Dubai, United Arab Emirates, March 28, 2025, Chain Wire

By trading volumes, Crypto Exchange Concall officially took part in the top five global crypto option exchanges, marking a major milestone just 18 months after its establishment. This achievement highlights the rapid growth of the platform in a sector that is increasingly drawing attention from both institutional and retail.

According to internal data and third-party analyses, the performance surge has linked to successful Q1 strategies, including impactful marketing campaigns and new product deployments, in collaboration with notable crypto partners such as SignalPlus, DWF and Big Candle Capital.

Crypto options: From niche strategies to core market structure

Options once reserved for quartz and hedge funds are becoming the go-to tool for crypto-native investors. These contracts grant traders the right to buy and sell assets at set prices, but not an obligation, to enable sophisticated hedges, volatility plays, and directional speculation.

As the broader digital asset market matures, crypto options are increasingly seen as an important component of the financial stack. This month, the story hit the mainstream when reports garnered $4-500 million that Coinbase was undergoing high consultation to win Delibit, the market’s dominant BTC and ETH options venue. The negotiations have been tapering ever since, but the message from the market is clear. Coded derivatives are no longer sideshows. They are the central stage.

Youngest in the Top 5 – and Fastest Rise

CONCINCALL’s breakout is not only noteworthy for its speed, but also for the relative youth of the company. Founded in late 2023, Conicalll is currently ranked as the top exchange in space, with Delibit now in sizes between 9-10%.

