After Solar Technology Company reported the top line and profit beats in the third quarter, the shares rose rapidly, and the sun shines on NEXTRACKER on Tuesday expansion trading. Even better, the management has raised the prospect of profitability throughout the year and reported a record backlog. According to LSEG, the third quarter of FY2025 was $ 679 million, down 4.5 % year -on -year, far exceeding the $ 651 million consensus estimation. LSEG data stated that the profit per share (EPS) was $ 1.03 in three months, which ended on December 31, rising 7.3 % a year and passing a 59 cent estimate. The result was strong and the call was bullish. NEXTRACKER executives have been fired in all cylinders and have acquired large -scale projects in both the United States and overseas, and the company navigates collateral due to tariffs, supply chains, or US energy policy priority. It seems to be suitable. It is no wonder that NEXTRACKER shares increased 16 % or more of 16 % or more in outside business hours, and increased about $ 46.20, respectively. This is higher than the best stock of this year’s shares, and is set to $ 45.27 per share on January 16th. NEXTRACKER began with tears in 2025 and expanded the momentum discovered in mid -December after pullbacks after the election performed the course. It was recently sold twice on January 7. However, following the peak of NEXTRACKER January 16, six out of six sessions of the past seven sessions until Tuesday, the stock was negative. NXT 1y Mountain NEXTRACKER has been shared in the last 12 months. In conclusion, it is difficult to seek something more than NEXTRACKER provided on Tuesday night. Sales and revenue broke down the expectations supported by the adjusted EBITDA margins that crushed Wall Street expectations. EBITDA -Abbreviation of interest, tax, depreciation, and revenue before depreciation -is an alternative to operational profitability. The free cash flow ran much more than the estimate. Even better, the future looks bright. According to the press release, management has raised cash flow and profits throughout the year. At the end of the second quarter of NEXTRACKER, the company stated that the back log was “$ 4.5 billion or more.” Investors are paying attention to the change in the description language, which was proven by the sale of revenue in August, after Nextracker used more than $ 4 billion in the second quarter. The growth of the backlog is supported by “robust demand in all major areas of companies that make meaningful contributions from new products”. During the calling of revenue, it was found that 87 % of the NEXTRACKER backlogs would be realized over the next 8 quarters. And in the eight -quarter chunks, President Howard Wenger said on the phone, which is expected to be realized in the next fourth quarter. Tuesday’s report states that this is a very powerful management team and a guidance and record that registered the board very well for the future. “Demand is strong as far as the US market is,” said Wenger. “In this quarter, there is a record reservation in the United States, and the pipeline shows a continuous strength.” Nevertheless, we have two two holds, $ 55 per stock of NEXTRACKER. We maintain price goals. First of all, it is not our style to follow the movements of movements as seen on Tuesday extension transactions. But in decisive, it is necessary to clarify the solar policy under the new Trump administration. President Donald Trump says he is a “Solar big fan,” but it is unknown what the government’s government spends in renewable energy and solar tax deduction. Trump is critical of wind energy, and since he took office last week, he has taken many measures to increase fossil fuel production in NEXTRACKER in the United States. Installation of solar panels to increase power generation according to the movement of the sun. The stock is unstable and most disappointed, but this investment is a long -term bet on increasing power demand, which is mostly promoted by artificial intelligence. Competitive company: Club Portfolio’s Allea Technology Weight: 0.92 % Started: June 27, 2024 Latest Purchase: Trump’s pledge to raise tariffs on imports to the United States on September 6, 2024 Another wrinkle. The NEXTRACKER executives who were asked about tariffs were confident in the ability to navigate what they could come, and had a variety of international supply chains, including India, which is a solid alternative to China and China. A strong relationship was called. “We are in this wonderful position [where] CEO’s Dan Shouger can be made locally for local markets, or exported to arbitrage depending on what is happening in a global supply chain. The successful initiative to sell Solar trackers made in Japan 100 % domestic, can use 10 % of the investment tax deduction included in the 2022 inflation reduction method, making it more attractive for customers. I noticed that there is a possibility. A positive update about this dynamics at the call on Tuesday. But they have a higher level of domestic content and have higher levels. Wengers argued that NEXTRACKER was winning because Nextracker was regarded as “flight to quality.” “These projects are getting bigger, along with the scale. We believe that we are emerging as a really reliable brand, but many major purchased vector, proven technology, and proof. He said that it is a proven energy yield. This all contributes to low -level costs, that is, LCOE, an important indicator of the industry. The same guidance, NEXTRACKER, as seen in late October, reconfirmed the profit guidance in FY2025 and increased the profitability and cash flow. 2025 Revenue Guidance: 2.8 billion to $ 2.9 billion adjusted EBITDA Guidance: Adjusted EPS Guidance, adjusted from $ 700 million to $ 740 million, $ 625 million to $ 665 million: $ 3.75 to 3.95 , 3.75-3.95, an increase in re -arrival guidance from $ 3.10 to $ 3.10. With the growing uncertainty about US policies, Trump returns to the White House, and Republican members control the rooms of both councils. However, the important increase in the prospects of profits indicates the strength of the NEXTRACKER leadership team because it is operated much more efficiently than expected by the company. (Jim Cramer’s charity trust is a long NXT. Click here for a complete list of stocks.) As a member of the CNBC Investing Club with Jim Cramer, JIM receives trade warnings before trading. The gym waits 45 minutes after sending a trade alert before purchasing or selling stocks in a charity portfolio. If the gym talks about shares on CNBC television, he will wait 72 hours after issuing a trade alert before doing business. The above investment club information is subject to the Terms of Use and Privacy Policy, along with the disclaimer. There is no duty or duty of the trustee by receiving the information provided in the investment club. Certain results and profits are not guaranteed.

