Despite growing rumors of an AI bubble, Sequoia Capital insists its investment approach is not influenced by market enthusiasm.

“Markets ebb and flow, but our strategy remains consistent. We are always looking for outlier founders with ideas to build generational businesses,” said Bogomir Balkansky, partner in Sequoia’s early investment team.

Demonstrating this consistency, Sequoia on Monday announced two new funds roughly matching the size of those launched nearly three years ago. A $750 million early-stage fund and a $200 million seed fund for Series A startups.

These funds were introduced after a tumultuous period for the legendary company. In 2021, Sequoia overhauled its structure to an evergreen main fund supported by strategy-specific “sub-funds,” primarily to allow the company to hold stakes in portfolio companies long after their IPO. The company took a huge financial hit in late 2022 when its investment in cryptocurrency exchange FTX exploded, resulting in losses of more than $200 million, and subsequently separated from its Indian and Chinese units in 2023.

The storied company, famous for backing Airbnb, Google, Nvidia, and Stripe in their early years, is putting recent challenges behind it and returning to its core purpose of investing in promising founders in their early stages.

Balkanski emphasized this mission, saying, “Our goal has always been, and continues to be, to identify these founders as quickly as possible, roll up our sleeves, and actively participate in their company-building journey.”

As AI startup valuations skyrocket, Sequoia wants to use the new capital to invest in the most promising founders early in their startup-building journey. This strategy allows the company to secure low prices while securing large ownership stakes.

tech crunch event

san francisco

|

October 27-29, 2025

This early stage focus is even more important for the company today. With valuations soaring at an unprecedented pace, getting in early is key to locking in lower prices and locking in big stakes.

This approach is paying off. Sequoia’s seed and Series A investments in Clay, Harvey, n8n, Sierra, and Temporal have increased in value many times over during the AI boom.

Balkanski revealed that despite its storied Series A history, Sequoia aims to uphold that tradition by investing earlier. “We have a great track record and tradition of partnering with companies at a very early stage, and today we would be classified as pre-seed.”

He emphasized the company’s early beliefs. Sequoia recently wrote initial checks on security tester Xbow, AI reliability engineer Traversal, and DeepSeek alternative Reflection AI. All of these companies have since raised significant amounts of capital at much higher valuations. Among the ways the company has helped behind the scenes is bringing a former Databricks CRO to Xbow’s board of directors, connecting Traversal with more than 30 potential customers, and arranging a meeting between Reflection AI and Nvidia’s Jensen Huang, which the company says directly led to a $500 million investment from the chipmaker.

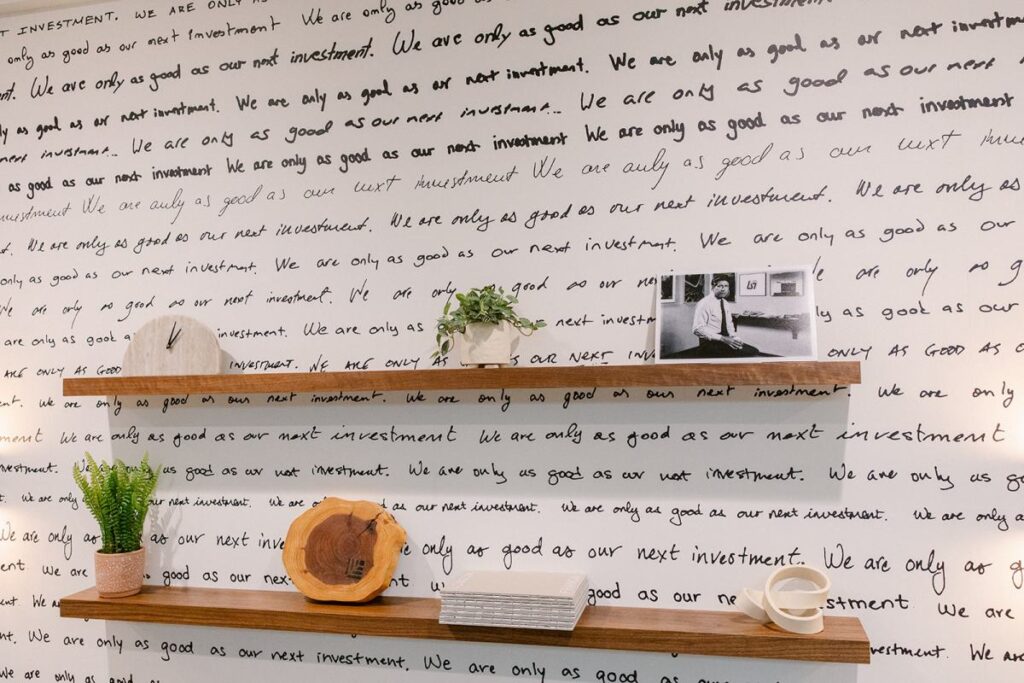

Despite these recent successes, Sequoia remains relentlessly focused on preserving its 50-year legacy as Silicon Valley’s top investor. To ensure this mindset is maintained, the company’s newly renovated offices feature a hand-painted wall reminding all investors, “We are only as good as our next investment.”

Source link