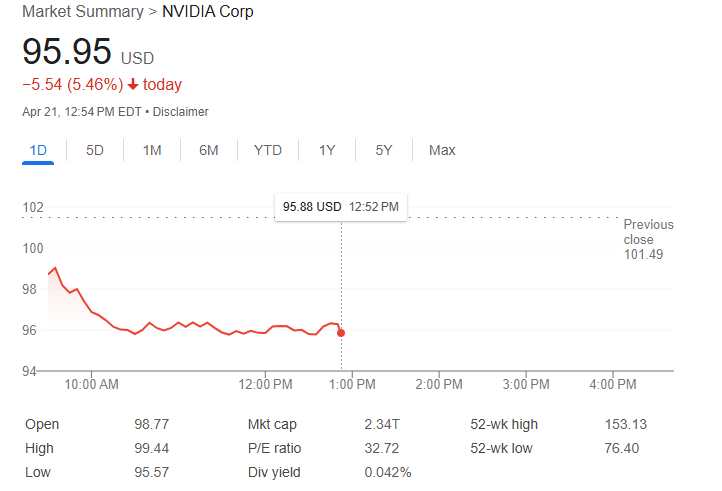

On January 24th, Nvidia closed at an astounding $3.49 trillion market capitalization. A few days later, Deepseek’s surprise breakout caused new doubts about runaway AI chip spending, losing $600 billion in less than two hours. Three months later, the bleeding has not stopped, but now there is pressure from China.

It all began earlier this month when the US government shut down China, one of Nvidia’s fastest growing revenue streams. New export restrictions wiped out what became the company’s biggest international play, causing billions of dollars of fallout.

On Tuesday, Nvidia said it would need a $5.5 billion hit this quarter after being forced to halt shipments of its H20 AI chips to China and other affected regions. Investors didn’t do well. After the announcement, shares fell 6% due to after-hours trading.

That drop wasn’t just one time. By Monday, Nvidia’s shares had dropped another 5.8% to close at $95.60. The company currently has a market capitalization of $2.34 trillion, exceeding $1.15 trillion in just three months.

Nvidia’s China problems have gotten worse. Huawei is ready to capitalize.

To slow the slides, Nvidia CEO Jensen Huang reportedly surprised Beijing last week. But the watch may already be working against him.

On Monday, Reuters reported that Huawei is preparing to launch bulk shipments of Ascend 910C chips to Chinese customers to fill the gap in Nvidia. Some units are already out and are expected to deliver as quickly as possible next month.

The 910C is Huawei’s latest AI-centric GPU built for both training and reasoning. Basically, it’s two 910B chips that combine with clever engineering. result? Approximately 800 teraflops of FP16 performance and 3.2 terabytes per second of memory bandwidth – 80% of what NVIDIA’s H100 offers is enough for Chinese companies looking to move away from US linked suppliers.

The chip is built using a 7nm process, relies primarily on Taiwan’s TSMC and is supported by Smic in China. Huawei had stocked TSMC chips before sanctions began, but Smic is expanding its own production. Together, they are pushing millions of units into the ship in 2025.

However, Huawei not only ships silicon, but also sells full stack systems. CloudMatrix 384 Clusters 384 of these GPUs put 384 in one AI calculation box that is supposed to deliver 300 PetaFlops. For comparison, Nvidia’s high-end GB200 NVL72 offers around 180. The trade-off is high energy usage, but the low power costs and low chip options make most Chinese customers doing that.

Earlier this month, the US imposed fresh export restrictions that required NVIDIA to obtain a license before shipping H20 chips to China. The H20 was the main product of Nvidia in the region. It is now virtually on the sidelines. Companies like Baidu, Tencent and Bytedance are leaving scrambling, and Huawei has already stepped in.

Huawei has started sampling the 910C to major Chinese tech companies in late 2024, already meeting early orders. Analysts are paying attention. Paul Triolo of Albright Stonebridge Group said, “Huawei’s Ascend 910C GPU will become the hardware of choice for AI model developers in China.” White Oak Capital’s Nori Chiou added that the export regulations “effectively promote Nvidia’s Chinese customers into Huawei’s AI chips.”

Nvidia grip is loose in China

Nvidia’s global position is not under threat for the time being, but the Chinese narrative is changing rapidly. After the latest restrictions, Nvidia’s shares slid 3.1% in pre-market trading. The company has received a $5.5 billion bill related to halting sales on H20, and CEO Jensen Huang recently admitted that China’s revenues have been cut by half.

Meanwhile, Huawei has achieved position. In a recent interview with the Financial Times, Huang recognized Huawei as a serious competitor.

China’s promotion of chip independence

Huawei’s Ascend 910C is at the heart of a wider push by China to reduce its dependence on foreign technologies. When our tipping becomes difficult, Chinese companies are increasing local alternatives. Huawei says it aims to ship 100,000 910C and 300,000 910B in 2025 with Ascend Chip’s production yield increased by 40% since last year.

The software is still in progress. Huawei’s ecosystem is lagging behind Nvidia’s Cuda platform, but it’s catching up. The growing partnership with AI developers like Deepseek could turn into a real challenge for Nvidia, especially when geopolitical pressures continue to rise.

🚀Want to share the story?

Submit your stories to TechStartUps.com in front of thousands of founders, investors, PE companies, tech executives, decision makers and tech leaders.

Please attract attention

Source link