Tim Rynott, CEO of Four Corners Helium LLC, discusses the interest and investment journey in US Helium, from the surge to the games on standby.

For some US helium investors, their confidence is cold. Will that change? Too many investors have made the business from tasty to brow foliage. Expensive learning curve with one common thread: wait.

I’m waiting for permission. I’m waiting for the rig. I’m waiting for a test. I’m waiting for income!

Early investors who rode stock multipliers on AIM, TSX and ASX exchanges are looking for news of encouragement that is locked into transparency. Instead, the US helium industry is beginning to resemble deep-sea oil and gas, where return on investment (ROI) dominates the day, and robust rate of return (ROR) remains elusive.

Early topics

Four major shortages in just 19 years. The average helium price is typical for less than 10 years. The US Federal Helium Reserve, a supplier of up to 30% of domestic supply, is currently ~90% depleted. The forecast for semiconductor growth enhanced by the Inflation Reduction Act could show demand growth of 6-10% per year.

The foundation remains. Helium is irreplaceable with important technologies, environmentally friendly, and yes, we’ll be hooked on toddlers for years to come.

ROR Reality

As an example, private capital-centric North American helium initially sacrificed early income by frontloading capital into its midstream. This is called a “trust” arrangement between a capital provider and a manager. Eleven years later, NAH is producing approximately 170 million cubic feet per year. This is almost 5% of North American supply. However, this model is special and unique. Public traders rarely share such patience.

For most explorers:

Midstream is neither fast nor cheap. The proximity of the pipeline to helium plants is ideal, but rare. Mobile facilities mean a thin margin when leased, and direct purchases create a ROR. Shallow reservoirs (800-1200 feet) fight at low pressure → at low rates. High pressure play on subsaults will bring higher flows (50-250 MCFD), but drilling and completing CAPEX can earn between $6 million and $15 million/well. The attractive high-positive plays in Montana/Saskatchewan/Alberta are more affordable to handle, but the type curve suggests a relatively sharp decline after the first two years of production.

ROI: Seal the transaction

As helium can diffuse virtually all underground material over geological time, all resulting accumulation of helium occurs fundamentally when the rate of discharge from the source exceeds the rate of seal leakage.

Low permeability evaporating layers (salt, hard stone, gypsum) are globally determined to produce the best seals not only for oil and gas but also for helium. It is also numerically established that violated seals remain the highest exploration risk for oil, gas and helium. In many cases, or “blown seals” associated with tectonics, micro-destruction, or offset faults, can also be difficult to eliminate risk with available exploration tools. Considering that it takes hundreds of millions of years to fill a helium reservoir (radioactive decay is IV, IV, IV), one episode event could destroy the Economic Party. In other words, it destroys the ROI.

Here are some testing tools/practices to help you get rid of your blown away stickers in the future:

Pore Pressure Plot Palins Pastic Mapping Borehole Images Log Isoclon and Isopach

Secondary exploration risk – source, rock mechanism (porosity/permeability), migration effectiveness, trap/timing are relatively quantifiable with proximal analogues and sufficient seismicity.

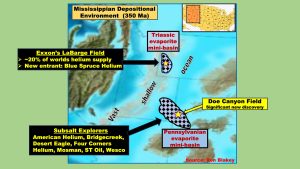

The Doe Canyon Field, the main modern analog of SW Colorado, is located on the east side of the enormous ancient shallow waters (Figure 1). Covered with 12,500 square miles of Pennsylvania’s evaporating canopy, DOE’s Mississippi porous dolomite has produced about 3 billion cubic feet of helium since 2016, allowing for an additional 46 billion cubic feet. The 4-Connors area is suitable for a preferred ROI, as there are over 20 million cubic .4-.5% helium (which reaches almost 3% near the 4 coma), and a wide laterally shallow uranium/thorium enriched subterranean rock.

