Mexico City-based Mendel has raised $35 million in Series B round funding.

After participating in the Y Combinator’s Winter 2021 cohort, she last grew up in December 2021. With this latest capital injection, the startup has brought in a total of $60 million in equity capital and $50 million through its credit facility.

Mendel’s mission is simple. It is about reforming corporate spending management by automating most operations of enterprise CFOs that are currently being done manually. Or, even more simply, you want to be a one-stop shop for all your B2B spending. Its offering integrates expense management, payments and corporate travel.

“Our goal is to provide real-time visibility and control over spending to Latin American CFOs and finance teams, whether it’s employee expenses, vendor payments, or business trip bookings,” said co-founder Alan Karpovsky.

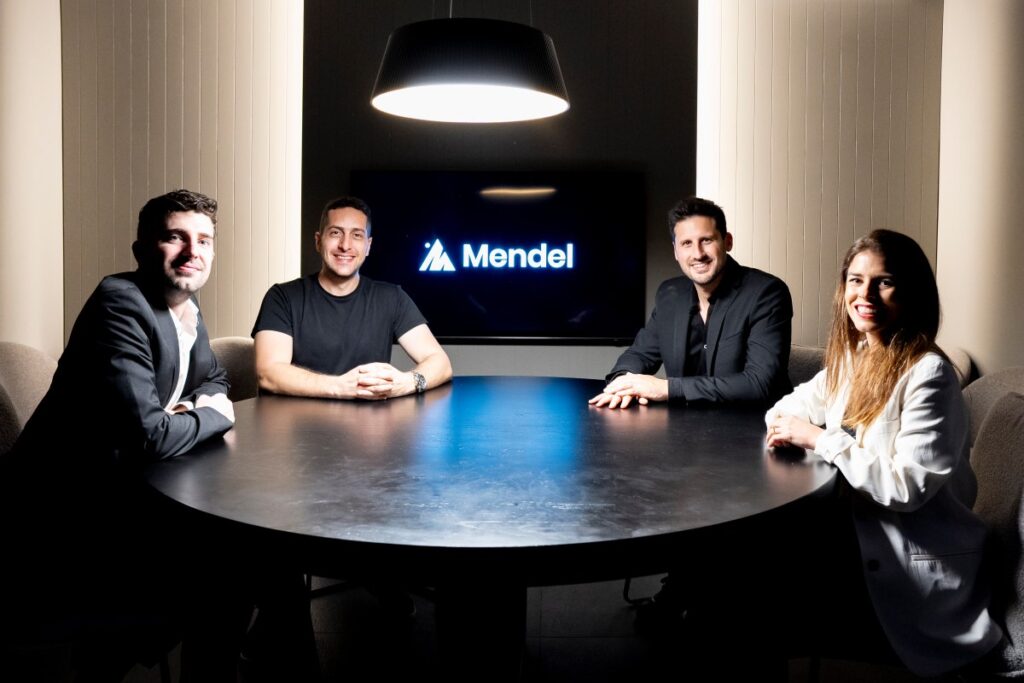

Karpovsky and Alejandro Zecler (who previously founded and sold other startups) launched Mendel in early 2021, with Helena Polyblank (CPO) and Gonzalo Castiglione (CTO) later joining as co-founders.

Mendel refused to reveal the rating, and Kalpovsky said only the round reflected a “significant step-up” from the company’s previous pay raises. The company also refused to reveal its hard revenue figures, noting that Karpovsky’s annual repeat revenue (ARR) has increased nearly 2.5 times the year-on-year, with a total margin of over 75%.

“We haven’t made any profit yet, but we expect to reach profitability by the second half of 2025,” he told TechCrunch.

Base10 Partners led Mendel’s latest round. This includes participation from new investors PayPal Ventures and Endeavor Catalyst, as well as existing supporters Infinity Ventures, Industry Ventures and Hi.vc.

SAP Concur meets Amex

The company says it is “Software First” and focuses on companies, so it can charge repeat SaaS fees rather than relying solely on interchange revenues and lending-based models. That revenue comes from a combination of cost management and travel tools from your credit card, as well as exchange fees and SaaS fees (over 50%) for take rates from bill-paying items.

Karpovsky believes the company’s LATAM focus will provide an advantage over other global players. This is because it can address “complex and country-specific regulations” such as tax codes, billing requirements, and multi-currency workflows.

“We like to say, ‘Mendel is like SAP agrees and Amex has kids,'” Karpovsky said.

In many ways, he said “Mendel is like a lamp for a Latin American company” when it comes to comparing it to the New York-based Decacorn lamp.

Mendel currently has 80 employees, compared to 64 employees a year ago. The company is planning to expand geographically in the future. In Mexico and Argentina, we have around 500 customers, including Mercado Libre, Femsa, Adecco and MacDonald’s. The company aims to expand to Chile, Colombia, Peru in 2025 and Brazil in 2026.

“Our approach from Day Zero was to first integrate Latam’s largest Spanish-speaking market before we began our Earth expansion,” says Karpovsky.

Base10 partner Jason Kong told TechCrunch that his company is attracted to what is considered Mendel’s “unique positioning.”

“The company’s high capital efficiency – positive cash flow in December 2024 – stood out in a sector where many players struggle with unit economics,” Kong added. “In addition, Mendel’s ability to replace legacy solutions like SAP has attracted large enterprise customers at large sales speeds (less than three months for over 3,000 employees companies), indicating a clear product market fit.” Also, other companies operating in this sector in Latin America include Clara and Jeeves (another YC alum), both targeting more SMBs and relying on transaction fees, Kong said.

Source link