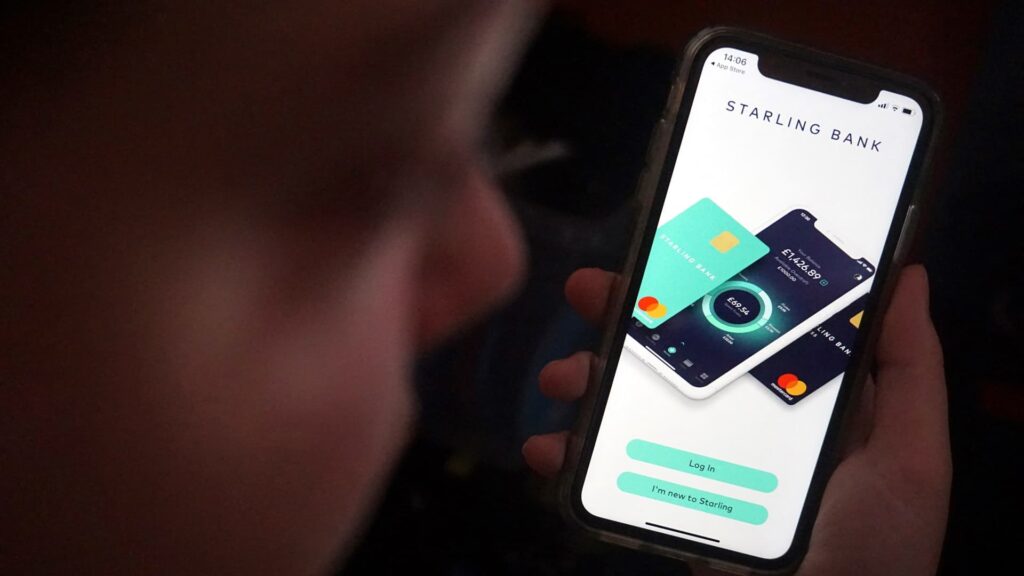

The Sterling Bank app appeared on people’s phones.

Adrian Dennis | AFP via Getty Images

LONDON – UK online lender Sterlingbank on Wednesday reported a sharp decline in annual profits.

Starling, which offers fee-free checking accounts and lending services via the mobile app, fell 26% year-on-year to £223.4 million ($301.9 million) for the year ended March 31, 2025.

Bank revenue totaled £714 million, up about 5% from £682 million the previous year. However, it marked a slowdown from revenue growth of over 50% that Sterling saw in 2024.

The profits that year were affected by a £29 million fine by the UK Financial Conduct Authority for failures related to Sterling’s financial crime prevention system.

Sterling has also flagged the issue of the Bounce Back Loan Scheme (BBLS), which is designed to provide businesses with access to cash during the coronavirus pandemic.

Sterling was one of several banks that were approved to lend cash to businesses during the 2020 Covid-19 outbreak. The scheme provided lenders with a 100% guarantee and the government was responsible for covering the full unpaid loan amount in the event that the borrower defaulted.

However, Sterling said that due to the weaknesses of historic fraud checks, he “identified a group of BBLS loans that may not comply with the guarantee requirements.” After flagging this into the state-run UK Business Bank, the company has since “supported to remove government guarantees on these loans.”

“As a result, we have obtained a £28.2 million provision in our account this year,” the bank said, referring to both the FCA fine and the BBLS issue.

However, Sterling said as of March 31, it holds an expected credit loss clause of £800,000 in connection with a specific BBLS loan that “guarantees provided under the BBLS guarantee agreement may become unavailable to the company.”

“This is a legacy issue that we addressed in transparent and fully with the UK business banks,” Sterling’s chief financial officer Declan Ferguson said in a media call Wednesday.

Sterling has been operating as a UK-approved bank since 2018. It counts shareholders such as Goldman Sachs, Fidelity Investments, and Qatar Investment Bureau.

The company was personally valued at £2.5 billion in 2022, and faces a hefty competition between both its incumbent banks and rival Fintechs like Monzo and Revolut.

Source link