Maximize ROR

Four Corners Helium, LLC, expects to utilize pore pressure plots and high-resolution isoclones in the pinch-out of large evapolite bodies. The ultimate goal is to test the reservoir with an evaporator seal thick enough to trap thin helium elements thin enough to avoid a 7-inch intermediate casing. If you need a 7-inch intermediate casing at today’s steel price, you’ll almost double the drill/finish cups in the subsault location, and you’ll get a return rate.

Secondly, stacked theater is also important. Earthquake reversals can risk shallow oil zones above helium deposits. Slow hookup of oil cash flow offset helium.

Demand/Demand meets ROI

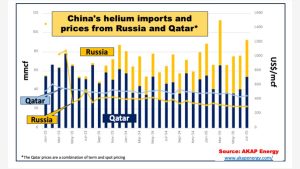

Current Helium Veterans – often oil and gas refugees who survived (or not) through cyclical oversupport scenarios – know how fluctuations in commodity prices can make ROR/ROI cruel. A suitable case: In September 2023, Russia violated China’s market share, cutting Qatar’s Chinese scaffolding by more than 40%, and lowering Qatar’s spot prices by 20% within 19 months (Figure 2). The US red flag is being rolled up!

Gazprom’s Amur Trains 1, 2 and 4 are online and have a chance of coming online later this year. Upon full growth, Amur could supply 3-3.5 times more than what is needed for the unlicensed Asian/Middle Eastern market (including China, India, the United Arab Emirates, Saudi Arabia, Vietnam and Malaysia).

If Gazprom can accommodate these countries, increase domestic allocations and build strategic inventory for either future pricing or future pricing, if there is still remaining capacity, what is next for this helium bounty?

First, sanctions were eventually lifted, allowing market options to be expanded.

Secondly, and to paraphrase Phil Cornblus and peers: “…Russian helium sanctions divide the previous global helium business into two entities. With that in mind, how does this relate to other highly processed, legally friendly countries?

Japan and South Korea account for a large 36% of Asian demand, but ride on slippery slopes. These countries do not have any specific sanctions banning Russian helium, but are firmly in line with the G7/US-EU camp. In other words, South Korea needs to express its loyalty to its allies, while still keeping the industrial lifeline quietly open where sanctions don’t bite. The sanctionless US, the largest helium consumer in the glove, is undoubtedly in the Russian crosshairs. There are obstacles, but costly delivery. Citizens’ anxiety from many Previas. Major US distributors (such as aviation products, Linde, Messer, Matheson) may he hes due to reputational risk. Complex tariffs. In this case, the exclusion of column 2 means that Russian helium could face high tariffs. The US is prohibited from using Gardner Russia’s filling helium containers. US-based Gardner supplies most of the world’s 11K gallon ISOs, but Chinese companies are moving rapidly to meet Gazprom’s needs. Competitive RORS/ROI – an area where American explorers can control their destiny. That is, can capitalist-led scientific ingenuity, sweat and resolve move US field-level economics beyond what Gazprom can undercut?

Geological rules

Mother Nature once again rules the day. Of the 195 countries on Earth, economic helium geological conditions have mainly occurred in only five countries so far.

In 2021, the American Geological Association (USGS) estimates 300 billion cubic feet of recoverable helium. If less than 25% of this amount is considered the economy, this volume of production could provide the needs of US generations.

Top US Helium Explorer – i.e. Avanti Helium, Blue Spruce, Desert Eagle, Exon, Four Corner Helium, Helix Resources, Mosman Oil and Gas, US Energy, Wesco brings high levels of expertise and scientific Arsenal. Consistency, earthquake age, and even higher resolution open hole cutting, NMR and borehole image logs, advanced geochemistry. There is a reason why many countries around the world are looking for the expertise and tools of US explorers.

It is said that modern Homo sapiens have been roaming the world for about 300,000 years, but helium was only discovered 157 years ago! So, investors, keep your brich in a mess – this new industry has a game that is waiting for you, adding to the pain!

This article will also be featured in the 24th edition of Quarterly Publishing.

Source link