It’s May 7, 2025, and we’re back with another roundup of the day’s biggest startup funding news. Yes, we’ve missed a few dates. No, we’re not promising perfect attendance. But if investors keep opening their wallets like this, we’ll keep showing up.

Today’s deal sheet is stacked—AI, biotech, cybersecurity, and even digital business cards. Investors aren’t just dabbling, they’re writing serious checks. From early-stage bets to late-stage moonshots, the signal is clear: the startup party isn’t over yet.

Here’s who raised, how much, and why it matters.

NewLimit Raises $130M Series B for Longevity Biotech

Funding Description: NewLimit, a biotech startup co-founded by Coinbase’s Brian Armstrong, secured a massive $130 million Series B round to accelerate its mission of developing therapies that extend human healthspan. The South San Francisco-based company is working on epigenetic reprogramming techniques to treat aging itself, aiming to tackle the root cause of many diseases. This new infusion, led by top-tier investors, will help NewLimit expand its operations and R&D efforts in the emerging longevity therapeutics field.

Funding Details:

Company Name: NewLimit

Investors Name: Kleiner Perkins (lead), Nat Friedman, Daniel Gross, Khosla Ventures, Human Capital, Valor Equity Partners, with existing backers including Dimension, Founders Fund, Brian Armstrong, John & Patrick Collison, Fred Ehrsam, Elad Gil, Joshua Kushner, Joe Lonsdale, Garry Tan.

Amount Raised: $130 million

Total Raised: Not disclosed

Funding Stage: Series B

Funding Date: May 7, 2025

OX Security Lands $60M to Scale Its Cybersecurity Platform

Funding Description: OX Security, a cybersecurity startup providing an application security platform, raised $60 million in a Series B round to fuel its growth. Originally founded by Israeli security veterans (now based in Boston), OX has developed technology to prioritize software vulnerabilities by analyzing real-world code behavior. The funding, led by a German telecom VC with participation from tech giants, brings OX’s total funding to $94 million, supporting product development and global expansion.

Funding Details:

Company Name: OX Security

Investors Name: DTCP (lead), Swisscom Ventures, IBM, Evolution Equity, Microsoft, and Team8

Amount Raised: $60 million

Total Raised: $94 million

Funding Stage: Series B

Funding Date: May 7, 2025

Sett Emerges from Stealth with $27M for AI Gaming Agents

Funding Description: Tel Aviv-based startup Sett came out of stealth mode, announcing a total of $27 million in funding to build AI agents for mobile game development. The company’s technology automates game design and operations, helping studios improve user acquisition and visibility. The latest portion of the funding was a Series A of $15 million led by Bessemer, following an earlier $12 million seed round, positioning Sett to expand its engineering and AI team in the competitive gaming industry.

Funding Details:

Company Name: Sett

Investors Name: Bessemer Venture Partners (lead), Saga VC, vgames, F2 Venture Capital, Akin Babayigit/Arcadia Gaming

Amount Raised: $15 million (latest round)

Total Raised: $27 million (including seed)

Funding Stage: Series A

Funding Date: May 7, 2025

Blinq Secures $25M to Expand Digital Business Cards

Funding Description: Blinq, a Melbourne, Australia-based startup offering a digital business card platform, raised $25 million in a Series A round to accelerate its global growth. Blinq’s app allows professionals to share contact information instantly via QR codes, links, and NFC, replacing traditional paper business cards. With over 2.5 million users globally, the company will use the new capital to develop more tools for professional networking and expand its reach across its offices in Australia and the U.S.

Funding Details:

Company Name: Blinq

Investors Name: Touring Capital (lead), Blackbird Ventures, Square Peg Capital (existing investors), and HubSpot Ventures (new)

Amount Raised: $25 million

Total Raised: Not disclosed

Funding Stage: Series A

Funding Date: May 7, 2025

FoodHealth Raises $7.5M to Scale Nutrition Intelligence Platform

Funding Description: San Francisco-based FoodHealth (formerly known as Bitewell), a nutrition intelligence startup, closed a $7.5 million Series A round to grow its healthy food scoring platform. FoodHealth provides a personalized “FoodHealth Score” that rates products on nutrient density and ingredient quality, already integrated into major grocers’ apps. The new funding, led by food-focused venture firms, brings FoodHealth’s total funding to $20 million and will help the company expand its operations and license its scoring system across the food industry.