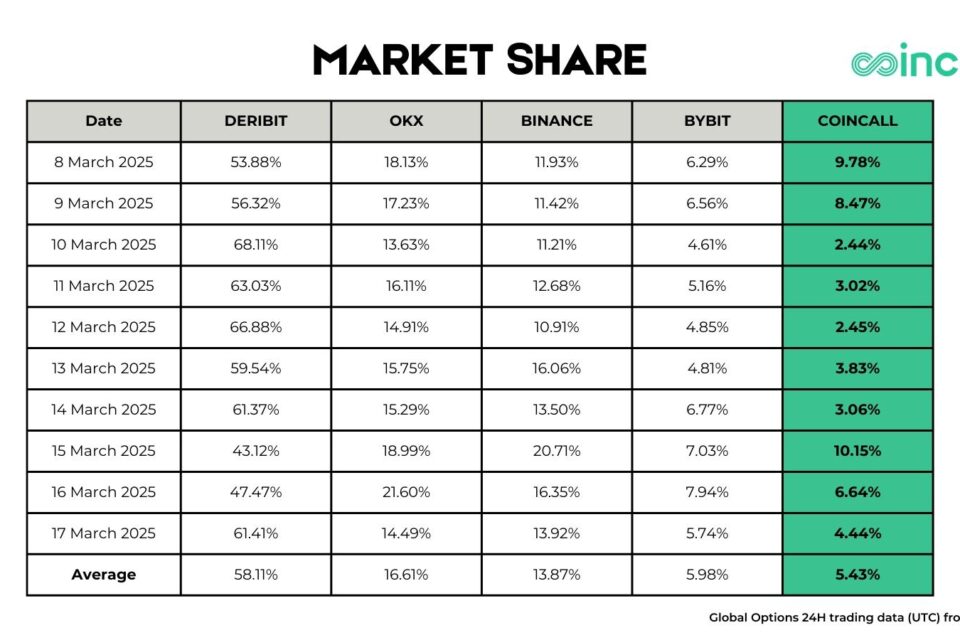

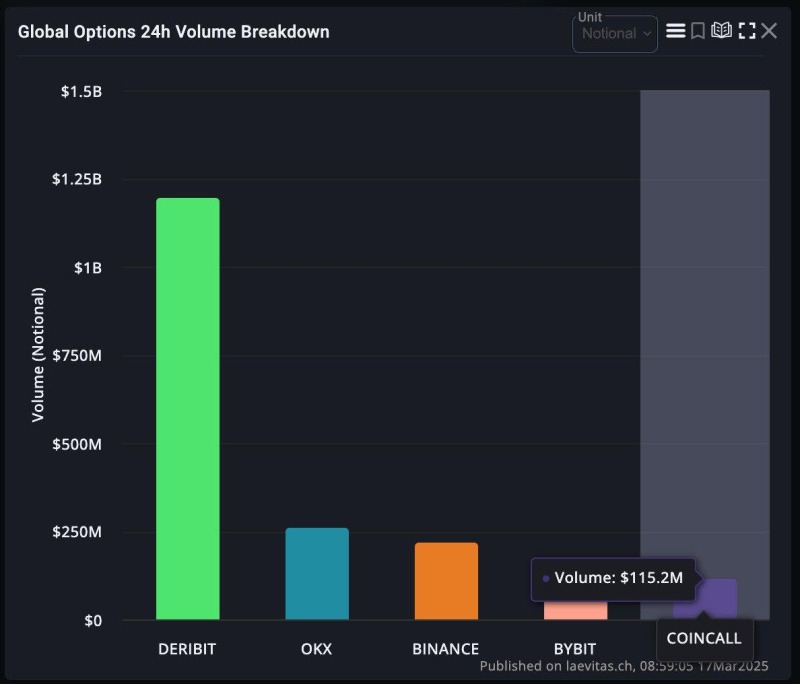

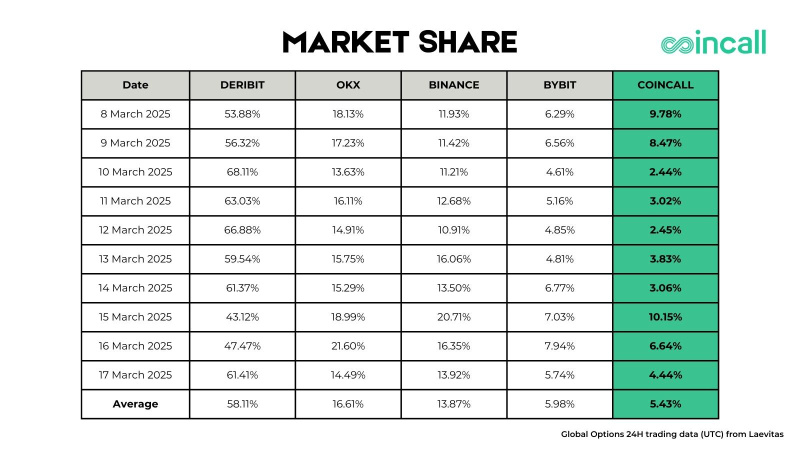

According to data from Laevitas, Concall gained an average market share of 5.43% between March 8th and 17th, 2025, and a prominent peak at 10.15% on March 15th. The exchange saw a strong day of 9.78% on March 8th and 6.64% on March 16th.

Concall’s comparative market share and growth trajectory will ensure that the youngest exchange to date has penetrated the top five, making it one of the most viable candidates for a potentially rising takeover or institutional partnership between players. As attention shifts from mature giants to agile challengers, Concall is at the heart of that conversation, growing to roughly the same market share as industry giant Bybit.

Leadership backed by vision

In January, Conicalll appointed Daryl Teo, a former strategist at Alibaba Group (NASDAQ: BABA) and longtime investor in Crypto Space, as Chief Operating Officer and minority shareholder. He joined CEO Jimmy’s executive team from OKX, Paradigm and Byte Dance previously.

“We’ve seen Crypto achieve consensus level legitimacy as a valuable store,” Teo said. “Options are the next wave. We provide leverage, flexibility and strategy. Our mission at Cincall is simple. We’re going to make investments that are quick, intuitive and safe for everyone.”

“Earn while trading” feature: Unlock yield + Capital efficiency

CONCINCALL’s latest innovation, Acquisition While Your Trady (EWYT), is designed to eliminate the traditional trade-off between yield agriculture and aggressive trading.

With ewyt, the user is:

Earn up to 6.4% APR at USDT Holdings. Access 90% of the piling funds as trading margins withdraw funds at any time.

This feature allows users to earn yields at Idol Capital without forgetting to trade activity, providing an alternative approach to capital use.

Users can explore their products here.

Macro Momentum: Crypto infrastructure is back

Conicalll’s rise reflects a wider tailwind for crypto infrastructure. In 2024, $11.5 billion in venture capital was invested in crypto and blockchain startups in 2,153 transactions, according to Pitchbook.

“The next stage in cryptography is defined by the actual infrastructure,” Teo said. “With capital efficiency and user accessibility in mind, the intentional platform building will shape the next decade.”

About the same

Cincall is the next generation of cryptocurrency options exchange founded in 2023, focusing on accessibility, capital efficiency and a seamless trading experience. With innovative features such as deep liquidity, rapid execution and acquisition in-trade, Concall is building the future of digital asset derivatives.

contact address

Daryl Theo

Same

daryl@coincall.com

Marketing Leads

Bella K.

Same

vera.k@coincall.com

Disclaimer: This is a paid press release published through ChainWire, a PR newswire syndication platform for blockchain companies.

🚀Want to introduce the story?

Submit your stories to TechStartUps.com in front of thousands of founders, investors, PE companies, tech executives, decision makers and tech leaders.

Please attract attention

Source link