door to a wide range of issuers, including banks, fintechs and major retailers, and is attempting to launch their own stubcoins or integrate them into existing payment systems.

The law grants Treasury Secretary Scott Bescent the sweep authority last week, who told the Senate Budget Subcommittee at a hearing that the U.S. stubcoin market could increase by about eight times more than the next few years.

The passage of the bill accused Republicans of “rubber stamping Trump’s crypto corruption” and D-ore, who accused the president of allowing him to “sell access to the government for personal gain.”

Markley said he had called for an amendment that would prohibit elected officials from profiting personally from digital assets, but GOP lawmakers blocked any effort to vote on floors.

In May, Senate Democrats announced the “Final Cryptocratic Act,” led by Merckley and minority leader Chuck Schumer of New York.

Genius is heading to a house that currently has its own version of Stablecoin Bill called Stable. Both ban stubcoins for consumers who are responsible for yields, but they branch out who regulates what.

The Senate version centralizes oversight with the Treasury, and the House divides the authorities between the Federal Reserve, the Secretary of Currency, and more. According to a council aide, it could take some time to reconcile the two.

The act of genius was considered the easiest cryptography to pass, but it took several months to reach the Senate floor, failed once, and passed only after intense negotiations.

“We thought it was easiest to start with stubcoin,” said R-Wyo Sen. Cynthia Ramis, who focused on stable coins on the Las Vegas stage at this year’s Bitcoin 2025 conference.

“It was very difficult. I didn’t know how difficult this would be,” she said.

At the same event, R-Tenn. “It was murder to take them there,” he said of the 18 Senator Democrats who ultimately crossed the aisle.

Destruction of Legacy Rails

Stablecoins are a subset of cryptocurrencies fixed at the value of real-world assets. Approximately 99% of all stub coins are linked to US dollar prices.

They offer immediate payments and reduced transaction fees, cut intermediaries, and provide legacy payment rails that directly intimidate them.

Shopify It’s already been deployed USDC– Through electricity payments Coinbase and stripes. Bank of AmericaLast week, the CEO told the Morgan Stanley conference that the banks were talking to the industry and exploring individually the issuance of Stablecoin.

Deutsche Bank has found Stablecoin Transactions reached $28 trillion last year, surpassing the MasterCard and Visa combination.

Still, there are restrictions. The Genius Act limits large, non-financial, high-tech companies from directly issuing Stablecoins unless they establish or affiliated with a regulated financial entity, unless they establish or affiliated with a provision that is a provision to blunt exclusive concern.

jpmorgan chainMeanwhile, it is taking another route and running JPMD. JPMD is a deposit token designed to function like a Stablecoin, but it is closely integrated with traditional banking systems.

JPMD, issued on Coinbase’s base blockchain, is only available to institutional clients and offers features such as 24/7 payments and interest payments.

Trump’s interests

Democrats have tried to amend the bill to prevent the president from gaining the benefit of crypto ventures, but the final law prohibits doing so with the exception of Congress members and their families.

Trump’s first financial disclosures as president, released Friday, revealed that he made at least $57 million in 2024 from token sales related to World Liberty Financial, a crypto platform that closely matches his political brand.

He holds 16 billion WLFI governance tokens (corresponding to voting stocks) based on previous private sales.

This is just one slice of a card crypto pie.

The controversial $Trump Memecoin, the $2.5 billion Bitcoin Treasury Department and the family venture that proposed Bitcoin and Ether ETFs via Truth.fi, including a newly launched mining company called American Bitcoin, reflecting an aggressive push to digital finance.

Forbes recently estimated Trump’s crypto holdings of nearly $1 billion and increased its total net worth to $5.6 billion.

Watch: President Trump’s Crypto Dinner

Source link