Funding Details:

Company Name: FoodHealth

Investors Name: Reach Capital and Ulu Ventures (co-leads), with Supply Change Capital, ReThink Food, Refinery Ventures, Mudita, Antler, and other returning investors

Amount Raised: $7.5 million

Total Raised: $20 million

Funding Stage: Series A

Funding Date: May 7, 2025

Inductive Bio Attracts $25M for AI-Driven Drug Discovery

Funding Description: Inductive Bio, a New York City-based biotech software startup, secured $25 million in Series A financing to advance its AI platform for small-molecule drug discovery. The company is building machine learning models and a data consortium to predict drug properties (ADMET) and speed up the optimization of lead compounds. The round was led by prominent deep-tech investors and angels from the AI and biotech sectors, providing Inductive Bio with resources to expand R&D and partnerships in pharmaceutical research.

Funding Details:

Company Name: Inductive Bio

Investors Name: Obvious Ventures (lead), Andreessen Horowitz (a16z) Bio+Health, Lux Capital, S32, Character, Amino Collective, plus angels Oren Etzioni, Jeff Hammerbacher, Malay Gandhi, and Jakob Uszkoreit

Amount Raised: $25 million

Total Raised: Not disclosed

Funding Stage: Series A

Funding Date: May 7, 2025

ImmuneWalk Therapeutics Closes $7M Seed Round for Immunology

Funding Description: ImmuneWalk Therapeutics, a biotech company based in New York and Petach Tikvah (Israel), announced a completed seed financing of $7 million to advance its novel immunology drug candidate. The funding came from an institutional life-science investor along with contributions from ImmuneWalk’s management team. ImmuneWalk is developing a monoclonal antibody (IW-601) that modulates the immune system by inhibiting certain white blood cells, and the seed funds will support ongoing clinical studies and presentations at upcoming medical conferences.

Funding Details:

Company Name: ImmuneWalk Therapeutics

Investors Name: Undisclosed institutional investor, with participation from ImmuneWalk’s management

Amount Raised: $7 million

Total Raised: $7 million (seed only)

Funding Stage: Seed

Funding Date: May 7, 2025

7Learnings Nets €10M+ to Optimize Retail Pricing with AI

Funding Description: Berlin-based 7Learnings raised over €10 million in a Series B round to scale its AI-powered retail optimization platform. The startup’s software helps e-commerce and retail companies predict the impact of pricing and automatically determine optimal prices using machine learning. With this new funding led by Acton Capital, 7Learnings plans to expand into North America and enhance its predictive pricing solutions for its growing client base of fashion and retail brands.

Funding Details:

Company Name: 7Learnings

Investors Name: Acton Capital (lead), with continued support from High-Tech Gründerfonds (HTGF)

Amount Raised: €10 million+ (over €10 million)

Total Raised: Not disclosed

Funding Stage: Series B

Funding Date: May 7, 2025

Jericho Security Grabs $15M to Combat Phishing with AI

Funding Description: Jericho Security, a New York-based cybersecurity startup, raised $15 million in Series A funding to expand its AI-driven platform for employee cyber training. Jericho’s solution simulates advanced social engineering attacks (like conversational phishing and deepfakes) using “agentic AI” to train employees to recognize and thwart threats. The round was led by early-stage investors and includes a broad syndicate of venture firms and angels, providing Jericho the capital to accelerate its go-to-market and R&D for next-gen security training tools.

Funding Details:

Company Name: Jericho Security

Investors Name: Jasper Lau of Era Fund (lead), with Lux Capital, Dash, Gaingels Enterprise & AI, Distique, Plug & Play, Henry, Metalab, Fog, Scrum Ventures, KBTG, and Textbook participating.

Amount Raised: $15 million

Total Raised: Not disclosed

Funding Stage: Series A

Funding Date: May 7, 2025

WisdomAI Secures $23M to Scale AI “Insight Agents” for Business

Funding Description: San Francisco’s WisdomAI raised $23 million to advance its “business insight agents,” AI tools that help enterprises make data-driven decisions. The funding (stage undisclosed, likely Series A) was led by Coatue, indicating strong interest in WisdomAI’s approach to aggregating and analyzing organizational data. With backing from enterprise-focused VCs, WisdomAI plans to accelerate product development and grow its engineering and sales teams to serve large customers seeking AI-powered decision support.

Funding Details:

Company Name: WisdomAI

Investors Name: Coatue Ventures (lead), Madrona Venture Group, GTM Capital, The Anthology Fund, plus angel investors

Amount Raised: $23 million

Total Raised: Not disclosed

Funding Stage: Undisclosed (early-stage)

Funding Date: May 7, 2025

CueZen Raises $5M Seed Round to Personalize Digital Health

Funding Description: Seattle-based CueZen, an AI-driven health personalization platform, announced a $5 million seed funding round led by Point72 Ventures. CueZen’s technology helps health tech companies boost user engagement by orchestrating data from wearable sensors and evidence-based health programs to deliver personalized wellness “nudges.” The fresh capital will be used to accelerate customer acquisition and expand CueZen’s platform capabilities as it partners with health enterprises to improve user retention and outcomes.

