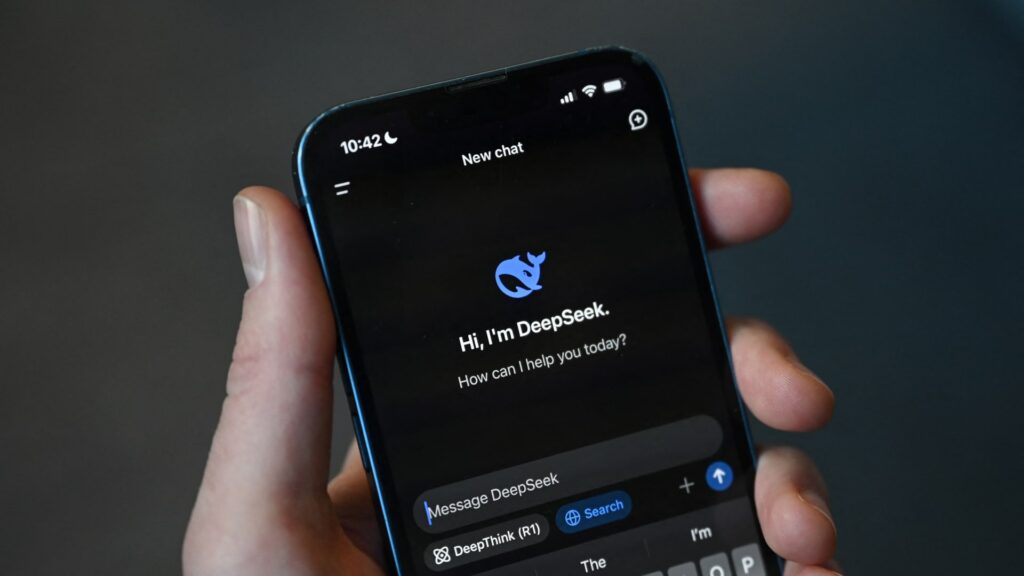

The most exposed of artificial intelligence is afraid that models developed in China can prove that the energy efficiency is higher, so it is sold rapidly on Monday and the high -tex cector builds a data center. We are afraid that paper demand in the United States will increase rapidly. However, according to Shahraar Pourreza, Shahraar Pourreza, a senior management director of Guggenheim Securities and Utility, this sale does not take into account the larger context of US power demand. “What we are telling people is a bit too early. It’s a bit of a knee reaction,” Polleza told CNBC on Monday. Investors panicked when the AI Assistant, developed by the Chinese Open Source Research Institute, Deepseek, was filmed before Openai’s Chatgpt and became the most downloaded application in the Apple application store. Vistra has plummeted 28 % on Monday, but Contellation Energy, Talen Energy, and Ge Vernova have fallen by more than 20 %. These shares are considered to be the best way for investors to play power demand rising from AI data centers. On Tuesday, VISTRA’s shares rose slightly. The stock was the second best performer after Palantir in 2024, almost tripled. Constellation stocks were almost doubled and were ranked as the top shares last year. On Tuesday, the loss was recorded on the second day. Talen shares, which have almost tripled in the past 12 months, have increased almost 4 % on Tuesday. Details are still appearing, but according to the BMO Capital Markets Monday memo, the DeepSeek server may be 50 % to 75 % less than the NVIDIA GPU platform. According to Bank of America notes, Deepseek’s AI model asks “high expectations for cloudcape, tip growth, and power requirements.” However, most of the growth of power demand in the United States is due to the expansion of electrification and domestic manufacturing among other themes. Analysts said that many investors have defeated the shares of Contellation, Vistra, and Talen only at the angle of AI, but “The outlook of the data center is like a cherry blossom on the theme of power demand. Ta. “What we are telling people is that the basics are still very healthy,” Poleza told CNBC. The United States still has a sharp need to expand its power, and the appearance of DeepSeek told the client that “it may show the need to actually accelerate the addition of capacity.” According to Bank of America, the need to invest in the US and European grids is still “basic requirements.” “One of the important bottlenecks in Europe and the US electric grid remains lack of investment and meets the load growth requirements,” said Bank of America analysts on Monday. Guggenheim has not changed the outlook for Constellation, Visitor or Talen. The company has $ 378 for constellations, which means rising 37 % from the current level. VISTRA’s goal is $ 212, suggesting about 55 %. Talen’s goal is $ 258, indicating 34 % rise. Correction: The goal of Gugenheim in Taren is $ 258, indicating 34 %. The previous version accidentally stated the numbers.

Source link