Lucasmeer, a junior energy analyst at the Nuclear Energy Agency (NEA), has investigated recent NEA analysis on small modular reactors (SMRs), highlighting the growing interest and advancement in SMR development around the world.

The work to develop and deploy small modular reactors (SMRs) is not only growing interest from the private sector and government, but we also want to learn more about the potential to support deep deossification and energy security.

Research shows that interest in SMRS is growing

Recent analysis by the Nuclear Energy Agency (NEA) shows that projects developing SMRs exist in almost every region of the world, including emerging economies, and contribute to a variety of purposes. The main challenges they face are the concept of new technology and the innovative fuel qualifications and licensing that many need. Nevertheless, NEA’s analysis suggests that demand-side pull for these technologies is likely to see widespread deployments for SMR over the coming years.

Ongoing NEA analysis is part of an effort to monitor and evaluate progress towards cutting-edge deployment of various SMR designs. The aim is to help policymakers, regulators, investors, industry experts and others navigate periods of rapid change in the nuclear industry. The latest results of this work can be found in the third edition of the NEA Small Modular ReactorDashboard¹, released in July 2025, and the new interactive online tool, the NEA Small Modular Reactor Digital Dashboard,², which provides readers with the ability to access and visualize their database directly.

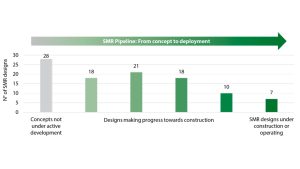

A total of 74 SMR designs were analyzed in the latest report of 127 identified worldwide. These 74 were designs with enough public information to evaluate and the designer was willing to participate. The analysis, like in previous editions, focused on licensing, sitting, funding, supply chain, engagement and fuel progress.

SMRS: Global Development

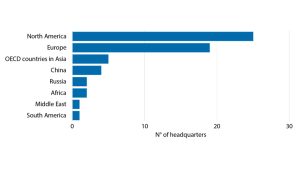

Regarding geographic location, Figure 1 illustrates how SMR work is global. Approximately seven designs are already working or under construction (Figure 2), and there is a strong pipeline of the project.

Of the 74 SMR designs evaluated by the NEA, 2025, 51 were involved in the pre-licensing or licensing process in 15 countries, with around 85 active debates among SMR developers and site owners around the world. Additionally, since the previous edition of the dashboard released in 2024, SMR designs have increased by 81%, confirming the announcement of funding.

The range of technical properties such as concept, composition, neutron spectra, size, and temperature allows SMR to expand the traditional market for nuclear energy. Some SMR designs may be particularly suitable for providing heat to the industrial sector, such as chemical production and oil and gas extraction. Other SMR designs may be suitable to provide reliable electricity production in remote or offshore locations. Some technologies may be used specifically for non-power applications, such as the production of medical isotopes and reducing or recycling radioactive waste.

investment

Unlike traditional large-scale nuclear power plants, SMRs are particularly interested in the private sector, with a vibrant startup culture, particularly in technology and heavy industries, supporting energy-intensive activities such as data centers. While most potential SMR sites (49) are still associated with utility and government-owned entities, 11 are connected to private industry players exploring SMRs as clean and reliable sources of power and heat. The US has the largest diversity of site ownership types, reflecting the wide range of stakeholders currently engaged in SMR deployments. SMR projects are increasingly considered to sit near industrial and commercial centers or near sites for retiring coal plants. Ownership structures have also evolved, with some vendors exploring build order operation (BOO) models, power purchase agreements (PPAs), virtual power purchase agreements (VPPAs), or lease agreements, rather than relying solely on owner and operator utilities.

From a fundraising perspective, private capital plays an increasingly important role, often complementing public matching grants. The NEA analysis found approximately $15.4 billion (USD 2023) of funding committed to SMRs around the world. The latest estimates include $10 billion from public resources and about $5.4 billion from private sources.

Different countries are in a position to acquire different types of benefits by participating in the SMR global value chain in different ways. In the US, France, the People’s Republic of China (China), and Russia, the majority of SMR-related supply chain activities support SMR designs headquartered in those countries. In contrast, in the UK, Canada and Italy, most SMR-related supply chain activities support SMR designs developed by overseas-headquartered design organizations.

SMR fuel

The majority of SMR designs reviewed in the NEA analysis require high assay low enriched uranium (haleu), defined as uranium enriched between 5% and 20%. While some developers remain an important barrier to the deployment of many SMR designs, some developers are engaged early to secure supplies for their first-time reactors. The collected data shows that as of early 2025, more than half of SMRs planning to use Haleu have not yet progressed beyond non-binding contracts and joint research with national labs related to fuel supply.

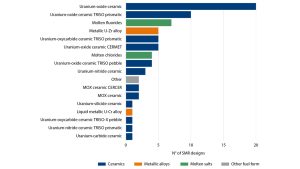

Another important challenge is that SMR designs are based on increasingly diverse fuel morphology. Most of them are not licensed or are not eligible for use yet. Standard uranium oxide ceramics are the most common physicochemical fuel type of SMR technology under active development, with 39 planned to be used as fuel (Figure 3). Of these, 19 incorporate or incorporate composite fuel architectures such as Triso (tristructural isotropy) to distinguish them from the traditional fuels used in today’s large-scale photowater reactors (LWRs), and could significantly alter fuel production requirements and performance characteristics. More broadly, the 47 SMR design relies on fuel types that are currently not available on a commercial scale.

While SMR offers potentially significant safety enhancements, the novelty and diversity of SMR designs indicate a major departure from established regulatory experience. Careful analysis supported by test data and verified code and simulation tools is necessary to establish that such systems are effective in various situations in which they are used. ³

Nuclear waste management

Waste management is another essential enablement condition for SMR deployment. Several advanced SMR designs have been developed and the possibility of reusing fuel from traditional nuclear reactors. In combination with recycling strategies, this could reduce the amount of high levels of nuclear waste stored and managed in deep geological repositories, with uranium mined for the front-end nuclear sector being mined. However, so far, there is insufficient information available from verifiable public sources, and we are assessing SMR progress in terms of planning waste management and preparation for end-of-life cycle management.

Continuous monitoring of SMR development and deployment

The vast number and diversity of SMR designs being tested and developed around the world requires continuous analysis to assess the progress made towards the actual deployment of these new technologies. NEA will continue to collect data and publish analysis as more verifiable information becomes available. This will be included in a future edition of the NEA SMR dashboard and will feed onto the NEA SMR digital dashboard on a rolling basis.

reference

NEA (2025), NEA Small Modular Reactor Dashboard, OECD Publishing, Paris, https://www.oecd-nea.org/jcms/pl_73678/nea-small-modular-smr-Dashboard Nea (2025a) http://www.oecd-nea.org/smr-digital-dashboard nea (2025b), CSNI Technical Opinion Paper No. 21: Small-scale Modular Reactor, oecd Publishing, https://doi.org/10.1787/0df32944-ene recommendations for research to support safe deployment of www.oecdnea.org/7660

This article will also be featured in the 23rd edition of Quarterly Publication.

Source link