Funding Details:

Company Name: CueZen

Investors Name: Point72 Ventures (lead), Pack VC, Fortson VC, Nextinfinity

Amount Raised: $5 million

Total Raised: $5 million (initial seed)

Funding Stage: Seed

Funding Date: May 7, 2025

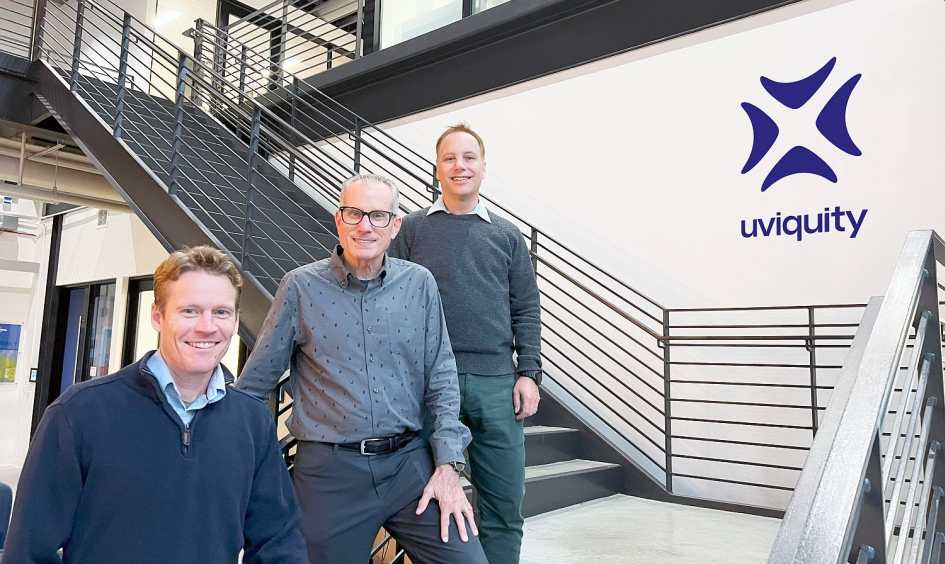

Uviquity Emerges with $6.6M to Innovate UV Disinfection Tech

Funding Description: Uviquity, a Raleigh, N.C.-based deep tech startup, emerged from stealth with $6.6 million in seed funding to develop its breakthrough Far-UVC light disinfection technology. Uviquity is creating tiny, semiconductor-based far-UVC light sources that can continuously disinfect air, water, and surfaces safely around people. The seed round, led by a deep-tech VC with agtech and filtration industry partners, will help Uviquity accelerate R&D and productize its fingertip-sized far-UVC chips for wide deployment in healthcare, agriculture, and consumer applications.

Funding Details:

Company Name: Uviquity

Investors Name: Emerald Development Managers (lead), AgFunder, MANN+HUMMEL

Amount Raised: $6.6 million

Total Raised: $6.6 million (stealth seed)

Funding Stage: Seed

Funding Date: May 7, 2025

Fastino Launches with $17.5M to Build Task-Specific AI Models

Funding Description: Fastino AI, based in Palo Alto, unveiled its new “Task-Specific Language Models” (TLMs) and announced a $17.5 million seed funding round led by Khosla Ventures. Fastino’s team of ex-Google DeepMind and Apple researchers developed AI models that achieve 99× faster inference than typical large language models by training on inexpensive gaming GPUs. The seed funding, which brings Fastino’s total financing to $25 million, will support the rollout of its developer API and further model development for tasks like text summarization, code execution, and data extraction.

Funding Details:

Company Name: Fastino AI

Investors Name: Khosla Ventures (lead), with Insight Partners (pre-seed lead), Valor Equity Partners, and angels including Scott Johnston (ex-CEO of Docker) and Lukas Biewald (CEO of Weights & Biases)

Amount Raised: $17.5 million

Total Raised: $25 million

Funding Stage: Seed

Funding Date: May 7, 2025

FirmPilot Adds $4.7M, Total Funding Reaches $11.7M for Legal Tech

Funding Description: FirmPilot, a Miami-based legal tech startup, announced that Thomson Reuters Ventures and HubSpot Ventures have joined as new strategic investors, bringing the company’s total funding to $11.7 million. The AI-powered marketing platform for law firms raised $4.7 million in this latest strategic round, building on its prior seed and Series A rounds. With this funding, FirmPilot plans to further develop its AI marketing engine that helps law firms attract clients online more cost-effectively.

