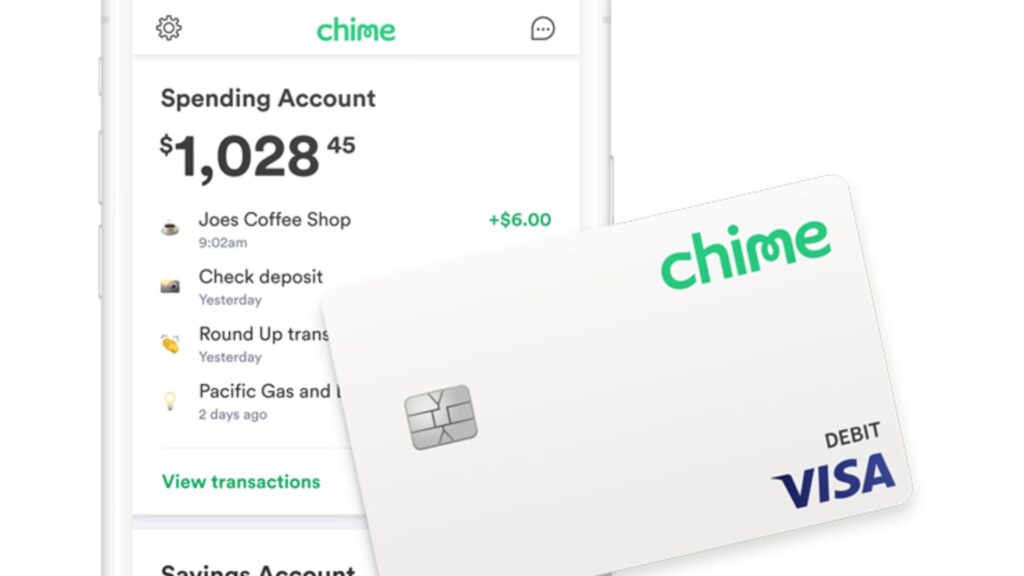

Chime Visa Credit Card

Source: Chime

Chime priced the IPO at $27 per share on Wednesday, a service that online banking service providers cherish for $11.6 billion.

The company raised about $700 million through its IPO, and an additional $165 million worth of shares was sold by existing investors. The shares are scheduled to open trading Thursday under the ticker symbol chim.

The FinTech IPO Pipeline will be provided after a years of freeze on the FinTech IPO Pipeline as rising interest rates and valuation resets stand by many late companies. The market has begun to loosen. Trading Platform Etro Crypto Company rose 29% in its NASDAQ debut last month Round It jumped out after it came to the market last week.

Meanwhile, online lender Klarna delayed its IPO plan and reported a sudden quarterly loss last month.

Chime’s decision to publish shows a major test of investors’ desire for consumer-oriented finance companies, even after a sudden cut from its final private valuation of $25 billion. SoftBank, Tiger Global and Sequoia all invested in the 2021 round at Chime’s Private Market Peak.

The company’s top institutional shareholders are DST Global and Crosslinked Capital, which owned 17% and 9.5% of its pre-offered shares, respectively.

Chime’s Core Business – By providing free banking services, debit cards and early pay access, the majority of your revenue comes from the exchange fee. The company competes in various fields with current Fintech positions. PayPal, square and Sophie.

Revenue for the most recent quarter rose 32% from the previous year to $518.7 million. Net income shrunk from $15.9 million a year ago to $12.9 million.

Morgan Stanley, Goldman Sachs and Jpmorgan Chase lead the IPO.

View: Chime File to be published

Source link