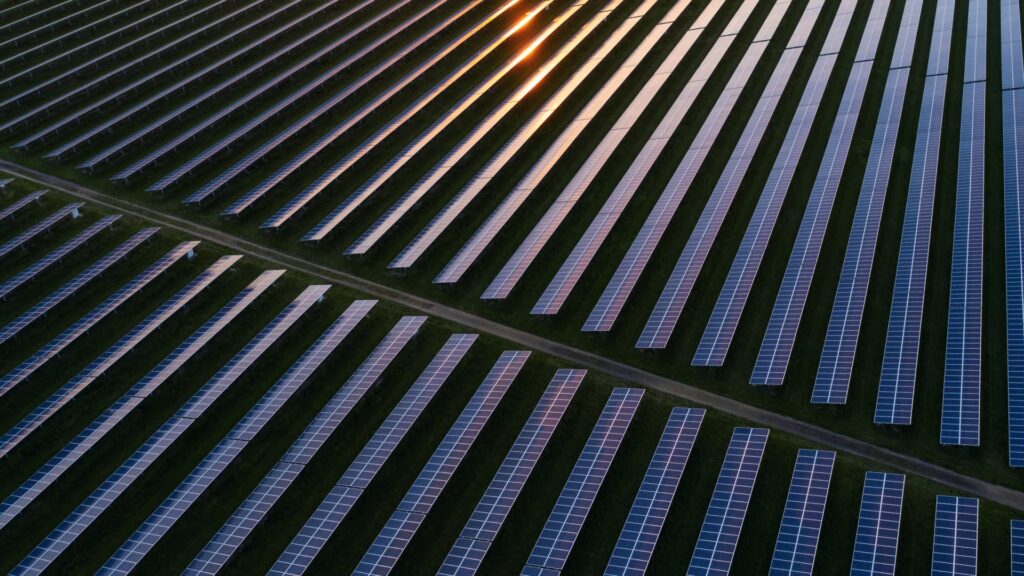

Justin Pajet | DigitalVision | Getty Image

After Solar Technology Company reported the top line and profit beats in the third quarter, the shares rose rapidly, and the sun shines on NEXTRACKER on Tuesday expansion trading. Even better, the management has raised the prospect of profitability throughout the year and reported a record backlog.

Source link