Funding Details:

Company Name: FirmPilot

Investors Name: Thomson Reuters Ventures, HubSpot Ventures (new investors in current round); previously, Blumberg Capital led its Series A

Amount Raised: $4.7 million (new round)

Total Raised: $11.7 million

Funding Stage: Strategic investment (post-Series A)

Funding Date: May 7, 2025

SimpleClosure Lands $15M to Streamline Startup Shutdowns

Funding Description: SimpleClosure, a Santa Monica, CA-based platform that helps other startups wind down operations, raised $15 million in a Series A round. The company, which automates the complex legal, financial, and compliance steps of shutting down a business, will use the funds to expand its product and integrations. The round, led by fintech investors, brings SimpleClosure’s total funding to over $20 million, reflecting investor confidence in a tool that has already helped over 1,500 founders close their companies more efficiently.

Funding Details:

Company Name: SimpleClosure

Investors Name: TTV Capital (lead), with existing investors Infinity Ventures, Anthemis, Vera Equity, and new backers The LegalTech Fund and Carta, plus angel investors

Amount Raised: $15 million

Total Raised: $20 million+

Funding Stage: Series A

Funding Date: May 7, 2025

Carta Healthcare Snags $18.25M for Clinical Data Platform

Funding Description: Carta Healthcare, a San Francisco-based provider of AI-powered clinical data management solutions, secured $18.25 million in a Series B1 financing round. Carta’s platform streamlines the extraction and analysis of patient data for health systems and clinical research. The round was led by UPMC Enterprises (the venture arm of a major health system), joined by several hospital venture funds and existing investors, aiming to help Carta meet rising demand from hospitals and life science companies for its data abstraction and analytics tools.

Funding Details:

Company Name: Carta Healthcare

Investors Name: UPMC Enterprises (lead), new strategic investors MemorialCare Innovation Fund, Rex Health Ventures, Tampa General Hospital Ventures, plus existing backers Memorial Hermann Health System, Frist Cressey Ventures, Storm Ventures, Paramark Ventures, CU Healthcare Innovation Fund, Mass General Brigham Ventures

Amount Raised: $18.25 million

Total Raised: Not disclosed

Funding Stage: Series B1

Funding Date: May 7, 2025

Funding Summary Table

Company Name

Investors Name (Lead and notable investors)

Amount Raised

Total Raised

Funding Stage

Funding Date

NewLimit

Kleiner Perkins; Nat Friedman; Daniel Gross; Khosla Ventures; Human Capital; Valor Equity; (others)

$130 M

N/A

Series B

May 7, 2025

OX Security

DTCP; Swisscom Ventures; IBM; Evolution Equity; Microsoft; Team8

$60 M

$94 M

Series B

May 7, 2025

Sett

Bessemer Venture Partners; Saga VC; vgames; F2 VC; Akin Babayigit

$15 M

$27 M

Series A

May 7, 2025

Blinq

Touring Capital; Blackbird Ventures; Square Peg; HubSpot Ventures

$25 M

N/A

Series A

May 7, 2025

FoodHealth

Reach Capital; Ulu Ventures; (others: Supply Change, ReThink Food, Refinery, Mudita, Antler)

$7.5 M

$20 M

Series A

May 7, 2025

Inductive Bio

Obvious Ventures; a16z Bio+Health; Lux Capital; S32; Character; Amino; (angels)

$25 M

N/A

Series A

May 7, 2025

ImmuneWalk Therapeutics

Undisclosed institutional investor; (Mgmt team)

$7 M

$7 M

Seed

May 7, 2025

7Learnings

Acton Capital; HTGF

€10 M+

N/A

Series B

May 7, 2025

Jericho Security

Jasper Lau (Era Fund); Lux Capital; Dash; Gaingels; Distique; Plug & Play; (others)

$15 M

N/A

Series A

May 7, 2025

WisdomAI

Coatue Ventures; Madrona; GTM Capital; The Anthology Fund; (angels)

$23 M

N/A

(Undisclosed)

May 7, 2025

CueZen

Point72 Ventures; Pack VC; Fortson VC; Nextinfinity

$5 M

$5 M

Seed

May 7, 2025

Uviquity

Emerald Dev. Managers; AgFunder; MANN+HUMMEL

$6.6 M

$6.6 M

Seed

May 7, 2025

Fastino

Khosla Ventures; Insight Partners; Valor Equity; (angels)

$17.5 M

$25 M

Seed

May 7, 2025

FirmPilot

Thomson Reuters Ventures; HubSpot Ventures

$4.7 M

$11.7 M

Strategic (Post-Series A)

May 7, 2025

SimpleClosure

TTV Capital; Infinity Ventures; Anthemis; Vera Equity; The LegalTech Fund; Carta

$15 M

$20 M+

Series A

May 7, 2025

Carta Healthcare

UPMC Enterprises; MemorialCare; Rex Health; TGH Ventures; (others)

N/A

N/A

N/A

May 7, 2025

🚀 Want Your Story Featured?

Get in front of thousands of founders, investors, PE firms, tech executives, decision makers, and tech readers by submitting your story to TechStartups.com.

Get Featured

Source link