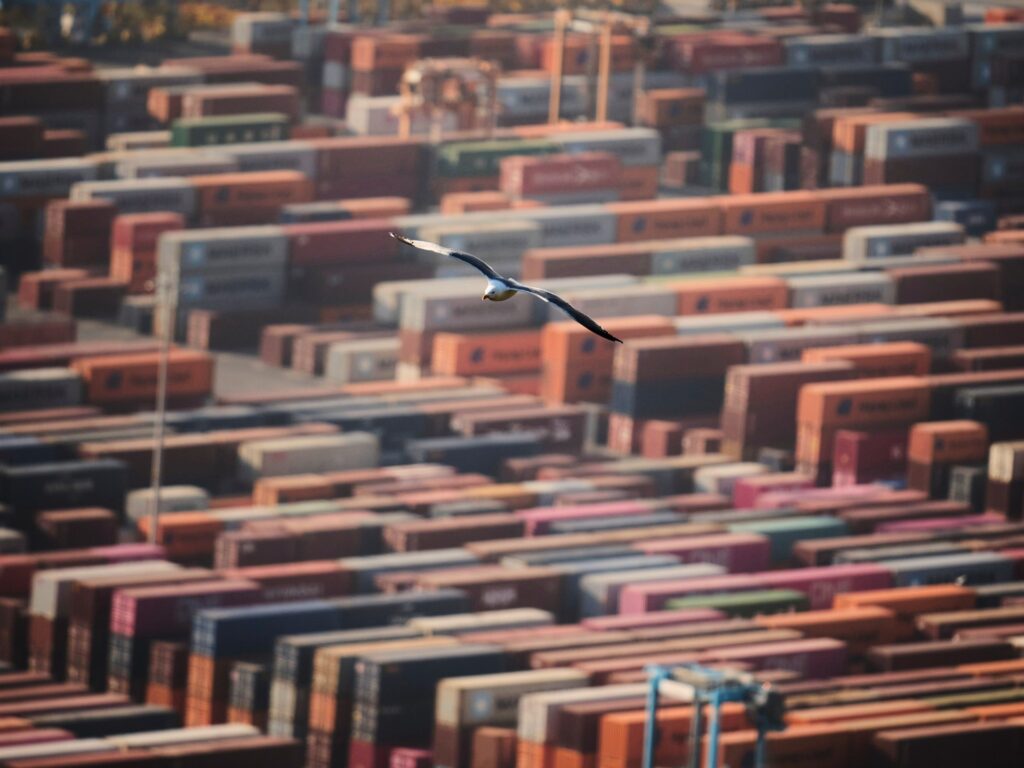

On Wednesday at 12:01am (04:01 GMT), US President Donald Trump’s “mutual” tariffs will begin, engaging in stock markets and strengthening the global trade war that has gained the edge over the corporations.

Trump has long pledged tariffs to US trading partners, including last year’s top job campaign trail.

Several targeted obligations, including steel and aluminum, have been in place for weeks.

On April 2, Trump announced his “liberation day” tariffs on dozens of countries, causing stock markets to plummet as investors digested the outlook for the end of an era of globalization and free trade.

Since then, several prominent Trump supporters have raised concerns about his trade salvo.

Bill Ackman, CEO of hedge fund Pershing Square Capital Management, has publicly urged the administration to suspend tariffs in order for the US and its trading partners to attack the transaction.

On Tuesday, White House press chief Carolyn Leavitt said Trump has no intention of delaying tariffs despite more than 70 countries reaching out to launch negotiations.

As the midnight deadline approached on Tuesday evening, analysts resigned to tariffs becoming a reality.

“We expect tariffs to be enforced as announced,” Gary Huhbauer, a senior non-resident fellow at the Peterson Institute of International Economics, told Al Jazeera.

“This will be painful for consumers and will skyrocket business uncertainty. The stock market will drop even further.”

Rachel Ziemba, a part-time senior fellow at the New America Security Center, said he hopes negotiations will continue despite Trump “doubling China’s tariffs and sticking to other tariffs.”

The challenge is the fact that “Trump’s desire to have no trade deficit makes it difficult to create transactions,” Ziemba said.

Economists say prices will inevitably rise for consumers. The only problem is how many problems.

‘tit-for-tat is on

As the world reacts, the most important country to see will be China.

Import tax on Chinese goods is expected to rise to an astounding 104% after Trump said he would impose an additional 50% tariff on China in response to retaliation measures.

“China tariffs will shut down all Chinese exports to the US,” said Vina Najibla, vice president of research and strategy at Canada’s Asia-Pacific Foundation.

It could not only raise prices in the US, which relies heavily on Chinese imports, but also encourage Beijing to expand trade in other markets, including Europe and Southeast Asia, resulting in ripple effects on those economies.

“More China – [trade war] The more escalates, the more impact it will have on Southeast Asian countries and other economies around the world,” Najibla said.

Apart from China, the European Union announced many measures last week, just like Canada. Other major trading partners, including Japan, South Korea and Vietnam, have refused to retaliate and are in negotiations with the US.

The outcome of these trade talks will be closely monitored by the market over the coming days and weeks, with investors desperately clear asking whether Trump’s tariffs are a temporary negotiation tactic or the beginning of a permanent sort of world trade.

Ziemba said investors would be encouraged to sit tight until then.

“Don’t borrow for an investment or invest the money you need right away,” Ziemba said.

“For now, Tit-for-Tat is on and the global economy is challenged by it,” she added.

Source link